Vise Technologies Inc. lifted its holdings in shares of Philip Morris International Inc. (NYSE:PM - Free Report) by 23.8% in the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 22,074 shares of the company's stock after acquiring an additional 4,239 shares during the quarter. Vise Technologies Inc.'s holdings in Philip Morris International were worth $2,657,000 as of its most recent filing with the Securities & Exchange Commission.

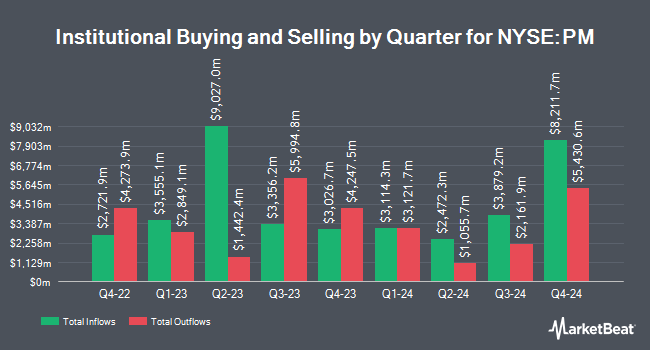

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Vanguard Group Inc. raised its holdings in shares of Philip Morris International by 0.8% during the fourth quarter. Vanguard Group Inc. now owns 139,432,392 shares of the company's stock valued at $16,780,688,000 after acquiring an additional 1,167,810 shares in the last quarter. Capital World Investors raised its holdings in shares of Philip Morris International by 3.6% during the fourth quarter. Capital World Investors now owns 122,584,210 shares of the company's stock valued at $14,752,926,000 after acquiring an additional 4,216,586 shares in the last quarter. GQG Partners LLC raised its holdings in shares of Philip Morris International by 14.3% during the fourth quarter. GQG Partners LLC now owns 48,746,809 shares of the company's stock valued at $5,866,678,000 after acquiring an additional 6,092,558 shares in the last quarter. Geode Capital Management LLC raised its holdings in shares of Philip Morris International by 9.9% during the fourth quarter. Geode Capital Management LLC now owns 35,286,582 shares of the company's stock valued at $4,241,837,000 after acquiring an additional 3,185,258 shares in the last quarter. Finally, Wellington Management Group LLP raised its holdings in shares of Philip Morris International by 3.1% during the fourth quarter. Wellington Management Group LLP now owns 17,276,790 shares of the company's stock valued at $2,079,262,000 after acquiring an additional 516,617 shares in the last quarter. Institutional investors own 78.63% of the company's stock.

Philip Morris International Price Performance

Shares of Philip Morris International stock traded down $0.01 during trading on Wednesday, hitting $179.22. 1,339,637 shares of the company's stock traded hands, compared to its average volume of 5,595,144. Philip Morris International Inc. has a 1 year low of $98.93 and a 1 year high of $179.83. The stock has a market capitalization of $278.95 billion, a P/E ratio of 39.73, a PEG ratio of 2.65 and a beta of 0.50. The business has a 50-day simple moving average of $163.62 and a 200-day simple moving average of $144.64.

Philip Morris International (NYSE:PM - Get Free Report) last released its quarterly earnings data on Wednesday, April 23rd. The company reported $1.69 EPS for the quarter, beating the consensus estimate of $1.61 by $0.08. Philip Morris International had a negative return on equity of 120.08% and a net margin of 7.89%. The company had revenue of $9.30 billion for the quarter, compared to analysts' expectations of $9.10 billion. During the same period last year, the firm posted $1.50 earnings per share. Philip Morris International's revenue was up 5.8% compared to the same quarter last year. On average, equities analysts predict that Philip Morris International Inc. will post 7.14 earnings per share for the current fiscal year.

Philip Morris International Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Thursday, April 10th. Shareholders of record on Thursday, March 20th were issued a $1.35 dividend. This represents a $5.40 dividend on an annualized basis and a yield of 3.01%. The ex-dividend date of this dividend was Thursday, March 20th. Philip Morris International's dividend payout ratio is 111.34%.

Insider Transactions at Philip Morris International

In other news, insider Lars Dahlgren sold 3,679 shares of the firm's stock in a transaction dated Thursday, March 6th. The stock was sold at an average price of $152.96, for a total value of $562,739.84. Following the transaction, the insider now owns 26,828 shares of the company's stock, valued at $4,103,610.88. This trade represents a 12.06% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Corporate insiders own 0.13% of the company's stock.

Analysts Set New Price Targets

PM has been the topic of several recent research reports. Argus raised Philip Morris International from a "hold" rating to a "buy" rating in a research note on Friday, March 14th. UBS Group raised Philip Morris International from a "sell" rating to a "neutral" rating and upped their price target for the stock from $130.00 to $170.00 in a research note on Friday, April 25th. Needham & Company LLC initiated coverage on Philip Morris International in a research note on Thursday, May 22nd. They issued a "buy" rating on the stock. Wall Street Zen raised Philip Morris International from a "hold" rating to a "buy" rating in a research note on Thursday, May 22nd. Finally, JPMorgan Chase & Co. upped their price target on Philip Morris International from $145.00 to $160.00 and gave the stock an "overweight" rating in a research note on Tuesday, February 18th. One analyst has rated the stock with a hold rating and eleven have given a buy rating to the company. Based on data from MarketBeat, Philip Morris International presently has a consensus rating of "Moderate Buy" and a consensus target price of $169.20.

View Our Latest Stock Report on PM

About Philip Morris International

(

Free Report)

Philip Morris International Inc operates as a tobacco company working to delivers a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector. The company's product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products primarily under the IQOS and ZYN brands; and consumer accessories, such as lighters and matches.

See Also

Before you consider Philip Morris International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Philip Morris International wasn't on the list.

While Philip Morris International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report