Victrix Investment Advisors bought a new position in shares of Union Pacific Co. (NYSE:UNP - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 1,704 shares of the railroad operator's stock, valued at approximately $389,000.

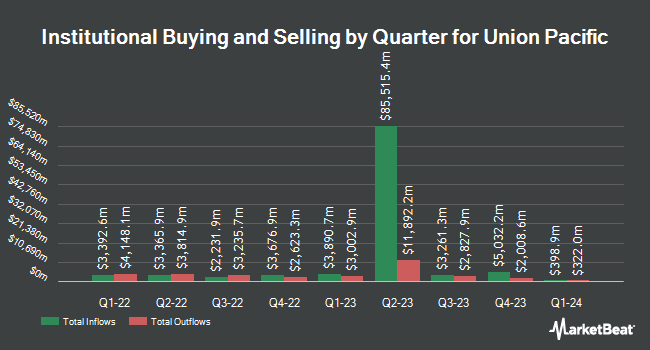

Other institutional investors have also modified their holdings of the company. Norges Bank bought a new position in shares of Union Pacific during the fourth quarter valued at approximately $1,927,377,000. Raymond James Financial Inc. bought a new position in shares of Union Pacific during the fourth quarter valued at approximately $1,035,905,000. Geode Capital Management LLC boosted its stake in shares of Union Pacific by 12.6% during the fourth quarter. Geode Capital Management LLC now owns 14,430,581 shares of the railroad operator's stock valued at $3,282,305,000 after purchasing an additional 1,616,895 shares in the last quarter. Capital Research Global Investors boosted its stake in shares of Union Pacific by 14.3% during the fourth quarter. Capital Research Global Investors now owns 10,395,364 shares of the railroad operator's stock valued at $2,370,559,000 after purchasing an additional 1,298,178 shares in the last quarter. Finally, Castlekeep Investment Advisors LLC bought a new position in shares of Union Pacific during the fourth quarter valued at approximately $273,361,000. 80.38% of the stock is owned by hedge funds and other institutional investors.

Union Pacific Stock Performance

Shares of NYSE:UNP traded down $4.60 on Wednesday, hitting $223.73. 2,183,560 shares of the company were exchanged, compared to its average volume of 2,643,953. Union Pacific Co. has a 1-year low of $204.66 and a 1-year high of $258.07. The stock's 50 day moving average price is $223.60 and its 200 day moving average price is $233.56. The company has a current ratio of 0.77, a quick ratio of 0.62 and a debt-to-equity ratio of 1.76. The firm has a market capitalization of $133.67 billion, a P/E ratio of 20.17, a price-to-earnings-growth ratio of 2.15 and a beta of 1.07.

Union Pacific (NYSE:UNP - Get Free Report) last posted its quarterly earnings data on Thursday, April 24th. The railroad operator reported $2.70 EPS for the quarter, missing the consensus estimate of $2.73 by ($0.03). Union Pacific had a return on equity of 41.12% and a net margin of 27.82%. The company had revenue of $6.03 billion for the quarter, compared to analyst estimates of $6.11 billion. During the same quarter in the previous year, the firm posted $2.69 earnings per share. The company's quarterly revenue was down .1% on a year-over-year basis. Sell-side analysts predict that Union Pacific Co. will post 11.99 EPS for the current year.

Union Pacific Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, June 30th. Investors of record on Friday, May 30th will be issued a dividend of $1.34 per share. The ex-dividend date is Friday, May 30th. This represents a $5.36 annualized dividend and a dividend yield of 2.40%. Union Pacific's dividend payout ratio (DPR) is presently 48.29%.

Wall Street Analysts Forecast Growth

UNP has been the topic of a number of recent research reports. Raymond James reiterated a "strong-buy" rating on shares of Union Pacific in a research note on Friday, April 25th. Citigroup upgraded shares of Union Pacific from a "neutral" rating to a "buy" rating and dropped their price objective for the company from $260.00 to $244.00 in a research note on Tuesday, April 8th. Redburn Atlantic upgraded shares of Union Pacific from a "neutral" rating to a "buy" rating and set a $259.00 price objective on the stock in a research note on Wednesday, April 16th. Susquehanna lowered their target price on shares of Union Pacific from $255.00 to $245.00 and set a "neutral" rating for the company in a research note on Friday, April 25th. Finally, Loop Capital downgraded shares of Union Pacific from a "hold" rating to a "sell" rating and lowered their target price for the company from $265.00 to $200.00 in a research note on Monday, February 3rd. One analyst has rated the stock with a sell rating, six have assigned a hold rating, fifteen have assigned a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $257.50.

View Our Latest Report on UNP

Union Pacific Profile

(

Free Report)

Union Pacific Corporation, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. The company offers transportation services for grain and grain products, fertilizers, food and refrigerated products, and coal and renewables to grain processors, animal feeders, ethanol producers, renewable biofuel producers, and other agricultural users; and construction products, industrial chemicals, plastics, forest products, specialized products, metals and ores, petroleum, liquid petroleum gases, soda ash, and sand, as well as finished automobiles, automotive parts, and merchandise in intermodal containers.

Further Reading

Before you consider Union Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Union Pacific wasn't on the list.

While Union Pacific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.