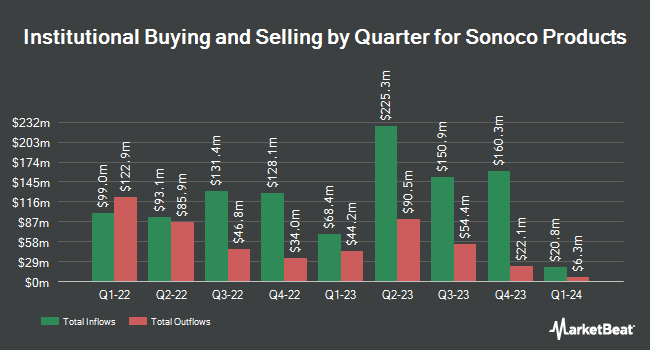

GAMMA Investing LLC increased its stake in Sonoco Products (NYSE:SON - Free Report) by 4,145.3% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 134,067 shares of the industrial products company's stock after purchasing an additional 130,909 shares during the period. GAMMA Investing LLC owned approximately 0.14% of Sonoco Products worth $6,333,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in SON. Quarry LP boosted its stake in shares of Sonoco Products by 111.3% during the 4th quarter. Quarry LP now owns 970 shares of the industrial products company's stock worth $47,000 after buying an additional 511 shares during the last quarter. Colonial Trust Co SC lifted its stake in Sonoco Products by 90.6% in the 4th quarter. Colonial Trust Co SC now owns 953 shares of the industrial products company's stock valued at $47,000 after purchasing an additional 453 shares during the last quarter. True Wealth Design LLC lifted its stake in Sonoco Products by 650.7% in the 4th quarter. True Wealth Design LLC now owns 1,096 shares of the industrial products company's stock valued at $54,000 after purchasing an additional 950 shares during the last quarter. Principal Securities Inc. lifted its stake in Sonoco Products by 35.0% in the 4th quarter. Principal Securities Inc. now owns 1,355 shares of the industrial products company's stock valued at $66,000 after purchasing an additional 351 shares during the last quarter. Finally, SRS Capital Advisors Inc. raised its holdings in Sonoco Products by 311.8% in the 4th quarter. SRS Capital Advisors Inc. now owns 1,713 shares of the industrial products company's stock valued at $84,000 after acquiring an additional 1,297 shares during the period. 77.69% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Sonoco Products

In other Sonoco Products news, Director Robert R. Hill, Jr. purchased 5,475 shares of the business's stock in a transaction dated Wednesday, April 30th. The shares were bought at an average price of $40.34 per share, for a total transaction of $220,861.50. Following the completion of the acquisition, the director now owns 29,540 shares in the company, valued at approximately $1,191,643.60. This trade represents a 22.75% increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO R. Howard Coker purchased 20,000 shares of the business's stock in a transaction dated Thursday, May 1st. The shares were acquired at an average price of $41.17 per share, for a total transaction of $823,400.00. Following the acquisition, the chief executive officer now owns 502,365 shares of the company's stock, valued at $20,682,367.05. This trade represents a 4.15% increase in their position. The disclosure for this purchase can be found here. Over the last 90 days, insiders have acquired 27,721 shares of company stock worth $1,144,366. Company insiders own 0.74% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have weighed in on SON. UBS Group began coverage on shares of Sonoco Products in a report on Wednesday, June 4th. They issued a "neutral" rating and a $48.00 price target on the stock. Jefferies Financial Group began coverage on shares of Sonoco Products in a report on Tuesday, April 22nd. They issued a "buy" rating and a $62.00 price target on the stock. Raymond James lowered their price target on shares of Sonoco Products from $54.00 to $50.00 and set an "outperform" rating on the stock in a report on Tuesday, April 22nd. Wells Fargo & Company raised shares of Sonoco Products from an "underweight" rating to an "overweight" rating and increased their price target for the company from $45.00 to $55.00 in a report on Friday, May 23rd. Finally, Wall Street Zen raised shares of Sonoco Products from a "sell" rating to a "hold" rating in a report on Wednesday, May 7th. Three research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, Sonoco Products presently has an average rating of "Moderate Buy" and an average price target of $56.25.

Read Our Latest Analysis on SON

Sonoco Products Price Performance

Shares of NYSE SON traded down $1.28 during trading hours on Friday, hitting $44.36. 618,325 shares of the stock were exchanged, compared to its average volume of 783,551. The company has a debt-to-equity ratio of 2.18, a quick ratio of 1.91 and a current ratio of 0.79. The company has a market cap of $4.38 billion, a PE ratio of 26.88, a price-to-earnings-growth ratio of 0.76 and a beta of 0.70. The company's fifty day simple moving average is $44.76 and its two-hundred day simple moving average is $46.99. Sonoco Products has a 1-year low of $39.46 and a 1-year high of $57.81.

Sonoco Products (NYSE:SON - Get Free Report) last posted its quarterly earnings results on Tuesday, April 29th. The industrial products company reported $1.38 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.41 by ($0.03). The firm had revenue of $1.71 billion for the quarter, compared to analyst estimates of $2.02 billion. Sonoco Products had a return on equity of 20.81% and a net margin of 2.60%. The business's revenue was up 30.6% on a year-over-year basis. During the same quarter in the prior year, the business posted $1.12 EPS. On average, sell-side analysts predict that Sonoco Products will post 6.1 EPS for the current year.

Sonoco Products Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, June 10th. Shareholders of record on Friday, May 9th were given a $0.53 dividend. The ex-dividend date was Friday, May 9th. This represents a $2.12 dividend on an annualized basis and a yield of 4.78%. This is a positive change from Sonoco Products's previous quarterly dividend of $0.52. Sonoco Products's dividend payout ratio (DPR) is currently 137.66%.

Sonoco Products Profile

(

Free Report)

Sonoco Products Company, together with its subsidiaries, designs, develops, manufactures, and sells various engineered and sustainable packaging products in North and South America, Europe, Australia, and Asia. The company operates Consumer Packaging and Industrial Paper Packaging segments. The Consumer Packaging segment offers round and shaped rigid paper, steel, and plastic containers; metal and peelable membrane ends, closures, and components; thermoformed plastic trays and enclosures; and high-barrier flexible packaging products.

Featured Stories

Before you consider Sonoco Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonoco Products wasn't on the list.

While Sonoco Products currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report