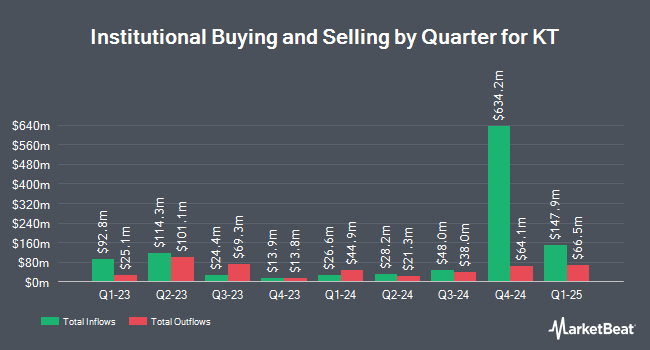

Tidal Investments LLC bought a new stake in KT Co. (NYSE:KT - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund bought 426,792 shares of the technology company's stock, valued at approximately $6,624,000. Tidal Investments LLC owned 0.08% of KT as of its most recent SEC filing.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. R Squared Ltd purchased a new stake in shares of KT in the 4th quarter valued at $36,000. Principal Securities Inc. raised its holdings in shares of KT by 70.6% in the 4th quarter. Principal Securities Inc. now owns 3,730 shares of the technology company's stock valued at $58,000 after buying an additional 1,544 shares during the period. Global Retirement Partners LLC raised its holdings in shares of KT by 58.2% in the 4th quarter. Global Retirement Partners LLC now owns 7,253 shares of the technology company's stock valued at $113,000 after buying an additional 2,667 shares during the period. TD Private Client Wealth LLC increased its holdings in KT by 37.5% during the 4th quarter. TD Private Client Wealth LLC now owns 7,996 shares of the technology company's stock worth $124,000 after purchasing an additional 2,181 shares during the period. Finally, Park Avenue Securities LLC purchased a new stake in KT during the 4th quarter worth about $181,000. Hedge funds and other institutional investors own 18.86% of the company's stock.

Analysts Set New Price Targets

KT has been the topic of several recent research reports. UBS Group initiated coverage on KT in a report on Wednesday, February 19th. They set a "buy" rating on the stock. The Goldman Sachs Group upgraded KT from a "neutral" rating to a "buy" rating in a report on Monday, March 3rd. Finally, StockNews.com downgraded KT from a "strong-buy" rating to a "buy" rating in a report on Tuesday.

Get Our Latest Report on KT

KT Trading Up 0.4%

NYSE:KT opened at $19.41 on Tuesday. The stock has a 50-day simple moving average of $18.30 and a 200-day simple moving average of $17.24. The stock has a market cap of $10.01 billion, a P/E ratio of 10.90, a P/E/G ratio of 0.37 and a beta of 0.68. KT Co. has a 1 year low of $13.11 and a 1 year high of $20.28. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.98 and a current ratio of 1.04.

About KT

(

Free Report)

KT Corporation provides integrated telecommunications and platform services in Korea and internationally. The company offers mobile voice and data telecommunications services based on 5G, 4G LTE and 3G W-CDMA technology; fixed-line telephone services, including local, domestic long-distance, international long-distance, and voice over Internet protocol telephone services, as well as interconnection services; broadband Internet access service and other Internet-related services; and data communication services, such as fixed-line and leased line services, as well as broadband Internet connection services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider KT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KT wasn't on the list.

While KT currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.