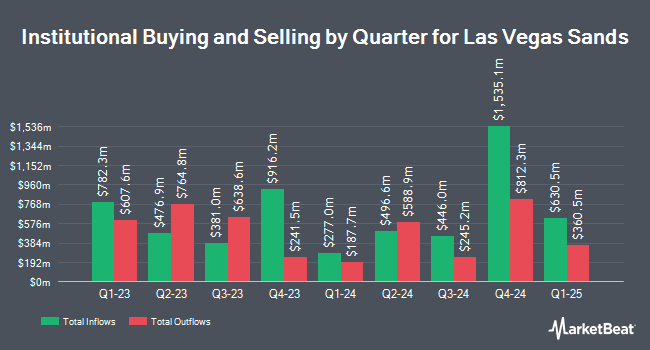

Worldquant Millennium Advisors LLC purchased a new stake in shares of Las Vegas Sands Corp. (NYSE:LVS - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the SEC. The fund purchased 61,537 shares of the casino operator's stock, valued at approximately $3,161,000.

Several other hedge funds also recently added to or reduced their stakes in LVS. Bank of Jackson Hole Trust purchased a new stake in Las Vegas Sands in the fourth quarter valued at approximately $26,000. UMB Bank n.a. grew its stake in Las Vegas Sands by 73.5% during the 4th quarter. UMB Bank n.a. now owns 583 shares of the casino operator's stock worth $30,000 after purchasing an additional 247 shares in the last quarter. Optiver Holding B.V. acquired a new position in Las Vegas Sands in the fourth quarter valued at $32,000. Brown Brothers Harriman & Co. acquired a new stake in Las Vegas Sands during the 4th quarter worth $36,000. Finally, Wilmington Savings Fund Society FSB grew its position in Las Vegas Sands by 45.6% during the 4th quarter. Wilmington Savings Fund Society FSB now owns 760 shares of the casino operator's stock worth $39,000 after purchasing an additional 238 shares during the last quarter. 39.16% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

LVS has been the subject of several recent analyst reports. Citigroup raised their target price on shares of Las Vegas Sands from $64.50 to $67.00 and gave the stock a "buy" rating in a research note on Thursday, January 30th. Morgan Stanley lowered their target price on Las Vegas Sands from $47.00 to $45.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 16th. Wells Fargo & Company cut their price target on Las Vegas Sands from $60.00 to $59.00 and set an "overweight" rating for the company in a research note on Thursday, January 30th. JPMorgan Chase & Co. lowered their price objective on shares of Las Vegas Sands from $62.00 to $61.00 and set an "overweight" rating on the stock in a research note on Wednesday, January 29th. Finally, Hsbc Global Res upgraded shares of Las Vegas Sands to a "strong-buy" rating in a research report on Thursday, April 24th. Four analysts have rated the stock with a hold rating, ten have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $56.75.

Check Out Our Latest Research Report on LVS

Las Vegas Sands Trading Down 2.2%

Shares of NYSE LVS traded down $0.90 during midday trading on Wednesday, hitting $40.74. The stock had a trading volume of 2,480,053 shares, compared to its average volume of 6,087,237. The company has a quick ratio of 0.73, a current ratio of 0.74 and a debt-to-equity ratio of 3.35. Las Vegas Sands Corp. has a 1-year low of $30.18 and a 1-year high of $56.60. The company has a market capitalization of $28.79 billion, a price-to-earnings ratio of 20.66, a PEG ratio of 1.41 and a beta of 0.99. The company has a fifty day moving average price of $37.32 and a 200 day moving average price of $44.04.

Las Vegas Sands (NYSE:LVS - Get Free Report) last released its quarterly earnings data on Wednesday, April 23rd. The casino operator reported $0.59 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.60 by ($0.01). The business had revenue of $2.86 billion during the quarter, compared to analyst estimates of $2.95 billion. Las Vegas Sands had a return on equity of 45.82% and a net margin of 12.80%. Las Vegas Sands's revenue was down 3.3% on a year-over-year basis. During the same period in the previous year, the company earned $0.78 EPS. On average, analysts predict that Las Vegas Sands Corp. will post 2.6 earnings per share for the current year.

Las Vegas Sands announced that its board has approved a share repurchase program on Wednesday, April 23rd that allows the company to repurchase $2.00 billion in outstanding shares. This repurchase authorization allows the casino operator to purchase up to 8.2% of its stock through open market purchases. Stock repurchase programs are often a sign that the company's board of directors believes its shares are undervalued.

Las Vegas Sands Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, May 14th. Stockholders of record on Tuesday, May 6th were issued a dividend of $0.25 per share. The ex-dividend date of this dividend was Tuesday, May 6th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 2.45%. Las Vegas Sands's dividend payout ratio (DPR) is presently 55.56%.

Las Vegas Sands Profile

(

Free Report)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Macao and Singapore. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Further Reading

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.