Two Sigma Investments LP lowered its stake in Elbit Systems Ltd. (NASDAQ:ESLT - Free Report) by 67.9% during the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 3,855 shares of the aerospace company's stock after selling 8,141 shares during the quarter. Two Sigma Investments LP's holdings in Elbit Systems were worth $995,000 as of its most recent filing with the SEC.

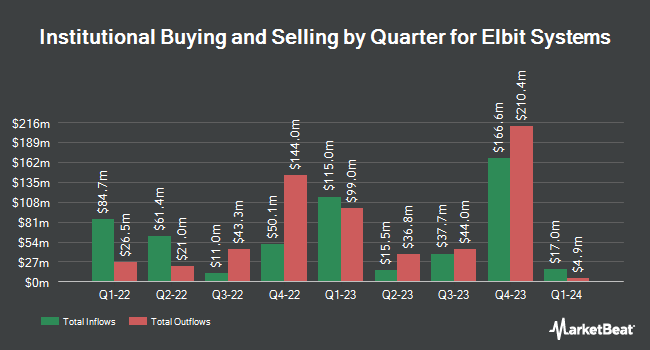

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Sig Brokerage LP acquired a new position in shares of Elbit Systems during the fourth quarter valued at approximately $591,000. Quantinno Capital Management LP boosted its stake in Elbit Systems by 20.9% during the 4th quarter. Quantinno Capital Management LP now owns 10,105 shares of the aerospace company's stock worth $2,629,000 after purchasing an additional 1,749 shares during the last quarter. Nuveen Asset Management LLC grew its holdings in shares of Elbit Systems by 4.2% during the fourth quarter. Nuveen Asset Management LLC now owns 71,799 shares of the aerospace company's stock worth $18,779,000 after buying an additional 2,892 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of Elbit Systems by 26.0% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 62,474 shares of the aerospace company's stock valued at $16,340,000 after buying an additional 12,891 shares during the last quarter. Finally, Laird Norton Wetherby Wealth Management LLC lifted its stake in Elbit Systems by 2.9% in the 4th quarter. Laird Norton Wetherby Wealth Management LLC now owns 2,094 shares of the aerospace company's stock worth $540,000 after purchasing an additional 60 shares in the last quarter. Hedge funds and other institutional investors own 17.88% of the company's stock.

Analyst Ratings Changes

Separately, Wall Street Zen cut Elbit Systems from a "strong-buy" rating to a "buy" rating in a report on Tuesday, February 25th.

Get Our Latest Stock Report on ESLT

Elbit Systems Trading Down 1.2%

Shares of NASDAQ ESLT traded down $5.19 during trading on Monday, hitting $415.03. 159,416 shares of the company were exchanged, compared to its average volume of 54,810. The company has a fifty day moving average price of $395.44 and a 200-day moving average price of $334.34. The company has a debt-to-equity ratio of 0.10, a quick ratio of 0.64 and a current ratio of 1.15. The firm has a market capitalization of $18.45 billion, a PE ratio of 70.95 and a beta of 0.31. Elbit Systems Ltd. has a 12-month low of $175.30 and a 12-month high of $432.92.

Elbit Systems (NASDAQ:ESLT - Get Free Report) last posted its quarterly earnings results on Tuesday, May 20th. The aerospace company reported $2.57 earnings per share for the quarter, beating the consensus estimate of $2.30 by $0.27. The business had revenue of $1.90 billion during the quarter, compared to analysts' expectations of $1.69 billion. Elbit Systems had a net margin of 4.00% and a return on equity of 11.34%. During the same quarter in the prior year, the company posted $1.81 EPS. As a group, equities research analysts expect that Elbit Systems Ltd. will post 8.05 EPS for the current year.

Elbit Systems Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, July 7th. Shareholders of record on Tuesday, June 24th will be given a $0.60 dividend. The ex-dividend date is Tuesday, June 24th. This represents a $2.40 dividend on an annualized basis and a yield of 0.58%. Elbit Systems's dividend payout ratio is currently 25.25%.

Elbit Systems Profile

(

Free Report)

Elbit Systems Ltd. develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications primarily in Israel. The company operates through Aerospace, C4I and Cyber, ISTAR and EW, Land, and Elbit Systems of America segments.

Further Reading

Before you consider Elbit Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elbit Systems wasn't on the list.

While Elbit Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.