Simon Quick Advisors LLC purchased a new position in shares of MSC Industrial Direct Company, Inc. (NYSE:MSM - Free Report) during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 3,310 shares of the industrial products company's stock, valued at approximately $257,000.

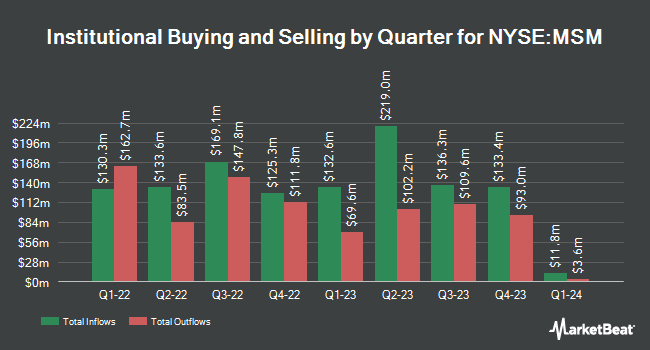

A number of other institutional investors and hedge funds have also recently bought and sold shares of MSM. V Square Quantitative Management LLC boosted its holdings in shares of MSC Industrial Direct by 77.0% in the fourth quarter. V Square Quantitative Management LLC now owns 531 shares of the industrial products company's stock valued at $40,000 after acquiring an additional 231 shares during the period. Rhumbline Advisers raised its position in MSC Industrial Direct by 0.9% in the 4th quarter. Rhumbline Advisers now owns 155,601 shares of the industrial products company's stock valued at $11,622,000 after purchasing an additional 1,418 shares during the last quarter. Allworth Financial LP boosted its stake in MSC Industrial Direct by 412.0% during the 4th quarter. Allworth Financial LP now owns 425 shares of the industrial products company's stock worth $35,000 after purchasing an additional 342 shares during the period. State of New Jersey Common Pension Fund D grew its position in MSC Industrial Direct by 8.9% during the 4th quarter. State of New Jersey Common Pension Fund D now owns 26,035 shares of the industrial products company's stock worth $1,945,000 after purchasing an additional 2,136 shares during the last quarter. Finally, Venturi Wealth Management LLC grew its position in MSC Industrial Direct by 2,543.5% during the 4th quarter. Venturi Wealth Management LLC now owns 2,855 shares of the industrial products company's stock worth $213,000 after purchasing an additional 2,747 shares during the last quarter. 79.26% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on MSM shares. Industrial Alliance Securities set a $89.00 target price on shares of MSC Industrial Direct in a research note on Tuesday, May 27th. Robert W. Baird decreased their price objective on MSC Industrial Direct from $90.00 to $84.00 and set a "neutral" rating for the company in a research report on Friday, April 4th. Loop Capital dropped their target price on MSC Industrial Direct from $83.00 to $74.00 and set a "hold" rating on the stock in a report on Friday, April 4th. Wolfe Research upgraded MSC Industrial Direct to a "strong-buy" rating in a research note on Sunday, April 6th. Finally, JPMorgan Chase & Co. upgraded shares of MSC Industrial Direct from a "neutral" rating to an "overweight" rating and lifted their price objective for the company from $73.00 to $89.00 in a research report on Tuesday, May 27th. Four investment analysts have rated the stock with a hold rating, one has issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $86.00.

Check Out Our Latest Report on MSC Industrial Direct

Insider Buying and Selling

In related news, Director Mitchell Jacobson purchased 27,642 shares of MSC Industrial Direct stock in a transaction dated Tuesday, April 8th. The stock was bought at an average cost of $69.77 per share, for a total transaction of $1,928,582.34. Following the transaction, the director now owns 1,951,725 shares in the company, valued at approximately $136,171,853.25. The trade was a 1.44% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 18.30% of the stock is owned by insiders.

MSC Industrial Direct Stock Performance

Shares of MSM stock traded down $0.57 during trading hours on Tuesday, reaching $81.51. 356,768 shares of the company's stock were exchanged, compared to its average volume of 621,780. The company has a debt-to-equity ratio of 0.22, a current ratio of 1.92 and a quick ratio of 0.88. The company's 50 day moving average is $78.78 and its two-hundred day moving average is $79.30. The company has a market cap of $4.54 billion, a P/E ratio of 20.83 and a beta of 0.87. MSC Industrial Direct Company, Inc. has a 1 year low of $68.10 and a 1 year high of $90.81.

MSC Industrial Direct (NYSE:MSM - Get Free Report) last released its quarterly earnings data on Thursday, April 3rd. The industrial products company reported $0.72 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.68 by $0.04. MSC Industrial Direct had a return on equity of 16.06% and a net margin of 5.69%. The firm had revenue of $891.70 million during the quarter, compared to analysts' expectations of $908.30 million. During the same quarter in the prior year, the business posted $1.18 earnings per share. MSC Industrial Direct's revenue was down 4.7% compared to the same quarter last year. Equities research analysts anticipate that MSC Industrial Direct Company, Inc. will post 3.57 EPS for the current fiscal year.

MSC Industrial Direct Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, April 23rd. Investors of record on Wednesday, April 9th were paid a $0.85 dividend. This represents a $3.40 annualized dividend and a dividend yield of 4.17%. The ex-dividend date was Wednesday, April 9th. MSC Industrial Direct's dividend payout ratio (DPR) is 89.71%.

About MSC Industrial Direct

(

Free Report)

MSC Industrial Direct Co, Inc, together with its subsidiaries, distributes metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally. The company's MRO products include cutting tools, measuring instruments, tooling components, metalworking products, fasteners, flat stock products, raw materials, abrasives, machinery hand and power tools, safety and janitorial supplies, plumbing supplies, materials handling products, power transmission components, and electrical supplies.

Featured Articles

Before you consider MSC Industrial Direct, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSC Industrial Direct wasn't on the list.

While MSC Industrial Direct currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report