Westwood Holdings Group Inc. boosted its holdings in ArcBest Co. (NASDAQ:ARCB - Free Report) by 2.6% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 635,858 shares of the transportation company's stock after purchasing an additional 16,239 shares during the quarter. Westwood Holdings Group Inc. owned about 2.72% of ArcBest worth $59,338,000 at the end of the most recent quarter.

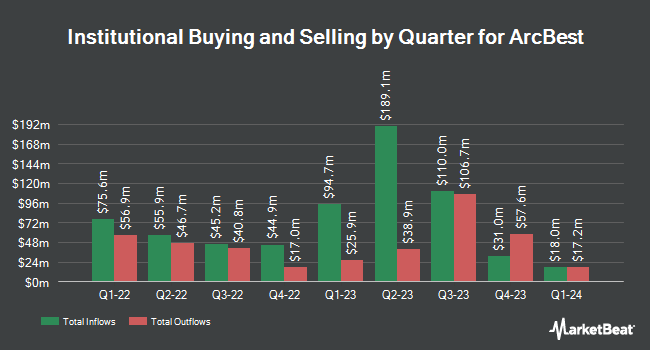

Several other institutional investors and hedge funds have also recently bought and sold shares of ARCB. Alliancebernstein L.P. raised its position in ArcBest by 9.4% in the 4th quarter. Alliancebernstein L.P. now owns 2,571,917 shares of the transportation company's stock valued at $240,011,000 after purchasing an additional 220,325 shares during the last quarter. JPMorgan Chase & Co. raised its position in ArcBest by 47.2% during the 4th quarter. JPMorgan Chase & Co. now owns 326,006 shares of the transportation company's stock worth $30,423,000 after buying an additional 104,499 shares during the last quarter. American Century Companies Inc. raised its position in ArcBest by 16.3% during the 4th quarter. American Century Companies Inc. now owns 618,919 shares of the transportation company's stock worth $57,758,000 after buying an additional 86,867 shares during the last quarter. Eisler Capital Management Ltd. purchased a new position in ArcBest during the 4th quarter worth $7,695,000. Finally, Norges Bank purchased a new position in ArcBest during the 4th quarter worth $5,826,000. Hedge funds and other institutional investors own 99.27% of the company's stock.

Wall Street Analyst Weigh In

ARCB has been the subject of a number of analyst reports. Morgan Stanley cut their price objective on shares of ArcBest from $160.00 to $145.00 and set an "overweight" rating for the company in a research report on Monday, February 3rd. Wells Fargo & Company cut their price objective on shares of ArcBest from $80.00 to $60.00 and set an "equal weight" rating for the company in a research report on Wednesday, April 30th. Stephens restated an "overweight" rating and set a $116.00 price objective on shares of ArcBest in a research report on Tuesday, March 11th. TD Cowen cut their price target on shares of ArcBest from $80.00 to $72.00 and set a "hold" rating for the company in a report on Wednesday, April 30th. Finally, The Goldman Sachs Group cut their price target on shares of ArcBest from $97.00 to $84.00 and set a "neutral" rating for the company in a report on Wednesday, April 30th. One analyst has rated the stock with a sell rating, eight have issued a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, ArcBest presently has an average rating of "Hold" and an average target price of $88.25.

View Our Latest Analysis on ArcBest

ArcBest Price Performance

NASDAQ ARCB traded down $1.28 during trading hours on Friday, reaching $60.77. The company's stock had a trading volume of 257,950 shares, compared to its average volume of 307,717. The stock has a market cap of $1.39 billion, a PE ratio of 8.29, a PEG ratio of 1.70 and a beta of 1.70. ArcBest Co. has a fifty-two week low of $55.19 and a fifty-two week high of $129.83. The company's 50-day moving average is $64.84 and its two-hundred day moving average is $85.95. The company has a debt-to-equity ratio of 0.10, a quick ratio of 1.04 and a current ratio of 1.01.

ArcBest (NASDAQ:ARCB - Get Free Report) last released its quarterly earnings results on Tuesday, April 29th. The transportation company reported $0.51 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.52 by ($0.01). ArcBest had a return on equity of 11.79% and a net margin of 4.16%. The firm had revenue of $967.08 million for the quarter, compared to analyst estimates of $990.03 million. During the same period in the prior year, the business earned $1.34 earnings per share. ArcBest's revenue for the quarter was down 6.7% on a year-over-year basis. Analysts forecast that ArcBest Co. will post 7 EPS for the current year.

ArcBest Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, May 23rd. Investors of record on Friday, May 9th were issued a $0.12 dividend. The ex-dividend date of this dividend was Friday, May 9th. This represents a $0.48 dividend on an annualized basis and a yield of 0.79%. ArcBest's payout ratio is 6.35%.

Insider Activity at ArcBest

In other news, CFO John Matthew Beasley bought 700 shares of ArcBest stock in a transaction that occurred on Thursday, March 13th. The shares were purchased at an average price of $74.89 per share, for a total transaction of $52,423.00. Following the completion of the acquisition, the chief financial officer now owns 8,142 shares of the company's stock, valued at $609,754.38. The trade was a 9.41% increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 1.28% of the stock is owned by insiders.

About ArcBest

(

Free Report)

ArcBest Corporation, an integrated logistics company, engages in the provision of ground, air, and ocean transportation solutions. It operates through two segments: Asset-Based and Asset-Light. The Asset-Based segment provides less-than-truckload (LTL) services, that transports general commodities, such as food, textiles, apparel, furniture, appliances, chemicals, non-bulk petroleum products, rubber, plastics, metal and metal products, wood, glass, automotive parts, machinery, and miscellaneous manufactured products.

Featured Articles

Before you consider ArcBest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcBest wasn't on the list.

While ArcBest currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.