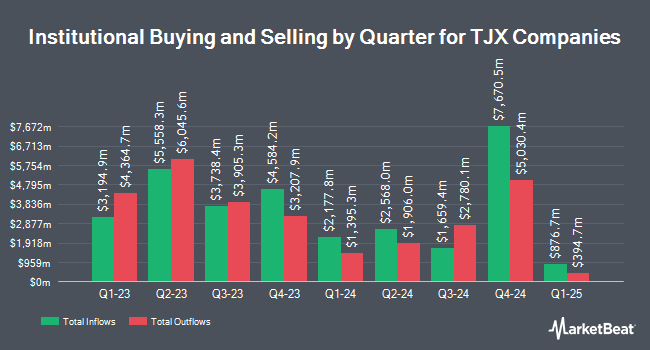

Western Wealth Management LLC lessened its holdings in shares of The TJX Companies, Inc. (NYSE:TJX - Free Report) by 91.6% during the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 2,131 shares of the apparel and home fashions retailer's stock after selling 23,317 shares during the quarter. Western Wealth Management LLC's holdings in TJX Companies were worth $258,000 as of its most recent filing with the SEC.

Several other hedge funds have also made changes to their positions in the business. Vanguard Group Inc. lifted its position in shares of TJX Companies by 0.6% during the fourth quarter. Vanguard Group Inc. now owns 99,314,635 shares of the apparel and home fashions retailer's stock worth $11,998,201,000 after purchasing an additional 578,948 shares in the last quarter. Geode Capital Management LLC raised its holdings in TJX Companies by 1.9% in the fourth quarter. Geode Capital Management LLC now owns 24,322,579 shares of the apparel and home fashions retailer's stock valued at $2,930,965,000 after acquiring an additional 464,995 shares in the last quarter. Capital International Investors raised its holdings in TJX Companies by 4.5% in the fourth quarter. Capital International Investors now owns 14,647,792 shares of the apparel and home fashions retailer's stock valued at $1,769,600,000 after acquiring an additional 626,739 shares in the last quarter. Northern Trust Corp raised its holdings in TJX Companies by 15.2% in the fourth quarter. Northern Trust Corp now owns 13,985,826 shares of the apparel and home fashions retailer's stock valued at $1,689,628,000 after acquiring an additional 1,845,225 shares in the last quarter. Finally, Norges Bank acquired a new stake in TJX Companies in the fourth quarter valued at approximately $1,670,565,000. Institutional investors and hedge funds own 91.09% of the company's stock.

Insider Activity at TJX Companies

In related news, CEO Ernie Herrman sold 23,428 shares of TJX Companies stock in a transaction on Wednesday, March 5th. The shares were sold at an average price of $123.03, for a total value of $2,882,346.84. Following the transaction, the chief executive officer now directly owns 484,189 shares in the company, valued at $59,569,772.67. This trade represents a 4.62% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. 0.13% of the stock is currently owned by insiders.

TJX Companies Stock Performance

Shares of TJX traded down $0.79 during mid-day trading on Friday, reaching $126.29. 1,839,320 shares of the company's stock were exchanged, compared to its average volume of 5,326,743. The company has a debt-to-equity ratio of 0.35, a current ratio of 1.19 and a quick ratio of 0.50. The stock has a market capitalization of $141.07 billion, a PE ratio of 29.74, a price-to-earnings-growth ratio of 2.75 and a beta of 0.94. The business's fifty day simple moving average is $126.74 and its 200-day simple moving average is $123.79. The TJX Companies, Inc. has a 52-week low of $101.80 and a 52-week high of $135.85.

TJX Companies (NYSE:TJX - Get Free Report) last announced its earnings results on Wednesday, May 21st. The apparel and home fashions retailer reported $0.92 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.90 by $0.02. The business had revenue of $13.11 billion for the quarter, compared to analyst estimates of $13.01 billion. TJX Companies had a net margin of 8.63% and a return on equity of 61.82%. The company's revenue for the quarter was up 5.1% compared to the same quarter last year. During the same period last year, the firm posted $0.93 earnings per share. On average, equities research analysts expect that The TJX Companies, Inc. will post 4.18 earnings per share for the current year.

TJX Companies Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, June 5th. Investors of record on Thursday, May 15th will be given a $0.425 dividend. This represents a $1.70 dividend on an annualized basis and a yield of 1.35%. This is a positive change from TJX Companies's previous quarterly dividend of $0.38. The ex-dividend date of this dividend is Thursday, May 15th. TJX Companies's dividend payout ratio (DPR) is 40.00%.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on the stock. JPMorgan Chase & Co. raised their target price on shares of TJX Companies from $127.00 to $130.00 and gave the company an "overweight" rating in a report on Monday, May 19th. Wells Fargo & Company reaffirmed an "equal weight" rating on shares of TJX Companies in a report on Wednesday, May 21st. Barclays reaffirmed an "overweight" rating and issued a $147.00 target price (up previously from $137.00) on shares of TJX Companies in a report on Thursday, May 22nd. Citigroup raised shares of TJX Companies from a "neutral" rating to a "buy" rating in a report on Wednesday, May 21st. Finally, Wall Street Zen raised shares of TJX Companies from a "hold" rating to a "buy" rating in a report on Monday, May 12th. One equities research analyst has rated the stock with a hold rating and eighteen have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $140.65.

Check Out Our Latest Stock Analysis on TJX

About TJX Companies

(

Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

Featured Stories

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report