Toronto Dominion Bank reduced its position in Expeditors International of Washington, Inc. (NASDAQ:EXPD - Free Report) by 32.2% during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 47,391 shares of the transportation company's stock after selling 22,521 shares during the quarter. Toronto Dominion Bank's holdings in Expeditors International of Washington were worth $5,250,000 as of its most recent filing with the SEC.

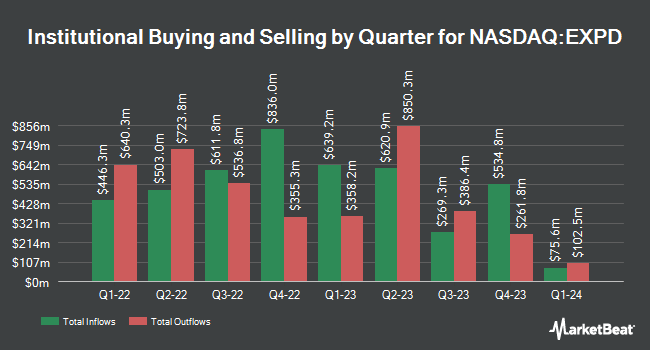

Other institutional investors also recently modified their holdings of the company. First Eagle Investment Management LLC boosted its position in Expeditors International of Washington by 32.0% during the fourth quarter. First Eagle Investment Management LLC now owns 4,070,429 shares of the transportation company's stock valued at $450,881,000 after acquiring an additional 987,233 shares during the last quarter. Boston Partners lifted its stake in shares of Expeditors International of Washington by 29.7% in the 4th quarter. Boston Partners now owns 3,797,712 shares of the transportation company's stock valued at $420,693,000 after purchasing an additional 869,637 shares during the period. Geode Capital Management LLC grew its stake in Expeditors International of Washington by 1.7% during the fourth quarter. Geode Capital Management LLC now owns 3,392,307 shares of the transportation company's stock worth $374,771,000 after purchasing an additional 57,736 shares during the period. First Trust Advisors LP grew its stake in Expeditors International of Washington by 33.8% during the fourth quarter. First Trust Advisors LP now owns 2,734,816 shares of the transportation company's stock worth $302,936,000 after purchasing an additional 690,539 shares during the period. Finally, Invesco Ltd. grew its stake in Expeditors International of Washington by 10.6% during the fourth quarter. Invesco Ltd. now owns 2,463,431 shares of the transportation company's stock worth $272,874,000 after purchasing an additional 235,409 shares during the period. 94.02% of the stock is owned by institutional investors.

Expeditors International of Washington Trading Down 0.5%

Shares of EXPD traded down $0.58 during mid-day trading on Friday, reaching $112.69. 2,573,305 shares of the stock traded hands, compared to its average volume of 1,277,689. Expeditors International of Washington, Inc. has a 1 year low of $100.47 and a 1 year high of $131.59. The company has a market cap of $15.43 billion, a price-to-earnings ratio of 19.70, a price-to-earnings-growth ratio of 5.00 and a beta of 1.09. The firm has a fifty day moving average price of $111.69 and a 200 day moving average price of $114.34.

Expeditors International of Washington Increases Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Monday, June 16th. Shareholders of record on Monday, June 2nd will be paid a $0.77 dividend. The ex-dividend date is Monday, June 2nd. This is an increase from Expeditors International of Washington's previous semi-annual dividend of $0.73. This represents a yield of 1.4%. Expeditors International of Washington's payout ratio is currently 25.58%.

Wall Street Analysts Forecast Growth

Several brokerages have recently commented on EXPD. Wall Street Zen downgraded shares of Expeditors International of Washington from a "buy" rating to a "hold" rating in a research report on Sunday, February 16th. JPMorgan Chase & Co. dropped their price target on shares of Expeditors International of Washington from $114.00 to $108.00 and set an "underweight" rating on the stock in a research report on Wednesday, February 19th. Barclays dropped their price target on shares of Expeditors International of Washington from $110.00 to $105.00 and set an "underweight" rating on the stock in a research report on Wednesday, May 7th. TD Cowen dropped their price target on shares of Expeditors International of Washington from $112.00 to $107.00 and set a "sell" rating on the stock in a research report on Wednesday, May 7th. Finally, Benchmark restated a "hold" rating on shares of Expeditors International of Washington in a research note on Wednesday, February 19th. Four analysts have rated the stock with a sell rating and eight have given a hold rating to the company. According to MarketBeat, Expeditors International of Washington has an average rating of "Hold" and an average price target of $113.89.

Get Our Latest Stock Analysis on EXPD

Expeditors International of Washington Company Profile

(

Free Report)

Expeditors International of Washington, Inc, together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services, such as air freight consolidation and forwarding; ocean freight and ocean services, including ocean freight consolidation, direct ocean forwarding, and order management; customs brokerage, import, intra-continental ground transportation and delivery, and warehousing and distribution services; and customs clearance, purchase order management, vendor consolidation, time-definite transportation services, temperature-controlled transit, cargo insurance, specialized cargo monitoring and tracking, and other supply chain solutions.

Further Reading

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.