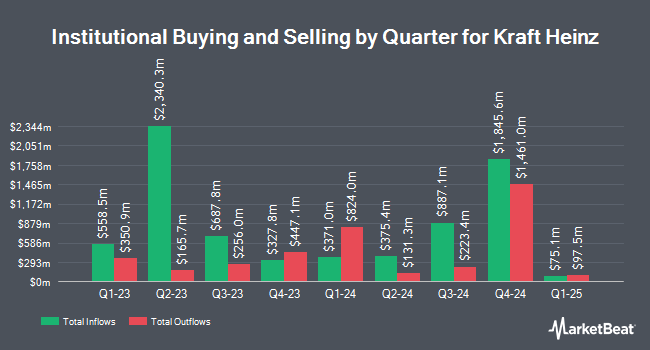

Worldquant Millennium Advisors LLC lifted its stake in shares of The Kraft Heinz Company (NASDAQ:KHC - Free Report) by 1,830.2% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,936,367 shares of the company's stock after buying an additional 1,836,048 shares during the quarter. Worldquant Millennium Advisors LLC owned about 0.16% of Kraft Heinz worth $59,466,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently bought and sold shares of the company. New York Life Investment Management LLC boosted its position in shares of Kraft Heinz by 0.3% in the fourth quarter. New York Life Investment Management LLC now owns 130,075 shares of the company's stock worth $3,995,000 after acquiring an additional 361 shares during the last quarter. Checchi Capital Advisers LLC boosted its position in shares of Kraft Heinz by 5.3% in the fourth quarter. Checchi Capital Advisers LLC now owns 7,265 shares of the company's stock worth $223,000 after acquiring an additional 366 shares during the last quarter. Meiji Yasuda Asset Management Co Ltd. boosted its position in shares of Kraft Heinz by 1.0% in the fourth quarter. Meiji Yasuda Asset Management Co Ltd. now owns 35,735 shares of the company's stock worth $1,097,000 after acquiring an additional 370 shares during the last quarter. Laird Norton Wetherby Wealth Management LLC boosted its position in shares of Kraft Heinz by 4.0% in the fourth quarter. Laird Norton Wetherby Wealth Management LLC now owns 10,009 shares of the company's stock worth $307,000 after acquiring an additional 386 shares during the last quarter. Finally, Rehmann Capital Advisory Group boosted its position in shares of Kraft Heinz by 3.0% in the fourth quarter. Rehmann Capital Advisory Group now owns 13,902 shares of the company's stock worth $427,000 after acquiring an additional 408 shares during the last quarter. Hedge funds and other institutional investors own 78.17% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on KHC shares. Barclays decreased their target price on shares of Kraft Heinz from $33.00 to $29.00 and set an "equal weight" rating on the stock in a research report on Friday, February 14th. Bank of America downgraded shares of Kraft Heinz from a "buy" rating to an "underperform" rating and dropped their target price for the stock from $36.00 to $30.00 in a research report on Thursday, February 13th. DZ Bank downgraded shares of Kraft Heinz from a "buy" rating to a "hold" rating and set a $31.00 target price for the company. in a research report on Friday, May 9th. Sanford C. Bernstein downgraded shares of Kraft Heinz from an "outperform" rating to a "market perform" rating and dropped their target price for the stock from $34.00 to $31.00 in a research report on Tuesday, April 22nd. Finally, Wall Street Zen raised shares of Kraft Heinz from a "sell" rating to a "hold" rating in a research report on Wednesday, March 12th. Four equities research analysts have rated the stock with a sell rating and fifteen have assigned a hold rating to the company's stock. According to data from MarketBeat.com, Kraft Heinz currently has an average rating of "Hold" and an average target price of $30.65.

Read Our Latest Stock Analysis on KHC

Kraft Heinz Stock Down 0.8%

Shares of KHC stock traded down $0.20 during mid-day trading on Friday, reaching $26.30. 10,298,023 shares of the company were exchanged, compared to its average volume of 9,401,979. The Kraft Heinz Company has a fifty-two week low of $26.01 and a fifty-two week high of $36.53. The company has a debt-to-equity ratio of 0.39, a quick ratio of 0.59 and a current ratio of 1.06. The company has a market capitalization of $31.13 billion, a P/E ratio of 11.64, a P/E/G ratio of 3.39 and a beta of 0.30. The business's 50 day simple moving average is $28.89 and its 200 day simple moving average is $29.95.

Kraft Heinz (NASDAQ:KHC - Get Free Report) last released its quarterly earnings results on Tuesday, April 29th. The company reported $0.62 earnings per share for the quarter, topping analysts' consensus estimates of $0.60 by $0.02. Kraft Heinz had a net margin of 10.62% and a return on equity of 7.58%. The business had revenue of $6 billion during the quarter, compared to the consensus estimate of $6.02 billion. During the same quarter last year, the company earned $0.69 earnings per share. The business's quarterly revenue was down 6.4% compared to the same quarter last year. Research analysts predict that The Kraft Heinz Company will post 2.68 earnings per share for the current year.

Kraft Heinz Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, June 27th. Investors of record on Friday, May 30th will be paid a dividend of $0.40 per share. This represents a $1.60 annualized dividend and a yield of 6.08%. The ex-dividend date of this dividend is Friday, May 30th. Kraft Heinz's dividend payout ratio (DPR) is presently 73.06%.

Kraft Heinz Profile

(

Free Report)

The Kraft Heinz Company, together with its subsidiaries, manufactures and markets food and beverage products in North America and internationally. Its products include condiments and sauces, cheese and dairy products, meals, meats, refreshment beverages, coffee, and other grocery products under the Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Ore-Ida, Maxwell House, Kool-Aid, Jell-O, Heinz, ABC, Master, Quero, Kraft, Golden Circle, Wattie's, Pudliszki, and Plasmon brands.

Featured Articles

Before you consider Kraft Heinz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kraft Heinz wasn't on the list.

While Kraft Heinz currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.