E. Ohman J or Asset Management AB raised its stake in shares of Watts Water Technologies, Inc. (NYSE:WTS - Free Report) by 41.3% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 17,089 shares of the technology company's stock after acquiring an additional 4,992 shares during the quarter. E. Ohman J or Asset Management AB owned approximately 0.05% of Watts Water Technologies worth $3,485,000 as of its most recent filing with the SEC.

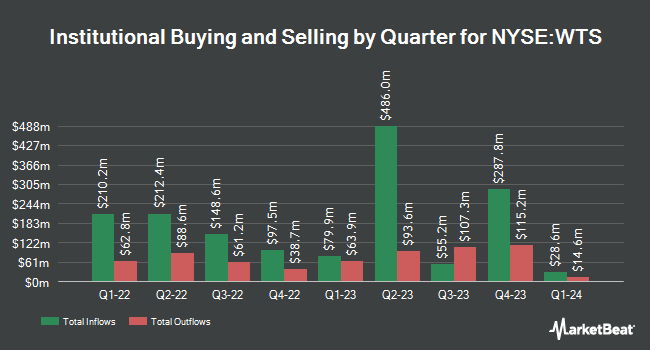

Other institutional investors and hedge funds also recently made changes to their positions in the company. Versant Capital Management Inc increased its stake in shares of Watts Water Technologies by 57.3% in the first quarter. Versant Capital Management Inc now owns 225 shares of the technology company's stock valued at $46,000 after buying an additional 82 shares in the last quarter. Headlands Technologies LLC grew its stake in shares of Watts Water Technologies by 329.1% during the fourth quarter. Headlands Technologies LLC now owns 236 shares of the technology company's stock valued at $48,000 after purchasing an additional 181 shares during the last quarter. Parallel Advisors LLC increased its holdings in shares of Watts Water Technologies by 45.0% in the first quarter. Parallel Advisors LLC now owns 293 shares of the technology company's stock valued at $60,000 after purchasing an additional 91 shares in the last quarter. Huntington National Bank raised its position in Watts Water Technologies by 60.5% in the 4th quarter. Huntington National Bank now owns 366 shares of the technology company's stock worth $74,000 after purchasing an additional 138 shares during the last quarter. Finally, NBC Securities Inc. bought a new position in Watts Water Technologies in the 1st quarter valued at $106,000. Institutional investors and hedge funds own 95.02% of the company's stock.

Analyst Ratings Changes

WTS has been the topic of several research reports. Northcoast Research lowered Watts Water Technologies from a "buy" rating to a "neutral" rating in a research note on Friday, May 16th. Stifel Nicolaus upgraded shares of Watts Water Technologies from a "hold" rating to a "buy" rating and upped their target price for the company from $219.00 to $229.00 in a research report on Wednesday, April 16th. Finally, The Goldman Sachs Group lifted their price target on shares of Watts Water Technologies from $197.00 to $217.00 and gave the stock a "neutral" rating in a research report on Wednesday, February 12th. Four equities research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $222.00.

View Our Latest Stock Analysis on Watts Water Technologies

Watts Water Technologies Trading Up 0.0%

WTS traded up $0.08 during mid-day trading on Tuesday, hitting $245.33. The stock had a trading volume of 164,917 shares, compared to its average volume of 175,105. The stock's fifty day simple moving average is $219.65 and its 200-day simple moving average is $213.40. The firm has a market capitalization of $8.19 billion, a price-to-earnings ratio of 28.23, a price-to-earnings-growth ratio of 3.42 and a beta of 1.13. Watts Water Technologies, Inc. has a 1-year low of $175.37 and a 1-year high of $248.17. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.59 and a quick ratio of 1.65.

Watts Water Technologies (NYSE:WTS - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The technology company reported $2.37 EPS for the quarter, topping the consensus estimate of $2.12 by $0.25. Watts Water Technologies had a return on equity of 18.08% and a net margin of 12.93%. The business had revenue of $558.00 million for the quarter, compared to the consensus estimate of $547.58 million. During the same quarter last year, the business posted $2.33 EPS. The firm's revenue was down 2.3% compared to the same quarter last year. As a group, research analysts forecast that Watts Water Technologies, Inc. will post 9.08 EPS for the current fiscal year.

Watts Water Technologies Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, June 13th. Shareholders of record on Friday, May 30th will be issued a dividend of $0.52 per share. This represents a $2.08 dividend on an annualized basis and a yield of 0.85%. The ex-dividend date is Friday, May 30th. This is a boost from Watts Water Technologies's previous quarterly dividend of $0.43. Watts Water Technologies's dividend payout ratio is 23.83%.

Insider Activity

In other Watts Water Technologies news, insider Monica Barry sold 768 shares of Watts Water Technologies stock in a transaction on Tuesday, May 13th. The shares were sold at an average price of $245.40, for a total value of $188,467.20. Following the sale, the insider now directly owns 6,236 shares in the company, valued at approximately $1,530,314.40. The trade was a 10.97% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, major shareholder Timothy P. Horne sold 7,000 shares of the firm's stock in a transaction dated Wednesday, May 28th. The shares were sold at an average price of $241.85, for a total value of $1,692,950.00. The disclosure for this sale can be found here. Insiders have sold a total of 15,768 shares of company stock worth $3,841,417 over the last three months. Corporate insiders own 1.00% of the company's stock.

Watts Water Technologies Company Profile

(

Free Report)

Watts Water Technologies, Inc, together with its subsidiaries, supplies products and solutions that manage and conserve the flow of fluids and energy into, through, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

Recommended Stories

Before you consider Watts Water Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Watts Water Technologies wasn't on the list.

While Watts Water Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.