Voloridge Investment Management LLC acquired a new position in shares of Rocket Lab USA, Inc. (NASDAQ:RKLB - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 876,745 shares of the rocket manufacturer's stock, valued at approximately $22,331,000. Voloridge Investment Management LLC owned 0.18% of Rocket Lab USA as of its most recent SEC filing.

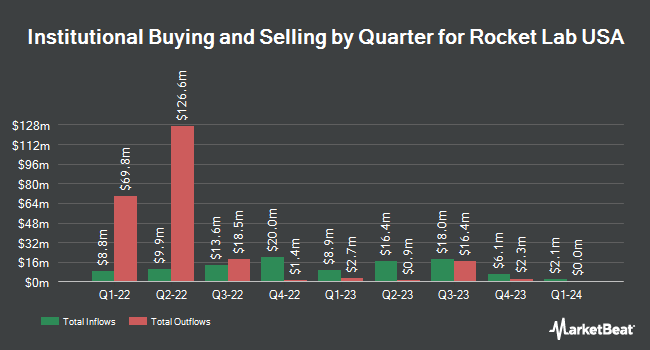

Several other institutional investors and hedge funds have also bought and sold shares of RKLB. Spectrum Wealth Counsel LLC acquired a new position in Rocket Lab USA during the fourth quarter worth about $25,000. Sandy Spring Bank acquired a new position in Rocket Lab USA during the fourth quarter worth about $26,000. Wingate Wealth Advisors Inc. acquired a new position in Rocket Lab USA during the fourth quarter worth about $40,000. Quarry LP acquired a new position in Rocket Lab USA during the fourth quarter worth about $48,000. Finally, NewEdge Advisors LLC raised its stake in Rocket Lab USA by 1,000.0% during the fourth quarter. NewEdge Advisors LLC now owns 1,925 shares of the rocket manufacturer's stock worth $49,000 after acquiring an additional 1,750 shares in the last quarter. Institutional investors own 71.78% of the company's stock.

Insider Buying and Selling

In related news, insider Frank Klein sold 44,553 shares of the stock in a transaction on Friday, March 14th. The stock was sold at an average price of $18.18, for a total value of $809,973.54. Following the transaction, the insider now directly owns 1,419,479 shares in the company, valued at $25,806,128.22. This trade represents a 3.04% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 13.70% of the stock is owned by company insiders.

Rocket Lab USA Stock Up 10.0%

Shares of RKLB traded up $2.55 during trading hours on Tuesday, reaching $27.97. The stock had a trading volume of 10,224,005 shares, compared to its average volume of 16,130,330. Rocket Lab USA, Inc. has a 12 month low of $4.15 and a 12 month high of $33.34. The firm has a 50-day simple moving average of $21.05 and a 200 day simple moving average of $23.12. The company has a current ratio of 2.58, a quick ratio of 2.16 and a debt-to-equity ratio of 0.97. The company has a market capitalization of $12.69 billion, a price-to-earnings ratio of -75.73 and a beta of 2.04.

Rocket Lab USA (NASDAQ:RKLB - Get Free Report) last issued its earnings results on Thursday, May 8th. The rocket manufacturer reported ($0.12) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.10) by ($0.02). Rocket Lab USA had a negative return on equity of 39.47% and a negative net margin of 51.76%. The firm had revenue of $122.57 million during the quarter, compared to the consensus estimate of $120.74 million. During the same quarter in the prior year, the business earned ($0.09) earnings per share. Rocket Lab USA's revenue for the quarter was up 32.1% on a year-over-year basis. Equities research analysts predict that Rocket Lab USA, Inc. will post -0.38 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research analysts have recently issued reports on RKLB shares. The Goldman Sachs Group upped their price objective on Rocket Lab USA from $14.35 to $16.00 and gave the company a "neutral" rating in a research note on Monday, May 12th. Citigroup lowered their price objective on Rocket Lab USA from $35.00 to $33.00 and set a "buy" rating for the company in a research note on Friday, February 28th. Wells Fargo & Company lowered their price objective on Rocket Lab USA from $21.00 to $18.00 and set an "equal weight" rating for the company in a research note on Tuesday, April 8th. Needham & Company LLC reissued a "buy" rating and set a $28.00 target price on shares of Rocket Lab USA in a research report on Tuesday, May 13th. Finally, TD Cowen raised shares of Rocket Lab USA to a "strong-buy" rating in a research report on Monday, February 24th. Five analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, Rocket Lab USA has an average rating of "Moderate Buy" and a consensus target price of $23.50.

Check Out Our Latest Analysis on RKLB

Rocket Lab USA Company Profile

(

Free Report)

Rocket Lab USA, Inc, a space company, provides launch services and space systems solutions for the space and defense industries. The company provides launch services, spacecraft design services, spacecraft components, spacecraft manufacturing, and other spacecraft and on-orbit management solutions; and constellation management services, as well as designs and manufactures small and medium-class rockets.

Featured Stories

Before you consider Rocket Lab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Lab wasn't on the list.

While Rocket Lab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.