Sowell Financial Services LLC acquired a new stake in shares of Unilever PLC (NYSE:UL - Free Report) in the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 7,902 shares of the company's stock, valued at approximately $471,000.

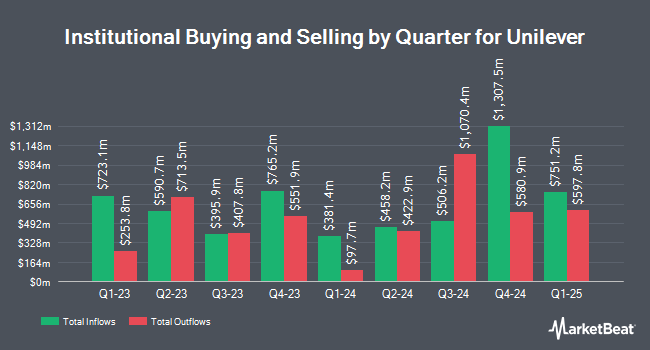

A number of other hedge funds also recently bought and sold shares of UL. Mission Wealth Management LP lifted its position in shares of Unilever by 1.4% in the first quarter. Mission Wealth Management LP now owns 11,497 shares of the company's stock worth $685,000 after purchasing an additional 159 shares in the last quarter. Pinion Investment Advisors LLC lifted its position in shares of Unilever by 2.0% in the fourth quarter. Pinion Investment Advisors LLC now owns 9,250 shares of the company's stock worth $524,000 after purchasing an additional 177 shares in the last quarter. Tyler Stone Wealth Management lifted its position in shares of Unilever by 2.8% in the fourth quarter. Tyler Stone Wealth Management now owns 6,576 shares of the company's stock worth $373,000 after purchasing an additional 180 shares in the last quarter. Ausdal Financial Partners Inc. lifted its position in shares of Unilever by 1.9% in the fourth quarter. Ausdal Financial Partners Inc. now owns 9,956 shares of the company's stock worth $565,000 after purchasing an additional 181 shares in the last quarter. Finally, Creative Financial Designs Inc. ADV lifted its position in shares of Unilever by 6.7% in the fourth quarter. Creative Financial Designs Inc. ADV now owns 2,966 shares of the company's stock worth $168,000 after purchasing an additional 185 shares in the last quarter. 9.67% of the stock is owned by hedge funds and other institutional investors.

Unilever Stock Performance

NYSE:UL opened at $61.17 on Friday. Unilever PLC has a 52 week low of $54.32 and a 52 week high of $65.87. The stock's 50 day moving average price is $62.98 and its 200 day moving average price is $59.54. The company has a market capitalization of $150.14 billion, a P/E ratio of 17.53, a P/E/G ratio of 3.46 and a beta of 0.43.

Unilever Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, June 13th. Shareholders of record on Friday, May 16th were issued a dividend of $0.5151 per share. This represents a $2.06 annualized dividend and a yield of 3.37%. The ex-dividend date of this dividend was Friday, May 16th. This is an increase from Unilever's previous quarterly dividend of $0.47. Unilever's dividend payout ratio (DPR) is 59.03%.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on UL shares. UBS Group raised shares of Unilever from a "strong sell" rating to a "hold" rating in a research report on Friday, May 2nd. BNP Paribas upgraded Unilever to a "strong-buy" rating in a report on Thursday, May 29th. BNP Paribas Exane initiated coverage on Unilever in a report on Thursday, May 29th. They issued an "outperform" rating and a $73.00 price objective on the stock. Wall Street Zen downgraded Unilever from a "buy" rating to a "hold" rating in a report on Tuesday, May 6th. Finally, DZ Bank upgraded Unilever from a "hold" rating to a "buy" rating in a report on Friday, February 21st. One analyst has rated the stock with a sell rating, three have given a hold rating, four have issued a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $70.67.

Check Out Our Latest Stock Analysis on Unilever

Unilever Company Profile

(

Free Report)

Unilever PLC operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe. It operates through five segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream. The Beauty & Wellbeing segment engages in the sale of hair care products, such as shampoo, conditioner, and styling; skin care products including face, hand, and body moisturizer; and prestige beauty and health & wellbeing products consist of the vitamins, minerals, and supplements.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Unilever, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unilever wasn't on the list.

While Unilever currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.