State of Wyoming acquired a new position in shares of Asana, Inc. (NYSE:ASAN - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 24,895 shares of the company's stock, valued at approximately $505,000.

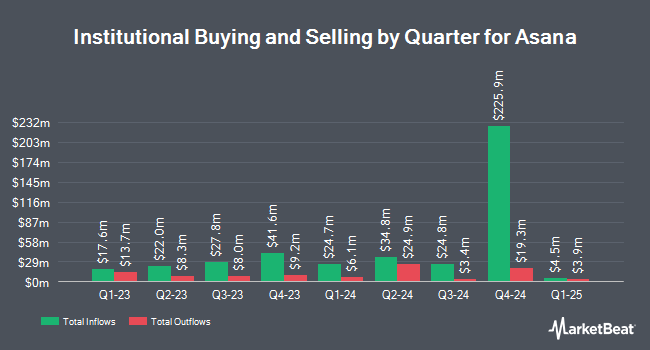

A number of other large investors have also modified their holdings of ASAN. Arrowstreet Capital Limited Partnership acquired a new position in Asana during the 4th quarter worth approximately $38,966,000. Paradice Investment Management LLC acquired a new position in shares of Asana during the fourth quarter worth $22,507,000. Voya Investment Management LLC increased its holdings in Asana by 8.1% in the fourth quarter. Voya Investment Management LLC now owns 12,539,038 shares of the company's stock valued at $254,166,000 after buying an additional 937,726 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. purchased a new position in Asana in the fourth quarter valued at $11,781,000. Finally, Trexquant Investment LP acquired a new stake in Asana in the fourth quarter valued at $11,391,000. Hedge funds and other institutional investors own 26.21% of the company's stock.

Asana Stock Performance

NYSE ASAN opened at $18.06 on Tuesday. The firm has a market cap of $4.21 billion, a P/E ratio of -16.12 and a beta of 1.21. Asana, Inc. has a 52-week low of $11.05 and a 52-week high of $27.77. The business's 50-day moving average price is $15.54 and its 200 day moving average price is $18.00. The company has a quick ratio of 1.49, a current ratio of 1.49 and a debt-to-equity ratio of 0.17.

Insiders Place Their Bets

In related news, Director Justin Rosenstein sold 25,000 shares of the stock in a transaction dated Thursday, March 13th. The shares were sold at an average price of $12.89, for a total transaction of $322,250.00. Following the completion of the transaction, the director now directly owns 922,309 shares of the company's stock, valued at $11,888,563.01. This represents a 2.64% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this link. Also, CEO Dustin A. Moskovitz acquired 225,000 shares of Asana stock in a transaction that occurred on Thursday, March 13th. The stock was purchased at an average price of $12.91 per share, with a total value of $2,904,750.00. Following the transaction, the chief executive officer now owns 48,123,436 shares of the company's stock, valued at $621,273,558.76. This trade represents a 0.47% increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last ninety days, insiders purchased 2,074,507 shares of company stock valued at $30,025,743 and sold 193,775 shares valued at $3,549,663. 61.28% of the stock is owned by insiders.

Analysts Set New Price Targets

Several research analysts have recently issued reports on ASAN shares. Jefferies Financial Group lowered their price objective on Asana from $19.00 to $15.00 and set a "hold" rating for the company in a research report on Tuesday, March 11th. UBS Group lowered their price target on Asana from $18.00 to $14.00 and set a "neutral" rating for the company in a report on Tuesday, March 11th. JMP Securities set a $22.00 price objective on shares of Asana in a report on Tuesday, March 11th. JPMorgan Chase & Co. reduced their price objective on shares of Asana from $15.00 to $13.00 and set an "underweight" rating for the company in a research report on Tuesday, March 11th. Finally, Morgan Stanley dropped their target price on shares of Asana from $15.00 to $14.00 and set an "equal weight" rating on the stock in a research report on Wednesday, April 16th. Two analysts have rated the stock with a sell rating, nine have issued a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $15.53.

Check Out Our Latest Research Report on ASAN

About Asana

(

Free Report)

Asana, Inc, together with its subsidiaries, operates a work management platform for individuals, team leads, and executives in the United States and internationally. Its platform helps organizations to orchestrate work from daily tasks to cross-functional strategic initiatives; manage work across a portfolio of projects or workflows, see progress against goals, identify bottlenecks, resource constraints, and milestones; and communicate company-wide goals, monitor status, and oversee work across projects and portfolios to gain real-time insights.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Asana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Asana wasn't on the list.

While Asana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.