Texas Bank & Trust Co purchased a new position in Intuit Inc. (NASDAQ:INTU - Free Report) during the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 834 shares of the software maker's stock, valued at approximately $524,000.

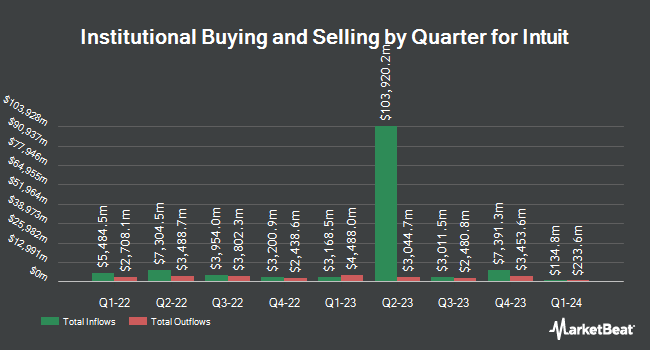

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. R Squared Ltd bought a new stake in Intuit in the fourth quarter worth about $25,000. NewSquare Capital LLC raised its position in Intuit by 72.0% in the fourth quarter. NewSquare Capital LLC now owns 43 shares of the software maker's stock worth $27,000 after acquiring an additional 18 shares in the last quarter. Heck Capital Advisors LLC bought a new stake in Intuit in the fourth quarter worth about $28,000. Migdal Insurance & Financial Holdings Ltd. bought a new stake in Intuit in the fourth quarter worth about $28,000. Finally, Summit Securities Group LLC bought a new stake in Intuit in the fourth quarter worth about $28,000. 83.66% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have commented on the stock. Redburn Atlantic assumed coverage on shares of Intuit in a research report on Wednesday, February 19th. They issued a "neutral" rating on the stock. Hsbc Global Res raised shares of Intuit from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, April 23rd. Mizuho raised their target price on shares of Intuit from $750.00 to $765.00 and gave the stock an "outperform" rating in a report on Monday, March 3rd. JPMorgan Chase & Co. upgraded shares of Intuit from a "neutral" rating to an "overweight" rating and boosted their price target for the company from $640.00 to $660.00 in a report on Wednesday, March 5th. Finally, Morgan Stanley decreased their price objective on shares of Intuit from $730.00 to $720.00 and set an "overweight" rating for the company in a research note on Wednesday, April 16th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating, nineteen have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $720.16.

View Our Latest Analysis on Intuit

Insider Activity

In other Intuit news, Director Eve B. Burton sold 1,702 shares of the company's stock in a transaction that occurred on Thursday, March 20th. The stock was sold at an average price of $600.00, for a total value of $1,021,200.00. Following the completion of the transaction, the director now owns 8 shares of the company's stock, valued at $4,800. This represents a 99.53% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP Laura A. Fennell sold 8,163 shares of the company's stock in a transaction that occurred on Monday, March 24th. The shares were sold at an average price of $612.46, for a total value of $4,999,510.98. Following the completion of the transaction, the executive vice president now directly owns 21,882 shares of the company's stock, valued at approximately $13,401,849.72. This trade represents a 27.17% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 23,696 shares of company stock valued at $14,347,731. 2.68% of the stock is owned by company insiders.

Intuit Stock Performance

Intuit stock traded up $0.30 during trading hours on Tuesday, reaching $671.16. 1,044,423 shares of the company were exchanged, compared to its average volume of 1,609,419. The firm has a market cap of $187.63 billion, a price-to-earnings ratio of 65.16, a PEG ratio of 2.85 and a beta of 1.24. The company has a current ratio of 1.24, a quick ratio of 1.24 and a debt-to-equity ratio of 0.31. The stock has a 50-day moving average of $611.83 and a 200 day moving average of $619.91. Intuit Inc. has a 12 month low of $532.65 and a 12 month high of $714.78.

Intuit Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, April 18th. Stockholders of record on Thursday, April 10th were given a $1.04 dividend. The ex-dividend date was Thursday, April 10th. This represents a $4.16 annualized dividend and a dividend yield of 0.62%. Intuit's dividend payout ratio is 38.81%.

Intuit Profile

(

Free Report)

Intuit Inc provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in four segments: Small Business & Self-Employed, Consumer, Credit Karma, and ProTax.

See Also

Before you consider Intuit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intuit wasn't on the list.

While Intuit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.