Sequoia Financial Advisors LLC lowered its stake in shares of Nokia Corporation (NYSE:NOK - Free Report) by 72.4% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 76,009 shares of the technology company's stock after selling 199,880 shares during the quarter. Sequoia Financial Advisors LLC's holdings in Nokia were worth $401,000 at the end of the most recent quarter.

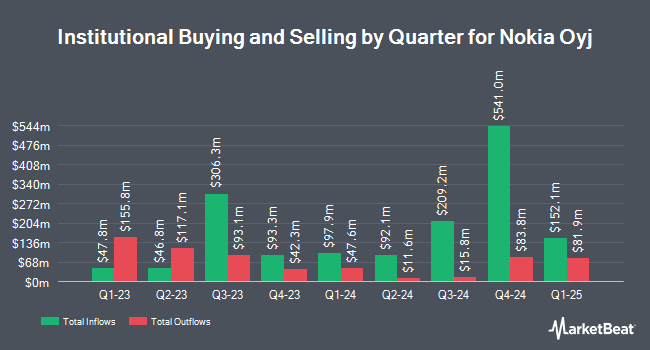

A number of other hedge funds and other institutional investors have also recently made changes to their positions in NOK. Wealthquest Corp acquired a new stake in shares of Nokia during the 1st quarter valued at approximately $27,000. Farther Finance Advisors LLC grew its stake in Nokia by 58.4% in the 1st quarter. Farther Finance Advisors LLC now owns 7,191 shares of the technology company's stock worth $38,000 after acquiring an additional 2,651 shares during the period. Formidable Asset Management LLC purchased a new stake in shares of Nokia during the 4th quarter valued at $49,000. Merit Financial Group LLC purchased a new stake in shares of Nokia during the 1st quarter valued at $54,000. Finally, Bank Julius Baer & Co. Ltd Zurich purchased a new stake in shares of Nokia during the 4th quarter valued at $58,000. Hedge funds and other institutional investors own 5.28% of the company's stock.

Nokia Stock Down 0.4%

NOK stock opened at $5.21 on Thursday. The company has a debt-to-equity ratio of 0.11, a current ratio of 1.36 and a quick ratio of 1.15. The firm has a market cap of $28.41 billion, a PE ratio of 34.74 and a beta of 0.91. Nokia Corporation has a 12 month low of $3.60 and a 12 month high of $5.48. The firm has a 50 day simple moving average of $5.20 and a 200 day simple moving average of $4.97.

Nokia (NYSE:NOK - Get Free Report) last released its earnings results on Thursday, April 24th. The technology company reported $0.03 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.05 by ($0.02). Nokia had a return on equity of 8.73% and a net margin of 4.09%. The company had revenue of $4.98 billion during the quarter, compared to analysts' expectations of $4.47 billion. During the same quarter in the previous year, the company earned $0.09 EPS. The firm's quarterly revenue was down 1.2% compared to the same quarter last year. Equities research analysts forecast that Nokia Corporation will post 0.34 earnings per share for the current fiscal year.

Nokia Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, May 15th. Shareholders of record on Monday, May 5th were given a $0.0336 dividend. This represents a $0.13 annualized dividend and a yield of 2.58%. This is a positive change from Nokia's previous quarterly dividend of $0.02. The ex-dividend date was Monday, May 5th. Nokia's dividend payout ratio (DPR) is currently 80.00%.

Analysts Set New Price Targets

Separately, Wall Street Zen raised shares of Nokia from a "hold" rating to a "buy" rating in a research report on Wednesday, May 21st. One investment analyst has rated the stock with a sell rating and five have issued a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $5.85.

Read Our Latest Report on Nokia

About Nokia

(

Free Report)

Nokia Oyj provides mobile, fixed, and cloud network solutions worldwide. The company operates through four segments: Network Infrastructure, Mobile Networks, Cloud and Network Services, and Nokia Technologies. The company provides fixed networking solutions, such as fiber and copper-based access infrastructure, in-home Wi-Fi solutions, and cloud and virtualization services; IP networking solutions, including IP access, aggregation, and edge and core routing for residential, mobile, enterprise and cloud applications; optical networks solutions that provides optical transport networks for metro, regional, and long-haul applications, and subsea applications; and submarine networks for undersea cable transmission.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nokia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nokia wasn't on the list.

While Nokia currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.