Conestoga Capital Advisors LLC lifted its holdings in Simulations Plus, Inc. (NASDAQ:SLP - Free Report) by 17.2% in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 2,609,388 shares of the technology company's stock after buying an additional 383,126 shares during the period. Conestoga Capital Advisors LLC owned about 12.97% of Simulations Plus worth $63,982,000 as of its most recent SEC filing.

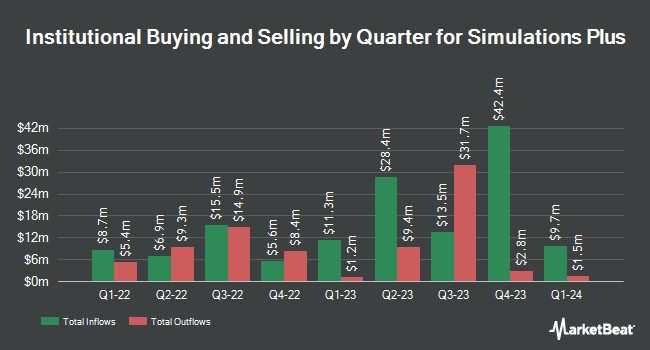

Several other hedge funds and other institutional investors have also modified their holdings of the business. Janus Henderson Group PLC increased its stake in Simulations Plus by 7,753.3% in the 4th quarter. Janus Henderson Group PLC now owns 542,899 shares of the technology company's stock valued at $15,141,000 after buying an additional 535,986 shares during the period. Royce & Associates LP increased its stake in shares of Simulations Plus by 56.6% in the fourth quarter. Royce & Associates LP now owns 371,797 shares of the technology company's stock worth $10,369,000 after acquiring an additional 134,381 shares during the last quarter. Nicholas Company Inc. acquired a new position in shares of Simulations Plus in the fourth quarter worth $3,418,000. Kennedy Capital Management LLC raised its holdings in shares of Simulations Plus by 59.4% during the fourth quarter. Kennedy Capital Management LLC now owns 289,286 shares of the technology company's stock worth $8,068,000 after acquiring an additional 107,766 shares in the last quarter. Finally, JPMorgan Chase & Co. boosted its position in Simulations Plus by 210.7% during the fourth quarter. JPMorgan Chase & Co. now owns 147,154 shares of the technology company's stock valued at $4,104,000 after purchasing an additional 99,789 shares during the last quarter. Institutional investors and hedge funds own 78.08% of the company's stock.

Simulations Plus Price Performance

SLP stock traded down $0.75 on Friday, reaching $17.33. 538,888 shares of the company were exchanged, compared to its average volume of 244,557. The firm has a market capitalization of $348.51 million, a PE ratio of 49.51 and a beta of 0.97. Simulations Plus, Inc. has a 12 month low of $17.06 and a 12 month high of $49.71. The stock's fifty day moving average price is $30.08 and its 200 day moving average price is $29.77.

Simulations Plus (NASDAQ:SLP - Get Free Report) last released its earnings results on Thursday, April 3rd. The technology company reported $0.31 earnings per share for the quarter, topping analysts' consensus estimates of $0.25 by $0.06. The business had revenue of $22.43 million for the quarter, compared to the consensus estimate of $21.93 million. Simulations Plus had a return on equity of 7.86% and a net margin of 9.18%. The firm's revenue for the quarter was up 22.5% compared to the same quarter last year. During the same period last year, the business earned $0.20 earnings per share. As a group, research analysts expect that Simulations Plus, Inc. will post 1.09 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

SLP has been the topic of a number of recent research reports. William Blair restated an "outperform" rating on shares of Simulations Plus in a research note on Tuesday, June 3rd. Craig Hallum lowered their price target on Simulations Plus from $45.00 to $36.00 and set a "buy" rating for the company in a research note on Friday, June 13th. Wall Street Zen raised shares of Simulations Plus from a "sell" rating to a "hold" rating in a research report on Monday, April 28th. JMP Securities reiterated a "market perform" rating on shares of Simulations Plus in a research note on Wednesday. Finally, KeyCorp increased their price target on shares of Simulations Plus from $32.00 to $40.00 and gave the stock an "overweight" rating in a research note on Wednesday, April 16th. Two equities research analysts have rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $41.25.

Check Out Our Latest Report on Simulations Plus

Insider Activity

In other news, Director Walter S. Woltosz sold 20,000 shares of Simulations Plus stock in a transaction dated Thursday, May 1st. The shares were sold at an average price of $33.51, for a total transaction of $670,200.00. Following the sale, the director now directly owns 3,344,157 shares in the company, valued at approximately $112,062,701.07. The trade was a 0.59% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 19.40% of the stock is currently owned by company insiders.

Simulations Plus Company Profile

(

Free Report)

Simulations Plus, Inc develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide. The company operates through two segments, Software and Services. It offers GastroPlus, which simulates the absorption and drug interaction of compounds administered to humans and animals; and DDDPlus and MembranePlus simulation products.

Recommended Stories

Before you consider Simulations Plus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simulations Plus wasn't on the list.

While Simulations Plus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.