Zimmer Partners LP increased its position in Everest Group, Ltd. (NYSE:EG - Free Report) by 8.9% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 137,500 shares of the company's stock after purchasing an additional 11,276 shares during the quarter. Zimmer Partners LP owned approximately 0.32% of Everest Group worth $49,838,000 as of its most recent SEC filing.

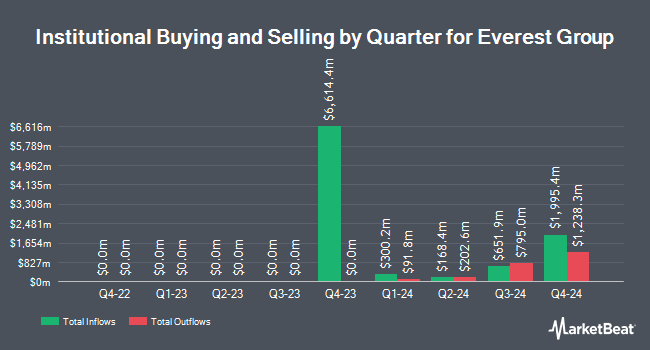

Several other hedge funds and other institutional investors also recently bought and sold shares of EG. Norges Bank bought a new position in Everest Group in the fourth quarter worth approximately $488,588,000. Vulcan Value Partners LLC boosted its position in Everest Group by 279.1% during the 4th quarter. Vulcan Value Partners LLC now owns 978,713 shares of the company's stock valued at $354,768,000 after acquiring an additional 720,572 shares in the last quarter. Sterling Capital Management LLC boosted its position in Everest Group by 11,756.0% during the 4th quarter. Sterling Capital Management LLC now owns 278,616 shares of the company's stock valued at $100,987,000 after acquiring an additional 276,266 shares in the last quarter. Balyasny Asset Management L.P. boosted its position in Everest Group by 14,518.5% during the 4th quarter. Balyasny Asset Management L.P. now owns 190,040 shares of the company's stock valued at $68,882,000 after acquiring an additional 188,740 shares in the last quarter. Finally, Donald Smith & CO. Inc. bought a new stake in Everest Group during the 4th quarter valued at $56,341,000. Institutional investors own 92.64% of the company's stock.

Everest Group Stock Performance

Shares of NYSE EG traded down $0.30 during trading on Friday, reaching $336.00. 421,507 shares of the company traded hands, compared to its average volume of 384,579. The firm's fifty day simple moving average is $349.89 and its 200 day simple moving average is $356.32. The stock has a market cap of $14.29 billion, a P/E ratio of 10.70, a PEG ratio of 0.24 and a beta of 0.58. Everest Group, Ltd. has a 12-month low of $320.00 and a 12-month high of $407.30. The company has a current ratio of 0.40, a quick ratio of 0.40 and a debt-to-equity ratio of 0.26.

Everest Group (NYSE:EG - Get Free Report) last released its quarterly earnings data on Wednesday, April 30th. The company reported $6.45 earnings per share for the quarter, missing analysts' consensus estimates of $7.46 by ($1.01). The company had revenue of $4.26 billion for the quarter, compared to analysts' expectations of $3.89 billion. Everest Group had a net margin of 7.95% and a return on equity of 9.04%. The business's quarterly revenue was up 3.1% on a year-over-year basis. During the same quarter in the previous year, the business posted $16.32 EPS. As a group, research analysts anticipate that Everest Group, Ltd. will post 47.93 earnings per share for the current fiscal year.

Everest Group Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, June 13th. Shareholders of record on Wednesday, May 28th will be paid a dividend of $2.00 per share. The ex-dividend date is Wednesday, May 28th. This represents a $8.00 dividend on an annualized basis and a dividend yield of 2.38%. Everest Group's payout ratio is currently 41.15%.

Insider Buying and Selling at Everest Group

In related news, Director Geraldine Losquadro sold 1,500 shares of Everest Group stock in a transaction dated Tuesday, March 18th. The stock was sold at an average price of $360.63, for a total value of $540,945.00. Following the completion of the transaction, the director now owns 12,279 shares in the company, valued at $4,428,175.77. The trade was a 10.89% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 1.10% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have issued reports on EG shares. Barclays dropped their target price on Everest Group from $470.00 to $394.00 and set an "overweight" rating on the stock in a research report on Friday, April 11th. Morgan Stanley raised their price objective on Everest Group from $330.00 to $350.00 and gave the stock an "equal weight" rating in a research report on Monday, May 19th. Raymond James reissued a "strong-buy" rating and issued a $410.00 price objective (down previously from $420.00) on shares of Everest Group in a research report on Tuesday, May 6th. Evercore ISI lowered their price objective on Everest Group from $400.00 to $396.00 and set an "in-line" rating for the company in a research report on Thursday, May 1st. Finally, UBS Group lowered their price objective on Everest Group from $375.00 to $372.00 and set a "neutral" rating for the company in a research report on Wednesday, April 9th. Six analysts have rated the stock with a hold rating, four have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Everest Group has a consensus rating of "Moderate Buy" and a consensus price target of $398.09.

Check Out Our Latest Stock Report on EG

About Everest Group

(

Free Report)

Everest Group, Ltd., through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally. The company operates through two segment, Insurance and Reinsurance. The Reinsurance segment writes property and casualty reinsurance; and specialty lines of business through reinsurance brokers, as well as directly with ceding companies in the United States, Bermuda, Ireland, Canada, Singapore, Switzerland, and the United Kingdom.

Featured Stories

Before you consider Everest Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everest Group wasn't on the list.

While Everest Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.