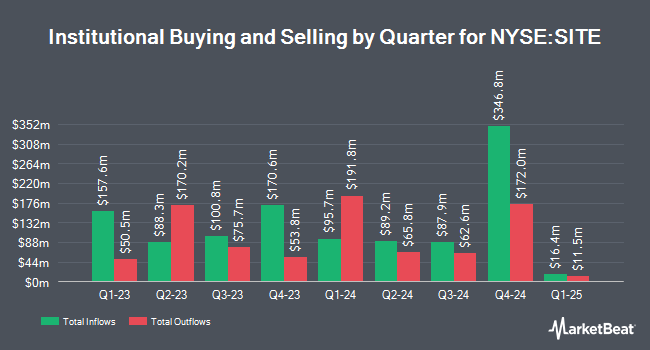

UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of SiteOne Landscape Supply, Inc. (NYSE:SITE - Free Report) by 9.5% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 153,907 shares of the industrial products company's stock after buying an additional 13,374 shares during the quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC owned about 0.34% of SiteOne Landscape Supply worth $20,280,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors have also added to or reduced their stakes in the stock. Arizona State Retirement System boosted its stake in SiteOne Landscape Supply by 0.6% during the fourth quarter. Arizona State Retirement System now owns 13,096 shares of the industrial products company's stock worth $1,726,000 after buying an additional 77 shares during the period. HighPoint Advisor Group LLC boosted its stake in SiteOne Landscape Supply by 4.0% during the fourth quarter. HighPoint Advisor Group LLC now owns 2,037 shares of the industrial products company's stock worth $271,000 after buying an additional 78 shares during the period. State of Wyoming lifted its position in shares of SiteOne Landscape Supply by 6.2% during the fourth quarter. State of Wyoming now owns 1,389 shares of the industrial products company's stock worth $183,000 after purchasing an additional 81 shares during the last quarter. Treasurer of the State of North Carolina lifted its position in shares of SiteOne Landscape Supply by 0.7% during the fourth quarter. Treasurer of the State of North Carolina now owns 19,611 shares of the industrial products company's stock worth $2,584,000 after purchasing an additional 130 shares during the last quarter. Finally, Tortoise Investment Management LLC lifted its position in shares of SiteOne Landscape Supply by 78.9% during the fourth quarter. Tortoise Investment Management LLC now owns 297 shares of the industrial products company's stock worth $39,000 after purchasing an additional 131 shares during the last quarter.

SiteOne Landscape Supply Stock Performance

NYSE SITE traded down $0.48 during trading hours on Friday, reaching $116.98. The stock had a trading volume of 372,742 shares, compared to its average volume of 432,394. The company has a debt-to-equity ratio of 0.31, a quick ratio of 1.16 and a current ratio of 2.53. SiteOne Landscape Supply, Inc. has a 52-week low of $101.25 and a 52-week high of $160.75. The stock has a fifty day moving average of $117.16 and a 200 day moving average of $130.01. The stock has a market cap of $5.24 billion, a P/E ratio of 43.49 and a beta of 1.62.

SiteOne Landscape Supply (NYSE:SITE - Get Free Report) last released its quarterly earnings data on Wednesday, April 30th. The industrial products company reported ($0.61) EPS for the quarter, missing the consensus estimate of ($0.50) by ($0.11). SiteOne Landscape Supply had a return on equity of 7.93% and a net margin of 2.72%. The company had revenue of $939.40 million during the quarter, compared to analysts' expectations of $933.90 million. During the same quarter in the prior year, the company posted ($0.43) EPS. The company's revenue for the quarter was up 3.8% on a year-over-year basis. Sell-side analysts predict that SiteOne Landscape Supply, Inc. will post 3.61 earnings per share for the current year.

Analyst Upgrades and Downgrades

SITE has been the subject of several recent research reports. Deutsche Bank Aktiengesellschaft initiated coverage on SiteOne Landscape Supply in a report on Tuesday, April 1st. They issued a "hold" rating and a $135.00 price objective for the company. Truist Financial reduced their target price on shares of SiteOne Landscape Supply from $165.00 to $145.00 and set a "buy" rating for the company in a report on Thursday, May 1st. UBS Group reduced their target price on shares of SiteOne Landscape Supply from $185.00 to $182.00 and set a "buy" rating for the company in a report on Thursday, February 13th. Wall Street Zen upgraded shares of SiteOne Landscape Supply from a "sell" rating to a "hold" rating in a report on Thursday, May 1st. Finally, Royal Bank of Canada reduced their target price on shares of SiteOne Landscape Supply from $136.00 to $130.00 and set a "sector perform" rating for the company in a report on Thursday, May 1st. One investment analyst has rated the stock with a sell rating, six have given a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $145.70.

View Our Latest Analysis on SiteOne Landscape Supply

SiteOne Landscape Supply Profile

(

Free Report)

SiteOne Landscape Supply, Inc, together with its subsidiaries, engages in the wholesale distribution of landscape supplies in the United States and Canada. The company provides irrigation products, including controllers, valves, sprinkler heads, irrigation pipes, micro irrigation, and drip products; fertilizer, grass seed, and ice melt products; control products, such as herbicides, fungicides, rodenticides, and other pesticides; landscape accessories that include mulches, soil amendments, drainage pipes, tools, and sods; nursery goods, which consist of deciduous and evergreen shrubs, ornamental, shade, evergreen trees, field grown and container-grown nursery stock, roses, perennials, annuals, bulbs, and plant species and cultivars; hardscapes, such as pavers, natural stones, blocks, and other durable materials; and outdoor lighting products that include lighting fixtures, LED lamps, wires, transformers, and accessories.

Recommended Stories

Before you consider SiteOne Landscape Supply, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SiteOne Landscape Supply wasn't on the list.

While SiteOne Landscape Supply currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.