Teacher Retirement System of Texas cut its position in Trane Technologies plc (NYSE:TT - Free Report) by 33.4% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 146,930 shares of the company's stock after selling 73,553 shares during the quarter. Teacher Retirement System of Texas owned 0.07% of Trane Technologies worth $49,504,000 as of its most recent SEC filing.

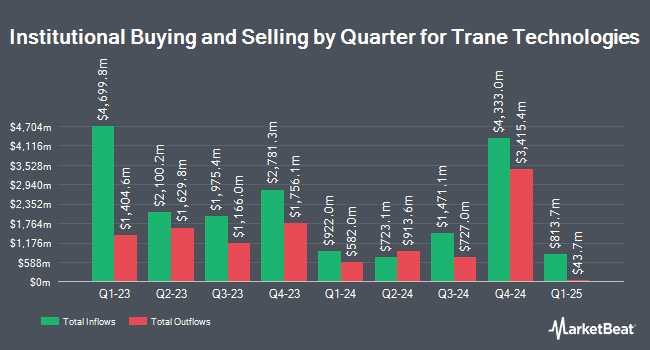

Other large investors have also recently bought and sold shares of the company. WFA Asset Management Corp increased its stake in shares of Trane Technologies by 208.3% in the first quarter. WFA Asset Management Corp now owns 74 shares of the company's stock valued at $25,000 after buying an additional 50 shares during the period. Minot DeBlois Advisors LLC acquired a new stake in shares of Trane Technologies in the fourth quarter valued at about $26,000. Vermillion & White Wealth Management Group LLC acquired a new stake in shares of Trane Technologies in the fourth quarter valued at about $28,000. Opal Wealth Advisors LLC acquired a new stake in Trane Technologies during the first quarter worth approximately $31,000. Finally, Tradewinds Capital Management LLC grew its stake in Trane Technologies by 46.2% in the first quarter. Tradewinds Capital Management LLC now owns 95 shares of the company's stock valued at $32,000 after acquiring an additional 30 shares during the period. 82.97% of the stock is currently owned by institutional investors.

Insider Activity

In related news, insider Donald E. Simmons sold 3,571 shares of Trane Technologies stock in a transaction on Wednesday, April 30th. The stock was sold at an average price of $380.00, for a total value of $1,356,980.00. Following the transaction, the insider owned 3,593 shares in the company, valued at approximately $1,365,340. This trade represents a 49.85% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 0.38% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

Several analysts have issued reports on TT shares. Royal Bank Of Canada boosted their target price on Trane Technologies from $363.00 to $408.00 and gave the company a "sector perform" rating in a research note on Thursday, May 1st. UBS Group boosted their target price on Trane Technologies from $470.00 to $500.00 and gave the company a "buy" rating in a research note on Thursday, May 22nd. Stephens upgraded Trane Technologies from an "equal weight" rating to an "overweight" rating and set a $475.00 price objective on the stock in a research note on Thursday, May 1st. HSBC upgraded Trane Technologies from a "hold" rating to a "buy" rating and boosted their price objective for the company from $405.00 to $415.00 in a research note on Friday, April 25th. Finally, Hsbc Global Res upgraded Trane Technologies from a "hold" rating to a "strong-buy" rating in a research note on Friday, April 25th. One analyst has rated the stock with a sell rating, seven have given a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $430.13.

View Our Latest Research Report on TT

Trane Technologies Stock Up 1.6%

Shares of NYSE TT traded up $6.93 during midday trading on Friday, hitting $439.64. 1,182,309 shares of the company's stock were exchanged, compared to its average volume of 1,333,717. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.09 and a quick ratio of 0.74. Trane Technologies plc has a twelve month low of $298.15 and a twelve month high of $438.15. The company has a market cap of $98.05 billion, a PE ratio of 36.58, a P/E/G ratio of 2.85 and a beta of 1.15. The firm's fifty day simple moving average is $418.47 and its 200-day simple moving average is $378.93.

Trane Technologies (NYSE:TT - Get Free Report) last posted its quarterly earnings data on Wednesday, April 30th. The company reported $2.45 EPS for the quarter, beating the consensus estimate of $2.20 by $0.25. The firm had revenue of $4.69 billion during the quarter, compared to the consensus estimate of $4.46 billion. Trane Technologies had a return on equity of 36.10% and a net margin of 13.47%. The firm's revenue was up 11.2% compared to the same quarter last year. During the same period in the prior year, the business earned $1.94 EPS. Research analysts predict that Trane Technologies plc will post 12.83 EPS for the current fiscal year.

Trane Technologies Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Friday, September 5th will be issued a dividend of $0.94 per share. This represents a $3.76 annualized dividend and a dividend yield of 0.86%. The ex-dividend date of this dividend is Friday, September 5th. Trane Technologies's dividend payout ratio (DPR) is 31.28%.

About Trane Technologies

(

Free Report)

Trane Technologies plc, together with its subsidiaries, designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, custom, and custom and transport refrigeration in Ireland and internationally. It offers air conditioners, exchangers, and handlers; airside and terminal devices; air sourced heat pumps, auxiliary power units; chillers; coils and condensers; gensets; dehumidifiers; ductless; furnaces; home automation products; humidifiers; indoor air quality assessments and related products; large and light commercial unitary products; refrigerant reclamation products; thermostats/controls; transport heater products; variable refrigerant flow products; and water source heat pumps.

Further Reading

Before you consider Trane Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trane Technologies wasn't on the list.

While Trane Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.