USS Investment Management Ltd lowered its holdings in Lowe's Companies, Inc. (NYSE:LOW - Free Report) by 7.6% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 114,130 shares of the home improvement retailer's stock after selling 9,366 shares during the period. USS Investment Management Ltd's holdings in Lowe's Companies were worth $28,184,000 as of its most recent filing with the Securities and Exchange Commission.

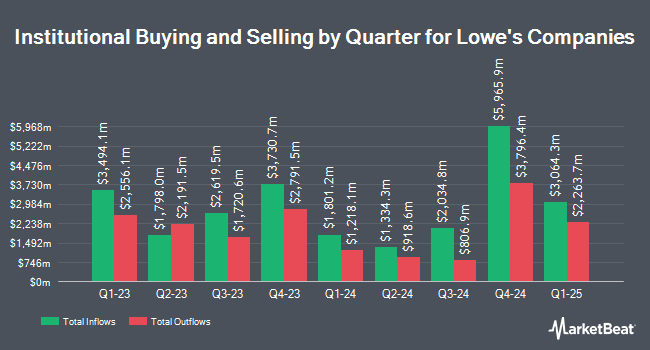

A number of other hedge funds have also added to or reduced their stakes in LOW. Hennion & Walsh Asset Management Inc. grew its position in shares of Lowe's Companies by 4.0% in the 4th quarter. Hennion & Walsh Asset Management Inc. now owns 4,339 shares of the home improvement retailer's stock valued at $1,071,000 after acquiring an additional 167 shares during the period. Grove Bank & Trust grew its position in shares of Lowe's Companies by 11.0% in the 4th quarter. Grove Bank & Trust now owns 2,980 shares of the home improvement retailer's stock valued at $735,000 after acquiring an additional 296 shares during the period. Client 1ST Advisory Group LLC bought a new position in shares of Lowe's Companies in the 4th quarter valued at about $350,000. Annex Advisory Services LLC grew its position in shares of Lowe's Companies by 48.7% in the 4th quarter. Annex Advisory Services LLC now owns 2,123 shares of the home improvement retailer's stock valued at $524,000 after acquiring an additional 695 shares during the period. Finally, Smart Money Group LLC grew its position in shares of Lowe's Companies by 5.3% in the 4th quarter. Smart Money Group LLC now owns 2,886 shares of the home improvement retailer's stock valued at $712,000 after acquiring an additional 146 shares during the period. Institutional investors own 74.06% of the company's stock.

Lowe's Companies Price Performance

LOW opened at $234.44 on Tuesday. Lowe's Companies, Inc. has a fifty-two week low of $206.39 and a fifty-two week high of $287.01. The firm has a market capitalization of $131.22 billion, a price-to-earnings ratio of 19.55, a PEG ratio of 1.96 and a beta of 1.00. The company's 50 day moving average price is $224.47 and its two-hundred day moving average price is $245.52.

Lowe's Companies (NYSE:LOW - Get Free Report) last posted its earnings results on Wednesday, February 26th. The home improvement retailer reported $1.93 earnings per share for the quarter, topping analysts' consensus estimates of $1.83 by $0.10. Lowe's Companies had a net margin of 8.19% and a negative return on equity of 47.55%. The firm had revenue of $18.55 billion for the quarter, compared to analyst estimates of $18.29 billion. As a group, equities research analysts predict that Lowe's Companies, Inc. will post 11.9 EPS for the current year.

Lowe's Companies Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, May 7th. Stockholders of record on Wednesday, April 23rd were given a $1.15 dividend. The ex-dividend date was Wednesday, April 23rd. This represents a $4.60 dividend on an annualized basis and a dividend yield of 1.96%. Lowe's Companies's dividend payout ratio (DPR) is currently 37.67%.

Analysts Set New Price Targets

A number of analysts have recently issued reports on LOW shares. JPMorgan Chase & Co. cut their target price on shares of Lowe's Companies from $300.00 to $263.00 and set an "overweight" rating for the company in a research note on Tuesday, May 6th. Telsey Advisory Group restated an "outperform" rating and set a $305.00 target price on shares of Lowe's Companies in a research note on Tuesday, April 15th. Royal Bank of Canada cut their target price on shares of Lowe's Companies from $292.00 to $285.00 and set a "sector perform" rating for the company in a research note on Thursday, February 27th. KeyCorp upgraded shares of Lowe's Companies from a "sector weight" rating to an "overweight" rating and set a $266.00 target price for the company in a research note on Friday, April 25th. Finally, Mizuho dropped their price objective on shares of Lowe's Companies from $305.00 to $300.00 and set an "outperform" rating for the company in a research note on Thursday, February 27th. One investment analyst has rated the stock with a sell rating, nine have assigned a hold rating and sixteen have issued a buy rating to the company. According to data from MarketBeat.com, Lowe's Companies has an average rating of "Moderate Buy" and a consensus target price of $276.17.

View Our Latest Stock Report on Lowe's Companies

About Lowe's Companies

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Recommended Stories

Want to see what other hedge funds are holding LOW? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Lowe's Companies, Inc. (NYSE:LOW - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.