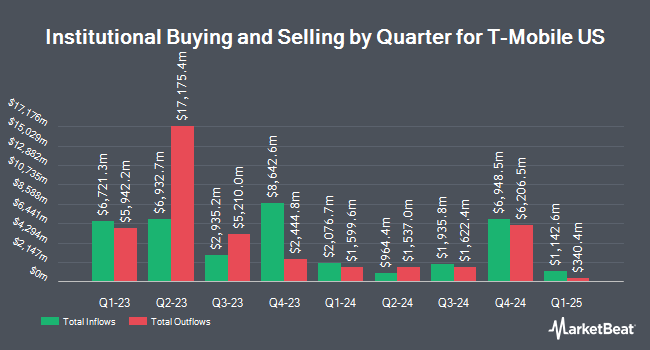

Westwood Holdings Group Inc. grew its holdings in T-Mobile US, Inc. (NASDAQ:TMUS - Free Report) by 360.9% in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 535,449 shares of the Wireless communications provider's stock after acquiring an additional 419,286 shares during the period. T-Mobile US accounts for approximately 0.9% of Westwood Holdings Group Inc.'s holdings, making the stock its 19th largest position. Westwood Holdings Group Inc.'s holdings in T-Mobile US were worth $118,190,000 at the end of the most recent quarter.

Several other large investors also recently added to or reduced their stakes in the business. Rakuten Securities Inc. boosted its holdings in shares of T-Mobile US by 93.9% during the 4th quarter. Rakuten Securities Inc. now owns 128 shares of the Wireless communications provider's stock worth $28,000 after buying an additional 62 shares during the period. CoreFirst Bank & Trust bought a new stake in shares of T-Mobile US during the 4th quarter worth $28,000. Financial Life Planners bought a new stake in shares of T-Mobile US during the 4th quarter worth $29,000. Albion Financial Group UT bought a new stake in T-Mobile US in the 4th quarter valued at $39,000. Finally, DT Investment Partners LLC boosted its holdings in T-Mobile US by 58.8% in the 4th quarter. DT Investment Partners LLC now owns 189 shares of the Wireless communications provider's stock valued at $42,000 after purchasing an additional 70 shares during the period. 42.49% of the stock is owned by institutional investors.

T-Mobile US Stock Performance

Shares of NASDAQ:TMUS opened at $242.66 on Monday. The company's 50 day moving average price is $253.96 and its two-hundred day moving average price is $243.27. T-Mobile US, Inc. has a 12-month low of $163.15 and a 12-month high of $276.49. The firm has a market cap of $275.53 billion, a PE ratio of 25.09, a PEG ratio of 1.55 and a beta of 0.69. The company has a quick ratio of 0.83, a current ratio of 0.91 and a debt-to-equity ratio of 1.28.

T-Mobile US (NASDAQ:TMUS - Get Free Report) last announced its earnings results on Thursday, April 24th. The Wireless communications provider reported $2.58 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.48 by $0.10. T-Mobile US had a net margin of 13.93% and a return on equity of 18.09%. The firm had revenue of $20.89 billion for the quarter, compared to analyst estimates of $20.67 billion. During the same quarter in the prior year, the business posted $2.00 EPS. The business's revenue was up 6.6% compared to the same quarter last year. Equities research analysts predict that T-Mobile US, Inc. will post 10.37 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on the stock. HSBC downgraded shares of T-Mobile US from a "buy" rating to a "hold" rating and set a $270.00 price target for the company. in a report on Wednesday, March 5th. Hsbc Global Res cut shares of T-Mobile US from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, March 5th. Barclays increased their price objective on shares of T-Mobile US from $230.00 to $250.00 and gave the company an "overweight" rating in a research note on Monday, February 3rd. Royal Bank of Canada increased their price objective on shares of T-Mobile US from $245.00 to $260.00 and gave the company a "sector perform" rating in a research note on Friday, March 21st. Finally, Wells Fargo & Company restated an "equal weight" rating on shares of T-Mobile US in a research note on Wednesday, February 26th. Ten equities research analysts have rated the stock with a hold rating, twelve have given a buy rating and two have given a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $257.68.

Get Our Latest Report on TMUS

Insider Buying and Selling

In related news, Director Srikant M. Datar sold 730 shares of the stock in a transaction that occurred on Wednesday, March 5th. The shares were sold at an average price of $263.00, for a total transaction of $191,990.00. Following the sale, the director now owns 3,291 shares in the company, valued at approximately $865,533. This trade represents a 18.15% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. 0.67% of the stock is currently owned by company insiders.

T-Mobile US Profile

(

Free Report)

T-Mobile US, Inc, together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands. The company offers voice, messaging, and data services to customers in the postpaid, prepaid, and wholesale and other services. It also provides wireless devices, including smartphones, wearables, tablets, home broadband routers, and other mobile communication devices, as well as wireless devices and accessories; financing through equipment installment plans; reinsurance for device insurance policies and extended warranty contracts; leasing through JUMP! On Demand; and High Speed Internet services.

Further Reading

Want to see what other hedge funds are holding TMUS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for T-Mobile US, Inc. (NASDAQ:TMUS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider T-Mobile US, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T-Mobile US wasn't on the list.

While T-Mobile US currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.