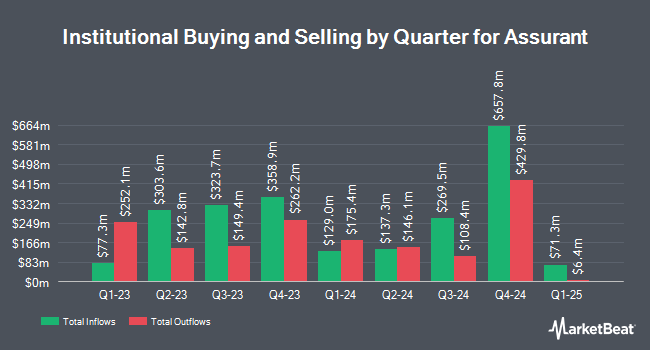

Twinbeech Capital LP purchased a new position in shares of Assurant, Inc. (NYSE:AIZ - Free Report) during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 2,250 shares of the financial services provider's stock, valued at approximately $480,000.

Other institutional investors have also recently bought and sold shares of the company. PNC Financial Services Group Inc. boosted its stake in Assurant by 1.3% during the fourth quarter. PNC Financial Services Group Inc. now owns 7,773 shares of the financial services provider's stock worth $1,657,000 after buying an additional 100 shares in the last quarter. Blue Trust Inc. boosted its stake in Assurant by 28.6% during the fourth quarter. Blue Trust Inc. now owns 845 shares of the financial services provider's stock worth $168,000 after buying an additional 188 shares in the last quarter. Atria Wealth Solutions Inc. acquired a new stake in Assurant during the fourth quarter worth $329,000. Merit Financial Group LLC acquired a new stake in Assurant during the fourth quarter worth $254,000. Finally, Barclays PLC boosted its stake in Assurant by 48.4% during the third quarter. Barclays PLC now owns 192,310 shares of the financial services provider's stock worth $38,243,000 after buying an additional 62,696 shares in the last quarter. Institutional investors and hedge funds own 92.65% of the company's stock.

Assurant Price Performance

Shares of Assurant stock traded down $1.71 during trading on Wednesday, reaching $199.29. The company's stock had a trading volume of 220,772 shares, compared to its average volume of 398,657. The stock has a 50-day moving average price of $196.54 and a two-hundred day moving average price of $206.99. The company has a current ratio of 0.43, a quick ratio of 0.43 and a debt-to-equity ratio of 0.41. Assurant, Inc. has a one year low of $160.12 and a one year high of $230.55. The stock has a market capitalization of $10.14 billion, a P/E ratio of 13.75 and a beta of 0.59.

Assurant (NYSE:AIZ - Get Free Report) last released its quarterly earnings results on Tuesday, May 6th. The financial services provider reported $3.39 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.78 by $0.61. The business had revenue of $3.07 billion during the quarter, compared to analysts' expectations of $3.06 billion. Assurant had a return on equity of 17.25% and a net margin of 6.40%. The firm's revenue for the quarter was up 6.7% compared to the same quarter last year. During the same period in the previous year, the business posted $4.78 earnings per share. As a group, sell-side analysts anticipate that Assurant, Inc. will post 16.88 EPS for the current fiscal year.

Assurant Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, June 30th. Shareholders of record on Monday, June 9th will be issued a dividend of $0.80 per share. The ex-dividend date is Monday, June 9th. This represents a $3.20 annualized dividend and a yield of 1.61%. Assurant's dividend payout ratio is currently 24.94%.

Insiders Place Their Bets

In other news, EVP Jay Rosenblum sold 1,000 shares of the company's stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $201.93, for a total value of $201,930.00. Following the completion of the sale, the executive vice president now directly owns 11,775 shares of the company's stock, valued at $2,377,725.75. This represents a 7.83% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Company insiders own 0.51% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on the stock. Truist Financial boosted their target price on shares of Assurant from $240.00 to $250.00 and gave the company a "buy" rating in a research note on Thursday, February 13th. Wall Street Zen upgraded shares of Assurant from a "hold" rating to a "buy" rating in a research note on Wednesday, May 7th. Keefe, Bruyette & Woods boosted their target price on shares of Assurant from $224.00 to $225.00 and gave the company an "outperform" rating in a research note on Monday, May 19th. Piper Sandler upgraded shares of Assurant from a "neutral" rating to an "overweight" rating and set a $223.00 target price on the stock in a research note on Thursday, April 10th. Finally, Morgan Stanley set a $217.00 target price on shares of Assurant and gave the company an "equal weight" rating in a research note on Monday, May 19th. One investment analyst has rated the stock with a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat.com, Assurant currently has an average rating of "Moderate Buy" and a consensus target price of $228.67.

Get Our Latest Stock Report on AIZ

Assurant Profile

(

Free Report)

Assurant, Inc, together with its subsidiaries, provides business services that supports, protects, and connects consumer purchases in North America, Latin America, Europe, and the Asia Pacific. The company operates through two segments: Global Lifestyle and Global Housing. The Global Lifestyle segment offers mobile device solutions, and extended service contracts and related services for consumer electronics and appliances, and credit and other insurance products; and vehicle protection, commercial equipment, and other related services.

See Also

Before you consider Assurant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assurant wasn't on the list.

While Assurant currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.