St. Louis Trust Co bought a new position in Bank of America Corporation (NYSE:BAC - Free Report) during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 5,725 shares of the financial services provider's stock, valued at approximately $239,000.

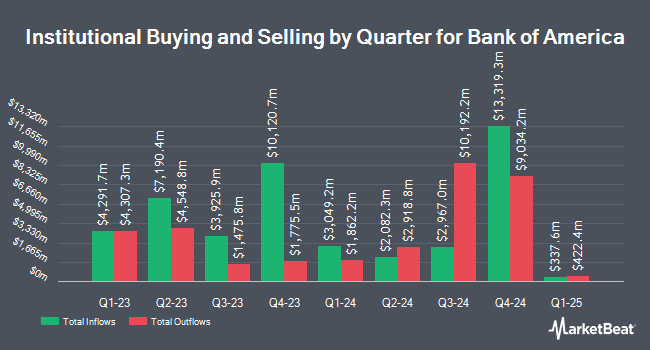

Several other institutional investors and hedge funds also recently modified their holdings of the business. Norges Bank bought a new position in Bank of America during the fourth quarter valued at about $5,226,989,000. Capital World Investors lifted its holdings in shares of Bank of America by 23.9% during the fourth quarter. Capital World Investors now owns 88,210,527 shares of the financial services provider's stock valued at $3,876,853,000 after purchasing an additional 17,031,143 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its holdings in shares of Bank of America by 10.6% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 122,437,422 shares of the financial services provider's stock valued at $5,381,126,000 after purchasing an additional 11,691,451 shares during the last quarter. Northern Trust Corp lifted its holdings in shares of Bank of America by 17.2% during the fourth quarter. Northern Trust Corp now owns 67,935,940 shares of the financial services provider's stock valued at $2,985,785,000 after purchasing an additional 9,980,859 shares during the last quarter. Finally, Deutsche Bank AG lifted its holdings in shares of Bank of America by 39.6% during the fourth quarter. Deutsche Bank AG now owns 33,152,004 shares of the financial services provider's stock valued at $1,457,031,000 after purchasing an additional 9,409,076 shares during the last quarter. Institutional investors own 70.71% of the company's stock.

Bank of America Price Performance

BAC stock traded up $0.31 during mid-day trading on Friday, hitting $47.33. The company had a trading volume of 48,220,966 shares, compared to its average volume of 40,501,913. The company has a market capitalization of $356.48 billion, a price-to-earnings ratio of 13.84, a P/E/G ratio of 1.29 and a beta of 1.30. Bank of America Corporation has a 12-month low of $33.07 and a 12-month high of $49.31. The company has a quick ratio of 0.78, a current ratio of 0.80 and a debt-to-equity ratio of 1.14. The company has a 50-day moving average price of $45.53 and a 200 day moving average price of $43.64.

Bank of America (NYSE:BAC - Get Free Report) last issued its quarterly earnings results on Wednesday, July 16th. The financial services provider reported $0.89 EPS for the quarter, beating the consensus estimate of $0.86 by $0.03. The company had revenue of ($22,273.00) million for the quarter, compared to the consensus estimate of $26.79 billion. Bank of America had a net margin of 14.81% and a return on equity of 10.25%. The firm's revenue was up 4.3% compared to the same quarter last year. During the same period in the prior year, the firm posted $0.83 EPS. On average, research analysts anticipate that Bank of America Corporation will post 3.7 earnings per share for the current year.

Bank of America Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, June 27th. Shareholders of record on Friday, June 6th were issued a $0.26 dividend. The ex-dividend date of this dividend was Friday, June 6th. This represents a $1.04 dividend on an annualized basis and a dividend yield of 2.20%. Bank of America's dividend payout ratio is currently 30.41%.

Analysts Set New Price Targets

A number of brokerages have recently commented on BAC. Cfra Research increased their price objective on Bank of America to $47.00 and gave the company a "buy" rating in a report on Wednesday, April 16th. Cowen assumed coverage on Bank of America in a research report on Wednesday, May 14th. They set a "buy" rating for the company. Barclays cut their price objective on Bank of America from $58.00 to $54.00 and set an "overweight" rating for the company in a research report on Wednesday, April 16th. Royal Bank Of Canada set a $53.00 target price on Bank of America and gave the company an "outperform" rating in a research note on Monday, June 30th. Finally, Keefe, Bruyette & Woods decreased their price objective on Bank of America from $55.00 to $52.00 and set an "outperform" rating for the company in a research note on Wednesday, April 16th. One analyst has rated the stock with a sell rating, five have given a hold rating, seventeen have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Bank of America presently has an average rating of "Moderate Buy" and an average target price of $50.03.

Read Our Latest Stock Analysis on Bank of America

About Bank of America

(

Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Featured Articles

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.