Sherbrooke Park Advisers LLC purchased a new position in shares of Plexus Corp. (NASDAQ:PLXS - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 2,498 shares of the technology company's stock, valued at approximately $391,000.

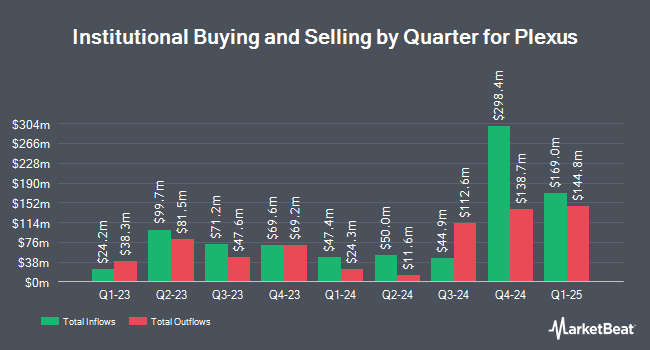

Several other large investors also recently bought and sold shares of the stock. Sig Brokerage LP purchased a new position in shares of Plexus in the 4th quarter valued at about $573,000. Point72 Asia Singapore Pte. Ltd. raised its holdings in Plexus by 140.7% in the fourth quarter. Point72 Asia Singapore Pte. Ltd. now owns 975 shares of the technology company's stock valued at $153,000 after acquiring an additional 570 shares in the last quarter. Point72 Asset Management L.P. purchased a new position in Plexus in the fourth quarter worth approximately $311,000. ProShare Advisors LLC grew its holdings in Plexus by 42.6% during the 4th quarter. ProShare Advisors LLC now owns 8,088 shares of the technology company's stock worth $1,266,000 after acquiring an additional 2,415 shares in the last quarter. Finally, Nuveen Asset Management LLC grew its holdings in Plexus by 6.6% during the 4th quarter. Nuveen Asset Management LLC now owns 351,557 shares of the technology company's stock worth $55,012,000 after acquiring an additional 21,911 shares in the last quarter. Hedge funds and other institutional investors own 94.45% of the company's stock.

Insiders Place Their Bets

In related news, CFO Patrick John Jermain sold 4,328 shares of the firm's stock in a transaction dated Thursday, May 15th. The shares were sold at an average price of $132.29, for a total value of $572,551.12. Following the completion of the sale, the chief financial officer now owns 25,637 shares in the company, valued at $3,391,518.73. This trade represents a 14.44% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 1.76% of the stock is currently owned by insiders.

Plexus Stock Performance

NASDAQ:PLXS traded down $1.46 during midday trading on Friday, reaching $129.01. The stock had a trading volume of 15,617 shares, compared to its average volume of 167,991. The company has a quick ratio of 0.70, a current ratio of 1.53 and a debt-to-equity ratio of 0.07. The stock has a market cap of $3.49 billion, a P/E ratio of 30.03 and a beta of 0.80. The firm has a fifty day simple moving average of $125.55 and a two-hundred day simple moving average of $142.63. Plexus Corp. has a 12-month low of $100.96 and a 12-month high of $172.89.

Plexus (NASDAQ:PLXS - Get Free Report) last released its earnings results on Wednesday, April 23rd. The technology company reported $1.66 EPS for the quarter, topping the consensus estimate of $1.54 by $0.12. Plexus had a net margin of 3.03% and a return on equity of 10.36%. The company had revenue of $980.17 million during the quarter, compared to analysts' expectations of $980.07 million. During the same quarter last year, the business earned $0.94 EPS. The business's revenue was up 1.4% on a year-over-year basis. On average, equities analysts expect that Plexus Corp. will post 5.9 EPS for the current year.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on PLXS shares. Benchmark reaffirmed a "buy" rating and set a $160.00 price objective on shares of Plexus in a research report on Friday, May 16th. Stifel Nicolaus set a $145.00 price target on Plexus in a research note on Thursday, April 24th. Finally, Needham & Company LLC reaffirmed a "buy" rating and set a $162.00 price objective (down from $172.00) on shares of Plexus in a research report on Friday, April 25th. Two investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat.com, Plexus presently has a consensus rating of "Moderate Buy" and an average target price of $155.67.

Check Out Our Latest Research Report on Plexus

About Plexus

(

Free Report)

Plexus Corp. provides electronic manufacturing services in the United States and internationally. It offers design, develop, supply chain, new product introduction, and manufacturing solutions, as well as sustaining services to companies in the healthcare/life sciences, industrial/commercial, aerospace/defense, and communications market sectors.

Read More

Before you consider Plexus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plexus wasn't on the list.

While Plexus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.