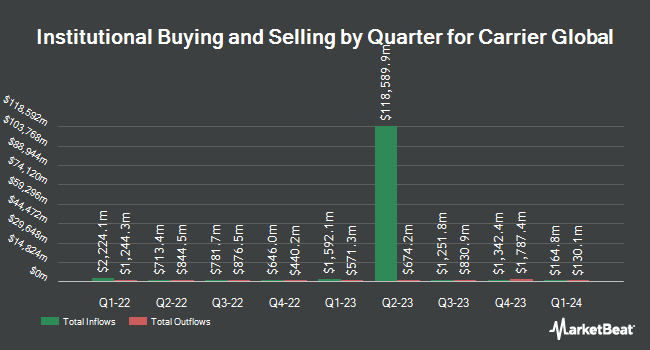

Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in shares of Carrier Global Co. (NYSE:CARR - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 829,611 shares of the company's stock, valued at approximately $56,629,000. Universal Beteiligungs und Servicegesellschaft mbH owned about 0.10% of Carrier Global as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in CARR. Challenger Wealth Management purchased a new stake in Carrier Global in the fourth quarter valued at $273,000. Aurdan Capital Management LLC purchased a new stake in Carrier Global in the fourth quarter valued at $201,000. Forum Financial Management LP raised its position in Carrier Global by 14.5% in the fourth quarter. Forum Financial Management LP now owns 7,388 shares of the company's stock valued at $504,000 after purchasing an additional 938 shares during the period. Breed s Hill Capital LLC raised its position in Carrier Global by 14.7% in the fourth quarter. Breed s Hill Capital LLC now owns 3,438 shares of the company's stock valued at $235,000 after purchasing an additional 441 shares during the period. Finally, Vise Technologies Inc. raised its position in Carrier Global by 29.2% in the fourth quarter. Vise Technologies Inc. now owns 15,497 shares of the company's stock valued at $1,058,000 after purchasing an additional 3,502 shares during the period. Institutional investors and hedge funds own 91.00% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on CARR shares. Wolfe Research upgraded Carrier Global from a "peer perform" rating to an "outperform" rating and set a $80.00 target price on the stock in a research report on Monday, February 24th. Mizuho set a $72.00 target price on Carrier Global in a research report on Tuesday, April 22nd. Robert W. Baird lifted their target price on Carrier Global from $80.00 to $88.00 and gave the company an "outperform" rating in a research report on Tuesday, May 20th. JPMorgan Chase & Co. boosted their price objective on Carrier Global from $66.00 to $79.00 and gave the company an "overweight" rating in a report on Friday, May 16th. Finally, Royal Bank of Canada boosted their price objective on Carrier Global from $86.00 to $87.00 and gave the company an "outperform" rating in a report on Tuesday, May 20th. Four equities research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $83.00.

View Our Latest Analysis on Carrier Global

Carrier Global Stock Down 0.4%

NYSE CARR traded down $0.29 during trading hours on Friday, hitting $71.12. 6,337,867 shares of the company were exchanged, compared to its average volume of 4,650,460. The company has a 50 day moving average of $65.63 and a two-hundred day moving average of $67.72. The company has a quick ratio of 0.96, a current ratio of 1.25 and a debt-to-equity ratio of 0.77. Carrier Global Co. has a 52-week low of $54.22 and a 52-week high of $83.32. The firm has a market cap of $60.97 billion, a price-to-earnings ratio of 11.32, a PEG ratio of 2.01 and a beta of 1.33.

Carrier Global (NYSE:CARR - Get Free Report) last issued its quarterly earnings results on Thursday, May 1st. The company reported $0.65 earnings per share for the quarter, topping the consensus estimate of $0.58 by $0.07. The company had revenue of $5.22 billion for the quarter, compared to the consensus estimate of $5.17 billion. Carrier Global had a return on equity of 18.82% and a net margin of 23.83%. Carrier Global's revenue was down 3.7% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.51 EPS. Equities research analysts anticipate that Carrier Global Co. will post 2.99 earnings per share for the current year.

Carrier Global Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, May 22nd. Stockholders of record on Friday, May 2nd were given a dividend of $0.225 per share. The ex-dividend date was Friday, May 2nd. This represents a $0.90 annualized dividend and a dividend yield of 1.27%. Carrier Global's dividend payout ratio is currently 13.93%.

Carrier Global Company Profile

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Further Reading

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.