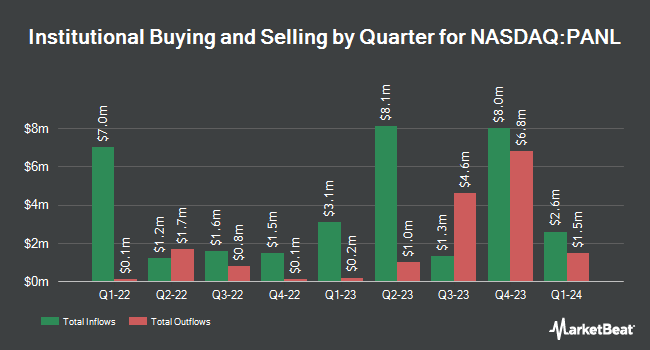

Squarepoint Ops LLC reduced its holdings in shares of Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL - Free Report) by 78.9% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 22,327 shares of the shipping company's stock after selling 83,458 shares during the quarter. Squarepoint Ops LLC's holdings in Pangaea Logistics Solutions were worth $120,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds and other institutional investors have also recently modified their holdings of PANL. Empowered Funds LLC lifted its holdings in shares of Pangaea Logistics Solutions by 5.1% during the fourth quarter. Empowered Funds LLC now owns 356,068 shares of the shipping company's stock valued at $1,909,000 after purchasing an additional 17,389 shares in the last quarter. Bank of New York Mellon Corp lifted its holdings in Pangaea Logistics Solutions by 3.3% in the fourth quarter. Bank of New York Mellon Corp now owns 92,114 shares of the shipping company's stock valued at $494,000 after acquiring an additional 2,916 shares during the period. Commonwealth Equity Services LLC bought a new position in Pangaea Logistics Solutions in the fourth quarter valued at about $55,000. Royce & Associates LP lifted its holdings in Pangaea Logistics Solutions by 24.0% in the fourth quarter. Royce & Associates LP now owns 960,102 shares of the shipping company's stock valued at $5,146,000 after acquiring an additional 185,650 shares during the period. Finally, Koss Olinger Consulting LLC bought a new position in Pangaea Logistics Solutions in the fourth quarter valued at about $105,000. 60.23% of the stock is owned by institutional investors.

Pangaea Logistics Solutions Stock Performance

PANL stock traded down $0.10 during trading on Friday, reaching $4.66. The stock had a trading volume of 194,746 shares, compared to its average volume of 207,440. Pangaea Logistics Solutions, Ltd. has a 52 week low of $3.93 and a 52 week high of $8.00. The stock's 50 day moving average is $4.36 and its two-hundred day moving average is $4.93. The company has a current ratio of 2.05, a quick ratio of 1.77 and a debt-to-equity ratio of 0.72. The firm has a market cap of $305.80 million, a PE ratio of 9.92 and a beta of 0.69.

Pangaea Logistics Solutions (NASDAQ:PANL - Get Free Report) last posted its earnings results on Monday, May 12th. The shipping company reported ($0.03) earnings per share for the quarter, beating analysts' consensus estimates of ($0.15) by $0.12. Pangaea Logistics Solutions had a return on equity of 7.88% and a net margin of 4.14%. The company had revenue of $122.80 million for the quarter, compared to the consensus estimate of $130.37 million. During the same quarter in the prior year, the company earned $0.14 earnings per share. As a group, equities analysts anticipate that Pangaea Logistics Solutions, Ltd. will post 0.43 earnings per share for the current year.

Pangaea Logistics Solutions Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, June 16th. Shareholders of record on Monday, June 2nd will be given a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a yield of 4.29%. The ex-dividend date of this dividend is Monday, June 2nd. Pangaea Logistics Solutions's payout ratio is 58.82%.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen downgraded Pangaea Logistics Solutions from a "hold" rating to a "sell" rating in a report on Wednesday, May 14th.

Get Our Latest Stock Report on Pangaea Logistics Solutions

Pangaea Logistics Solutions Company Profile

(

Free Report)

Pangaea Logistics Solutions, Ltd., together with its subsidiaries, provides seaborne dry bulk logistics and transportation services to industrial customers worldwide. It offers various dry bulk cargoes, such as grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone.

See Also

Before you consider Pangaea Logistics Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pangaea Logistics Solutions wasn't on the list.

While Pangaea Logistics Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.