Siemens Fonds Invest GmbH purchased a new stake in shares of Resideo Technologies, Inc. (NYSE:REZI - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 33,795 shares of the company's stock, valued at approximately $779,000.

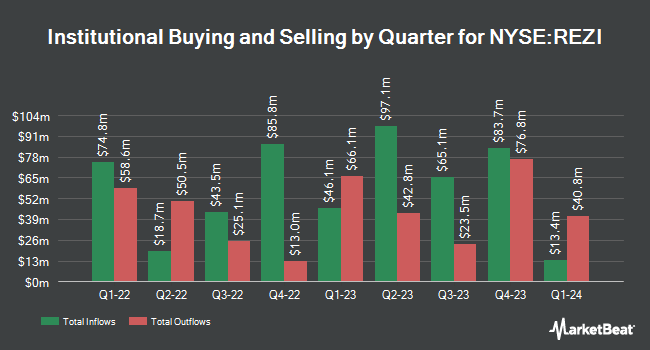

Several other institutional investors have also recently added to or reduced their stakes in the company. Quarry LP acquired a new stake in Resideo Technologies in the 4th quarter valued at about $28,000. R Squared Ltd acquired a new stake in Resideo Technologies in the 4th quarter valued at about $30,000. Smartleaf Asset Management LLC increased its position in Resideo Technologies by 293.3% in the 4th quarter. Smartleaf Asset Management LLC now owns 2,600 shares of the company's stock valued at $60,000 after acquiring an additional 1,939 shares in the last quarter. Blue Trust Inc. increased its position in Resideo Technologies by 28.9% in the 4th quarter. Blue Trust Inc. now owns 3,241 shares of the company's stock valued at $75,000 after acquiring an additional 726 shares in the last quarter. Finally, Sterling Capital Management LLC increased its position in Resideo Technologies by 705.9% in the 4th quarter. Sterling Capital Management LLC now owns 4,755 shares of the company's stock valued at $110,000 after acquiring an additional 4,165 shares in the last quarter. 91.71% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, JPMorgan Chase & Co. cut shares of Resideo Technologies from an "overweight" rating to a "neutral" rating and lowered their price objective for the company from $31.00 to $16.00 in a research report on Tuesday, April 22nd.

View Our Latest Research Report on Resideo Technologies

Insider Buying and Selling at Resideo Technologies

In other news, major shareholder Channel Holdings Ii L.P. Cd&R bought 5,754,501 shares of the stock in a transaction that occurred on Friday, May 9th. The shares were acquired at an average cost of $17.38 per share, for a total transaction of $100,013,227.38. Following the completion of the acquisition, the insider now owns 5,754,501 shares in the company, valued at approximately $100,013,227.38. This represents a ∞ increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through the SEC website. Insiders own 1.50% of the company's stock.

Resideo Technologies Price Performance

REZI traded down $0.13 during midday trading on Monday, hitting $20.57. The company had a trading volume of 732,191 shares, compared to its average volume of 976,088. Resideo Technologies, Inc. has a twelve month low of $14.18 and a twelve month high of $28.28. The firm's 50-day simple moving average is $17.94 and its 200-day simple moving average is $20.95. The company has a debt-to-equity ratio of 0.69, a quick ratio of 1.10 and a current ratio of 1.82. The company has a market capitalization of $3.05 billion, a PE ratio of 32.65 and a beta of 2.23.

About Resideo Technologies

(

Free Report)

Resideo Technologies, Inc develops, manufactures, and sells comfort, energy management, and safety and security solutions to the commercial and residential end markets in the United States, Europe, and internationally. The company operates in two segments, Products and Solutions, and ADI Global Distribution.

Featured Stories

Before you consider Resideo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Resideo Technologies wasn't on the list.

While Resideo Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.