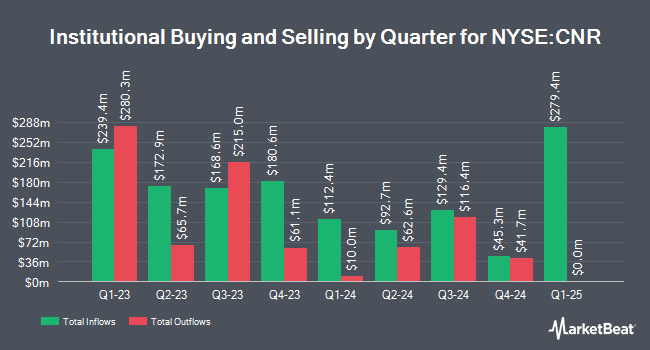

Yousif Capital Management LLC bought a new position in Core Natural Resources, Inc. (NYSE:CNR - Free Report) during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 18,400 shares of the energy company's stock, valued at approximately $1,419,000.

Several other institutional investors have also recently modified their holdings of CNR. Versant Capital Management Inc bought a new position in Core Natural Resources during the 1st quarter worth approximately $25,000. EverSource Wealth Advisors LLC bought a new position in Core Natural Resources during the 4th quarter worth approximately $26,000. Farther Finance Advisors LLC purchased a new stake in Core Natural Resources in the 1st quarter worth approximately $30,000. Smartleaf Asset Management LLC lifted its holdings in Core Natural Resources by 82.0% in the 4th quarter. Smartleaf Asset Management LLC now owns 222 shares of the energy company's stock worth $31,000 after buying an additional 100 shares during the period. Finally, Whipplewood Advisors LLC purchased a new stake in Core Natural Resources in the 1st quarter worth approximately $31,000. 86.54% of the stock is currently owned by institutional investors.

Core Natural Resources Stock Down 6.7%

Shares of CNR stock traded down $5.05 during mid-day trading on Friday, hitting $69.82. The company's stock had a trading volume of 2,107,211 shares, compared to its average volume of 691,839. Core Natural Resources, Inc. has a 52-week low of $58.19 and a 52-week high of $134.59. The business has a 50-day moving average price of $71.83 and a 200 day moving average price of $94.48. The company has a debt-to-equity ratio of 0.08, a quick ratio of 1.34 and a current ratio of 1.89. The stock has a market cap of $3.68 billion, a price-to-earnings ratio of 14.43 and a beta of 0.69.

Core Natural Resources (NYSE:CNR - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The energy company reported ($1.38) earnings per share for the quarter, missing the consensus estimate of $1.74 by ($3.12). Core Natural Resources had a return on equity of 8.32% and a net margin of 4.29%. The business had revenue of $1.02 billion during the quarter, compared to analysts' expectations of $964.15 million. Research analysts predict that Core Natural Resources, Inc. will post 11.4 EPS for the current fiscal year.

Core Natural Resources Cuts Dividend

The business also recently announced a dividend, which was paid on Friday, June 13th. Investors of record on Monday, June 2nd were given a dividend of $0.10 per share. The ex-dividend date was Friday, May 30th. This represents a yield of 0.57%. Core Natural Resources's dividend payout ratio (DPR) is presently 8.26%.

Wall Street Analyst Weigh In

CNR has been the subject of several research analyst reports. UBS Group initiated coverage on Core Natural Resources in a report on Wednesday, June 11th. They issued a "buy" rating and a $80.00 price objective for the company. B. Riley lowered their target price on Core Natural Resources from $136.00 to $119.00 and set a "buy" rating for the company in a research note on Friday, April 11th. Finally, Benchmark lowered their target price on Core Natural Resources from $112.00 to $105.00 and set a "buy" rating for the company in a research note on Friday, May 9th. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $120.80.

Get Our Latest Stock Analysis on CNR

Insider Activity at Core Natural Resources

In other news, Director Holly K. Koeppel sold 8,815 shares of the business's stock in a transaction dated Monday, March 31st. The stock was sold at an average price of $75.30, for a total value of $663,769.50. Following the transaction, the director now directly owns 13,348 shares in the company, valued at $1,005,104.40. The trade was a 39.77% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 1.41% of the stock is owned by company insiders.

About Core Natural Resources

(

Free Report)

Core Natural Resources, Inc, together with its subsidiaries, produces and sells bituminous coal in the United States and internationally. It operates through two segments, Pennsylvania Mining Complex (PAMC) and CONSOL Marine Terminal. The company's PAMC segment engages in the mining, preparing, and marketing of bituminous coal to power generators, industrial end-users, and metallurgical end-users.

See Also

Before you consider Core Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Core Natural Resources wasn't on the list.

While Core Natural Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.