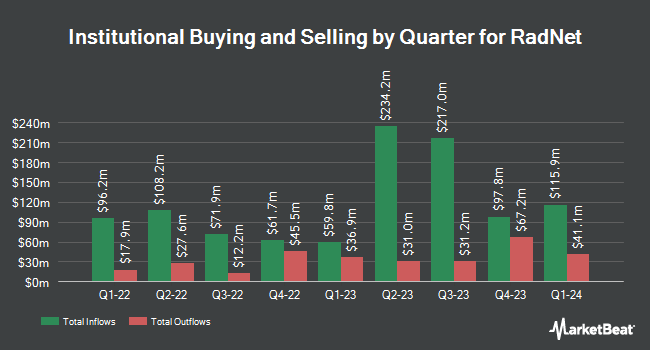

Squarepoint Ops LLC acquired a new stake in RadNet, Inc. (NASDAQ:RDNT - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 48,779 shares of the medical research company's stock, valued at approximately $3,407,000. Squarepoint Ops LLC owned about 0.07% of RadNet as of its most recent filing with the SEC.

Several other hedge funds have also recently added to or reduced their stakes in RDNT. Norges Bank acquired a new position in RadNet in the 4th quarter valued at $56,381,000. Raymond James Financial Inc. acquired a new position in RadNet in the 4th quarter valued at $33,090,000. T. Rowe Price Investment Management Inc. raised its stake in RadNet by 79.3% in the 4th quarter. T. Rowe Price Investment Management Inc. now owns 913,691 shares of the medical research company's stock valued at $63,813,000 after purchasing an additional 404,241 shares during the last quarter. Tidal Investments LLC raised its stake in RadNet by 7,219.2% in the 4th quarter. Tidal Investments LLC now owns 389,308 shares of the medical research company's stock valued at $27,189,000 after purchasing an additional 383,989 shares during the last quarter. Finally, Allspring Global Investments Holdings LLC raised its stake in RadNet by 30.4% in the 4th quarter. Allspring Global Investments Holdings LLC now owns 1,475,995 shares of the medical research company's stock valued at $103,532,000 after purchasing an additional 344,146 shares during the last quarter. 77.90% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on RDNT shares. Raymond James raised RadNet from an "outperform" rating to a "strong-buy" rating and reduced their price objective for the company from $85.00 to $65.00 in a research note on Wednesday, March 5th. Barclays reduced their price objective on RadNet from $74.00 to $60.00 and set an "overweight" rating for the company in a research note on Monday, March 24th. Truist Financial cut their target price on RadNet from $88.00 to $74.00 and set a "buy" rating for the company in a research note on Friday, April 11th. Finally, Wall Street Zen downgraded RadNet from a "hold" rating to a "sell" rating in a research note on Thursday, May 22nd. One analyst has rated the stock with a sell rating, three have assigned a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Buy" and an average target price of $69.75.

Read Our Latest Research Report on RDNT

Insider Buying and Selling at RadNet

In related news, CEO Cornelis Wesdorp sold 1,000 shares of the business's stock in a transaction that occurred on Friday, March 7th. The stock was sold at an average price of $50.52, for a total transaction of $50,520.00. Following the completion of the sale, the chief executive officer now owns 55,995 shares in the company, valued at $2,828,867.40. The trade was a 1.75% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Norman R. Hames sold 5,536 shares of the business's stock in a transaction that occurred on Thursday, May 15th. The stock was sold at an average price of $60.00, for a total value of $332,160.00. Following the sale, the chief operating officer now owns 249,183 shares of the company's stock, valued at approximately $14,950,980. The trade was a 2.17% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 101,447 shares of company stock valued at $5,539,950 in the last three months. 5.12% of the stock is owned by corporate insiders.

RadNet Trading Up 4.7%

Shares of RDNT traded up $2.59 during midday trading on Friday, reaching $57.78. The company had a trading volume of 1,250,804 shares, compared to its average volume of 690,791. RadNet, Inc. has a 1-year low of $45.00 and a 1-year high of $93.65. The stock has a market cap of $4.34 billion, a PE ratio of -825.31 and a beta of 1.46. The firm has a 50 day simple moving average of $53.40 and a 200-day simple moving average of $62.03. The company has a quick ratio of 2.16, a current ratio of 2.16 and a debt-to-equity ratio of 0.89.

RadNet (NASDAQ:RDNT - Get Free Report) last released its quarterly earnings results on Thursday, February 27th. The medical research company reported $0.22 earnings per share for the quarter, topping analysts' consensus estimates of $0.21 by $0.01. The business had revenue of $477.10 million during the quarter, compared to analysts' expectations of $459.42 million. RadNet had a positive return on equity of 4.29% and a negative net margin of 0.25%. Research analysts forecast that RadNet, Inc. will post 0.56 EPS for the current fiscal year.

RadNet Profile

(

Free Report)

RadNet, Inc, together with its subsidiaries, provides outpatient diagnostic imaging services in the United States. The company operates in two segments: Imaging Centers and Artificial Intelligence. Its services include magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, diagnostic radiology, fluoroscopy, and other related procedures, as well as multi-modality imaging services.

See Also

Before you consider RadNet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RadNet wasn't on the list.

While RadNet currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.