Squarepoint Ops LLC purchased a new position in shares of The Shyft Group, Inc. (NASDAQ:SHYF - Free Report) during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 36,560 shares of the company's stock, valued at approximately $429,000. Squarepoint Ops LLC owned 0.11% of The Shyft Group at the end of the most recent reporting period.

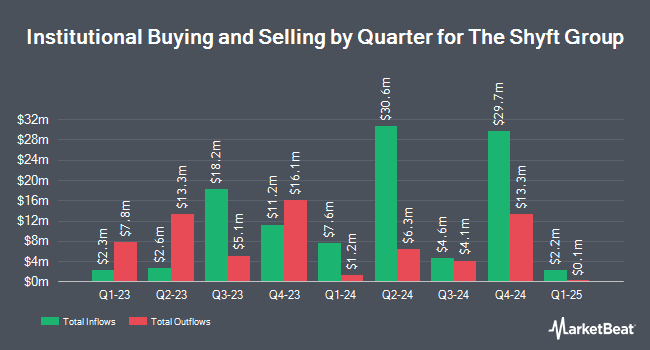

Other institutional investors and hedge funds also recently bought and sold shares of the company. T. Rowe Price Investment Management Inc. grew its holdings in shares of The Shyft Group by 60.1% in the fourth quarter. T. Rowe Price Investment Management Inc. now owns 3,240,017 shares of the company's stock valued at $38,038,000 after purchasing an additional 1,216,701 shares in the last quarter. Ausdal Financial Partners Inc. acquired a new stake in The Shyft Group during the 4th quarter worth approximately $8,789,000. Manatuck Hill Partners LLC boosted its position in The Shyft Group by 183.3% in the 4th quarter. Manatuck Hill Partners LLC now owns 425,000 shares of the company's stock valued at $4,990,000 after buying an additional 275,000 shares during the period. Royce & Associates LP grew its stake in shares of The Shyft Group by 21.4% in the fourth quarter. Royce & Associates LP now owns 1,156,776 shares of the company's stock worth $13,581,000 after acquiring an additional 203,758 shares in the last quarter. Finally, Nuveen Asset Management LLC grew its stake in shares of The Shyft Group by 30.3% in the fourth quarter. Nuveen Asset Management LLC now owns 496,516 shares of the company's stock worth $5,829,000 after acquiring an additional 115,430 shares in the last quarter. 85.84% of the stock is currently owned by hedge funds and other institutional investors.

The Shyft Group Stock Up 2.9%

Shares of The Shyft Group stock traded up $0.32 during trading hours on Friday, reaching $11.29. 218,306 shares of the company were exchanged, compared to its average volume of 289,616. The firm has a market cap of $395.26 million, a PE ratio of -125.43 and a beta of 1.94. The company has a debt-to-equity ratio of 0.44, a quick ratio of 1.16 and a current ratio of 1.82. The Shyft Group, Inc. has a 1 year low of $6.82 and a 1 year high of $17.56. The stock's fifty day moving average is $9.00 and its 200 day moving average is $10.55.

The Shyft Group Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, June 16th. Stockholders of record on Friday, May 16th will be paid a $0.05 dividend. This represents a $0.20 annualized dividend and a dividend yield of 1.77%. The ex-dividend date of this dividend is Friday, May 16th. The Shyft Group's payout ratio is presently 2,000.00%.

About The Shyft Group

(

Free Report)

The Shyft Group, Inc engages in the manufacture and assembly of specialty vehicles for the commercial and recreational vehicle industries in the United States and internationally. It operates in two segments, Fleet Vehicles and Services, and Specialty Vehicles. The Fleet Vehicles and Services segment offers commercial vehicles used in the e-commerce/last mile/parcel delivery, beverage and grocery delivery, laundry and linen, mobile retail, and trades and construction industries.

Further Reading

Before you consider The Shyft Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Shyft Group wasn't on the list.

While The Shyft Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.