Wesbanco Bank Inc. boosted its stake in shares of Amgen Inc. (NASDAQ:AMGN - Free Report) by 23.2% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 64,170 shares of the medical research company's stock after buying an additional 12,092 shares during the quarter. Wesbanco Bank Inc.'s holdings in Amgen were worth $19,992,000 as of its most recent SEC filing.

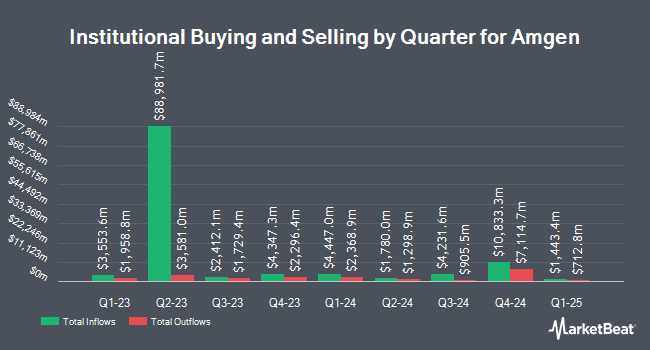

Several other large investors also recently added to or reduced their stakes in AMGN. Ascent Wealth Partners LLC increased its holdings in Amgen by 0.7% during the fourth quarter. Ascent Wealth Partners LLC now owns 9,024 shares of the medical research company's stock valued at $2,352,000 after buying an additional 64 shares during the period. ICICI Prudential Asset Management Co Ltd boosted its position in Amgen by 242.2% during the 4th quarter. ICICI Prudential Asset Management Co Ltd now owns 23,999 shares of the medical research company's stock valued at $6,255,000 after acquiring an additional 16,985 shares in the last quarter. Fisher Asset Management LLC increased its holdings in shares of Amgen by 285.4% in the 4th quarter. Fisher Asset Management LLC now owns 394,489 shares of the medical research company's stock valued at $102,820,000 after acquiring an additional 292,137 shares during the period. Aire Advisors LLC raised its position in shares of Amgen by 26.3% in the 4th quarter. Aire Advisors LLC now owns 13,280 shares of the medical research company's stock worth $3,461,000 after acquiring an additional 2,762 shares in the last quarter. Finally, Beacon Harbor Wealth Advisors Inc. purchased a new stake in shares of Amgen during the 4th quarter worth $3,531,000. 76.50% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Amgen

In other Amgen news, SVP Rachna Khosla sold 1,500 shares of the business's stock in a transaction dated Thursday, June 5th. The shares were sold at an average price of $289.68, for a total value of $434,520.00. Following the transaction, the senior vice president now directly owns 8,162 shares in the company, valued at $2,364,368.16. The trade was a 15.52% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 0.76% of the stock is owned by company insiders.

Analysts Set New Price Targets

Several equities analysts have issued reports on the stock. Cantor Fitzgerald assumed coverage on shares of Amgen in a report on Tuesday, April 22nd. They issued a "neutral" rating and a $305.00 price target on the stock. Erste Group Bank downgraded Amgen from a "strong-buy" rating to a "hold" rating in a research note on Thursday, May 8th. Morgan Stanley reiterated an "equal weight" rating on shares of Amgen in a research note on Friday, May 2nd. Royal Bank of Canada dropped their price target on Amgen from $324.00 to $320.00 and set an "outperform" rating on the stock in a research note on Friday, May 2nd. Finally, Bank of America increased their price objective on shares of Amgen from $275.00 to $294.00 and gave the company an "underperform" rating in a research report on Wednesday, March 5th. Two investment analysts have rated the stock with a sell rating, twelve have issued a hold rating, nine have issued a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat, Amgen presently has an average rating of "Hold" and a consensus target price of $309.22.

Check Out Our Latest Analysis on Amgen

Amgen Stock Performance

NASDAQ:AMGN opened at $290.33 on Monday. The company has a fifty day moving average of $281.57 and a two-hundred day moving average of $285.39. Amgen Inc. has a fifty-two week low of $253.30 and a fifty-two week high of $346.85. The stock has a market capitalization of $156.11 billion, a PE ratio of 38.45, a P/E/G ratio of 2.63 and a beta of 0.51. The company has a debt-to-equity ratio of 9.62, a quick ratio of 0.95 and a current ratio of 1.26.

Amgen (NASDAQ:AMGN - Get Free Report) last released its quarterly earnings results on Thursday, May 1st. The medical research company reported $4.90 earnings per share for the quarter, topping the consensus estimate of $4.18 by $0.72. Amgen had a net margin of 12.24% and a return on equity of 176.32%. The firm had revenue of $8.15 billion during the quarter, compared to the consensus estimate of $8.05 billion. During the same quarter in the prior year, the firm earned $3.96 EPS. The company's revenue for the quarter was up 9.4% on a year-over-year basis. As a group, research analysts forecast that Amgen Inc. will post 20.62 earnings per share for the current fiscal year.

Amgen Company Profile

(

Free Report)

Amgen Inc discovers, develops, manufactures, and delivers human therapeutics worldwide. The company's principal products include Enbrel to treat plaque psoriasis, rheumatoid arthritis, and psoriatic arthritis; Otezla for the treatment of adult patients with plaque psoriasis, psoriatic arthritis, and oral ulcers associated with Behçet's disease; Prolia to treat postmenopausal women with osteoporosis; XGEVA for skeletal-related events prevention; Repatha, which reduces the risks of myocardial infarction, stroke, and coronary revascularization; Nplate for the treatment of patients with immune thrombocytopenia; KYPROLIS to treat patients with relapsed or refractory multiple myeloma; Aranesp to treat a lower-than-normal number of red blood cells and anemia; EVENITY for the treatment of osteoporosis in postmenopausal for men and women; Vectibix to treat patients with wild-type RAS metastatic colorectal cancer; BLINCYTO for the treatment of patients with acute lymphoblastic leukemia; TEPEZZA to treat thyroid eye disease; and KRYSTEXXA for the treatment of chronic refractory gout.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amgen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amgen wasn't on the list.

While Amgen currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.