Sherbrooke Park Advisers LLC lowered its holdings in YETI Holdings, Inc. (NYSE:YETI - Free Report) by 40.4% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 12,559 shares of the company's stock after selling 8,525 shares during the quarter. Sherbrooke Park Advisers LLC's holdings in YETI were worth $484,000 at the end of the most recent quarter.

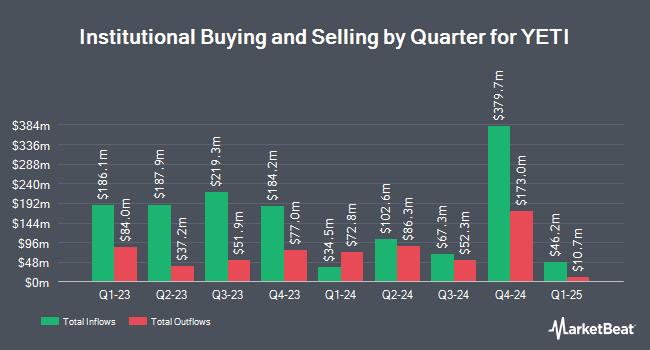

Other hedge funds and other institutional investors have also bought and sold shares of the company. Pinebridge Investments L.P. raised its holdings in shares of YETI by 42.7% in the fourth quarter. Pinebridge Investments L.P. now owns 38,074 shares of the company's stock valued at $1,466,000 after purchasing an additional 11,391 shares during the last quarter. Tower Research Capital LLC TRC boosted its stake in YETI by 1,172.7% in the fourth quarter. Tower Research Capital LLC TRC now owns 15,807 shares of the company's stock valued at $609,000 after acquiring an additional 14,565 shares during the last quarter. Boothbay Fund Management LLC grew its position in shares of YETI by 983.0% during the 4th quarter. Boothbay Fund Management LLC now owns 120,973 shares of the company's stock valued at $4,659,000 after acquiring an additional 109,803 shares during the period. Truist Financial Corp grew its position in shares of YETI by 304.2% during the 4th quarter. Truist Financial Corp now owns 28,501 shares of the company's stock valued at $1,098,000 after acquiring an additional 21,450 shares during the period. Finally, Clearbridge Investments LLC purchased a new stake in shares of YETI during the 4th quarter worth approximately $10,767,000.

YETI Trading Down 5.0%

YETI traded down $1.57 during trading on Wednesday, hitting $29.74. 2,384,275 shares of the stock traded hands, compared to its average volume of 1,744,569. The firm has a market capitalization of $2.46 billion, a P/E ratio of 14.44, a price-to-earnings-growth ratio of 1.05 and a beta of 1.91. YETI Holdings, Inc. has a 12-month low of $26.61 and a 12-month high of $45.25. The company has a debt-to-equity ratio of 0.10, a current ratio of 2.18 and a quick ratio of 1.36. The firm has a 50-day moving average of $30.51 and a 200 day moving average of $35.65.

YETI (NYSE:YETI - Get Free Report) last posted its earnings results on Thursday, May 8th. The company reported $0.31 earnings per share for the quarter, topping analysts' consensus estimates of $0.27 by $0.04. YETI had a net margin of 9.60% and a return on equity of 28.23%. The company had revenue of $351.13 million during the quarter, compared to analyst estimates of $347.72 million. During the same period in the prior year, the business posted $0.34 earnings per share. YETI's revenue for the quarter was up 2.8% on a year-over-year basis. Equities research analysts anticipate that YETI Holdings, Inc. will post 2.57 EPS for the current year.

Wall Street Analyst Weigh In

YETI has been the subject of a number of recent research reports. Canaccord Genuity Group decreased their target price on YETI from $44.00 to $42.00 and set a "hold" rating for the company in a research report on Friday, February 14th. UBS Group cut their price objective on YETI from $43.00 to $31.00 and set a "neutral" rating for the company in a report on Thursday, April 17th. Raymond James decreased their price objective on YETI from $50.00 to $34.00 and set an "outperform" rating on the stock in a report on Friday, May 9th. Stifel Nicolaus dropped their target price on YETI from $40.00 to $34.00 and set a "hold" rating for the company in a research report on Thursday, April 10th. Finally, Piper Sandler reduced their price target on shares of YETI from $52.00 to $38.00 and set an "overweight" rating on the stock in a research report on Monday, May 5th. Ten investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, YETI has a consensus rating of "Hold" and an average target price of $39.40.

View Our Latest Stock Report on YETI

YETI Profile

(

Free Report)

YETI Holdings, Inc designs, retails, and distributes products for the outdoor and recreation market under the YETI brand. It offers coolers and equipment, including hard and soft coolers, cargo, bags, outdoor living, and associated accessories, as well as backpacks, duffel bags, luggage, packing cubes, carryalls, camp chairs, blankets, dog beds, dog bowls, and gear cases under the LoadOut, Panga, Crossroads, Camino, Hondo Base, Trailhead, Lowlands, Boomer, and SideKick Dry brands.

Read More

Before you consider YETI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and YETI wasn't on the list.

While YETI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.