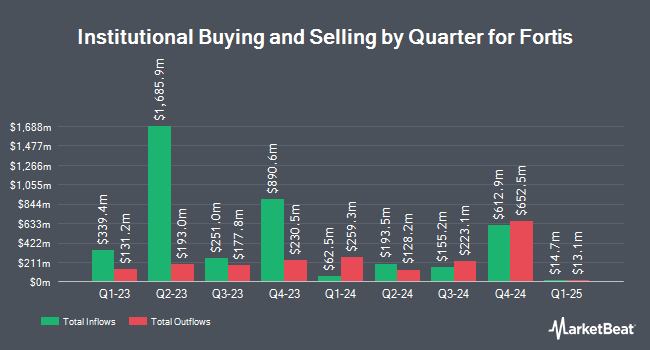

Twinbeech Capital LP purchased a new stake in Fortis Inc. (NYSE:FTS - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm purchased 7,275 shares of the utilities provider's stock, valued at approximately $302,000.

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Raymond James Financial Inc. acquired a new stake in Fortis during the fourth quarter worth approximately $1,751,000. Forsta AP Fonden raised its position in Fortis by 94.8% during the 4th quarter. Forsta AP Fonden now owns 294,600 shares of the utilities provider's stock valued at $12,235,000 after purchasing an additional 143,400 shares during the last quarter. US Bancorp DE grew its holdings in shares of Fortis by 12.7% during the 4th quarter. US Bancorp DE now owns 14,544 shares of the utilities provider's stock worth $605,000 after acquiring an additional 1,638 shares during the period. DGS Capital Management LLC grew its stake in shares of Fortis by 52.3% in the 4th quarter. DGS Capital Management LLC now owns 30,560 shares of the utilities provider's stock worth $1,270,000 after buying an additional 10,491 shares during the last quarter. Finally, Bank of New York Mellon Corp lifted its holdings in shares of Fortis by 7.4% during the 4th quarter. Bank of New York Mellon Corp now owns 533,741 shares of the utilities provider's stock valued at $22,188,000 after buying an additional 36,587 shares during the period. 57.77% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on FTS shares. Jefferies Financial Group assumed coverage on Fortis in a report on Thursday, February 13th. They issued a "hold" rating on the stock. Royal Bank of Canada boosted their price objective on shares of Fortis from $69.00 to $72.00 and gave the company a "sector perform" rating in a report on Thursday, May 8th. Finally, Desjardins assumed coverage on shares of Fortis in a research note on Tuesday, May 6th. They set a "hold" rating on the stock. Two research analysts have rated the stock with a sell rating and five have assigned a hold rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $72.00.

Check Out Our Latest Stock Analysis on FTS

Fortis Trading Down 1.2%

Shares of FTS stock traded down $0.56 during mid-day trading on Wednesday, reaching $47.97. The company's stock had a trading volume of 86,672 shares, compared to its average volume of 617,382. Fortis Inc. has a 12-month low of $38.15 and a 12-month high of $50.06. The firm has a market capitalization of $24.06 billion, a PE ratio of 20.35, a price-to-earnings-growth ratio of 3.94 and a beta of 0.50. The company has a quick ratio of 0.63, a current ratio of 0.63 and a debt-to-equity ratio of 1.30. The company's 50 day simple moving average is $47.11 and its 200-day simple moving average is $44.64.

Fortis (NYSE:FTS - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The utilities provider reported $0.70 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.69 by $0.01. The business had revenue of $2.31 billion for the quarter, compared to analyst estimates of $3.42 billion. Fortis had a net margin of 14.12% and a return on equity of 7.09%. During the same quarter in the previous year, the business earned $0.93 earnings per share. On average, research analysts predict that Fortis Inc. will post 2.35 EPS for the current fiscal year.

Fortis Company Profile

(

Free Report)

Fortis Inc operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries. It generates, transmits, and distributes electricity to approximately 447,000 retail customers in southeastern Arizona; and 103,000 retail customers in Arizona's Mohave and Santa Cruz counties with an aggregate capacity of 3,408 megawatts (MW), including 68 MW of solar capacity and 250 MV of wind capacity.

Further Reading

Before you consider Fortis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortis wasn't on the list.

While Fortis currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.