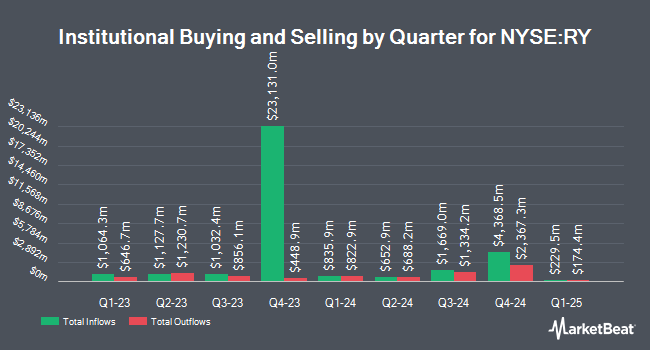

Vise Technologies Inc. increased its holdings in Royal Bank of Canada (NYSE:RY - Free Report) TSE: RY by 43.8% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 14,142 shares of the financial services provider's stock after acquiring an additional 4,306 shares during the period. Vise Technologies Inc.'s holdings in Royal Bank of Canada were worth $1,704,000 at the end of the most recent quarter.

A number of other institutional investors and hedge funds also recently modified their holdings of the business. Roxbury Financial LLC bought a new stake in shares of Royal Bank of Canada in the 4th quarter worth approximately $29,000. WealthTrak Capital Management LLC purchased a new stake in Royal Bank of Canada in the fourth quarter worth $28,000. Optiver Holding B.V. bought a new stake in shares of Royal Bank of Canada in the fourth quarter valued at $35,000. Jackson Grant Investment Advisers Inc. purchased a new position in shares of Royal Bank of Canada during the 4th quarter valued at $36,000. Finally, Crews Bank & Trust bought a new position in shares of Royal Bank of Canada during the 4th quarter worth $36,000. 45.31% of the stock is owned by hedge funds and other institutional investors.

Royal Bank of Canada Trading Down 2.8%

NYSE:RY traded down $3.67 during trading hours on Thursday, reaching $125.27. The company's stock had a trading volume of 1,121,132 shares, compared to its average volume of 1,131,211. The company has a debt-to-equity ratio of 0.11, a quick ratio of 0.86 and a current ratio of 0.86. The firm has a market capitalization of $177.18 billion, a price-to-earnings ratio of 15.16, a PEG ratio of 1.80 and a beta of 0.89. The firm has a 50-day simple moving average of $118.42 and a 200-day simple moving average of $119.63. Royal Bank of Canada has a 1 year low of $102.44 and a 1 year high of $134.72.

Royal Bank of Canada Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, May 23rd. Stockholders of record on Thursday, April 24th were issued a dividend of $1.0251 per share. This represents a $4.10 dividend on an annualized basis and a dividend yield of 3.27%. The ex-dividend date was Thursday, April 24th. Royal Bank of Canada's dividend payout ratio (DPR) is presently 46.18%.

Analysts Set New Price Targets

RY has been the topic of several recent research reports. Scotiabank assumed coverage on shares of Royal Bank of Canada in a report on Thursday, May 15th. They set a "sector outperform" rating on the stock. CIBC reissued an "outperform" rating on shares of Royal Bank of Canada in a report on Tuesday, May 20th. Cibc World Mkts upgraded Royal Bank of Canada from a "hold" rating to a "strong-buy" rating in a research report on Thursday, April 3rd. Finally, Wall Street Zen raised Royal Bank of Canada from a "sell" rating to a "hold" rating in a report on Friday, May 9th. Two analysts have rated the stock with a hold rating, six have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Royal Bank of Canada currently has an average rating of "Moderate Buy" and a consensus price target of $156.50.

Check Out Our Latest Analysis on Royal Bank of Canada

Royal Bank of Canada Profile

(

Free Report)

Royal Bank of Canada operates as a diversified financial service company worldwide. The company's Personal & Commercial Banking segment offers checking and savings accounts, home equity financing, personal lending, private banking, indirect lending, including auto financing, mutual funds and self-directed brokerage accounts, guaranteed investment certificates, credit cards, and payment products and solutions; and lending, leasing, deposit, investment, foreign exchange, cash management, auto dealer financing, trade products, and services to small and medium-sized commercial businesses.

Featured Articles

Before you consider Royal Bank Of Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Bank Of Canada wasn't on the list.

While Royal Bank Of Canada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.