First Manhattan CO. LLC. grew its position in shares of TMC the metals company Inc. (NASDAQ:TMC - Free Report) by 115.2% during the 4th quarter, according to the company in its most recent filing with the SEC. The firm owned 18,726,800 shares of the company's stock after purchasing an additional 10,025,000 shares during the quarter. First Manhattan CO. LLC. owned 5.78% of TMC the metals worth $20,974,000 as of its most recent filing with the SEC.

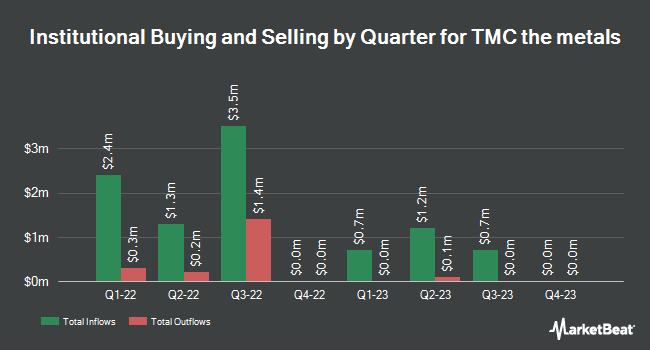

Several other hedge funds also recently modified their holdings of TMC. Virtu Financial LLC acquired a new position in shares of TMC the metals during the 3rd quarter worth $44,000. Tidal Investments LLC increased its holdings in shares of TMC the metals by 32.6% during the third quarter. Tidal Investments LLC now owns 485,332 shares of the company's stock worth $514,000 after buying an additional 119,335 shares in the last quarter. Oppenheimer & Co. Inc. bought a new stake in TMC the metals during the 4th quarter worth approximately $28,000. SBI Securities Co. Ltd. acquired a new position in shares of TMC the metals during the fourth quarter worth approximately $94,000. Finally, Raymond James Financial Inc. acquired a new position in shares of TMC the metals in the 4th quarter valued at $28,000. 4.39% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, CFO Craig Shesky sold 353,702 shares of the firm's stock in a transaction dated Tuesday, April 1st. The shares were sold at an average price of $1.66, for a total transaction of $587,145.32. Following the completion of the sale, the chief financial officer now owns 1,145,717 shares in the company, valued at approximately $1,901,890.22. This trade represents a 23.59% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. 30.00% of the stock is currently owned by corporate insiders.

TMC the metals Stock Performance

Shares of TMC the metals stock traded up $0.09 during trading hours on Wednesday, reaching $3.06. The company's stock had a trading volume of 5,438,171 shares, compared to its average volume of 2,820,792. TMC the metals company Inc. has a one year low of $0.72 and a one year high of $3.80. The company has a market capitalization of $1.06 billion, a P/E ratio of -9.87 and a beta of 1.33. The stock's fifty day simple moving average is $2.31 and its two-hundred day simple moving average is $1.63.

TMC the metals (NASDAQ:TMC - Get Free Report) last released its quarterly earnings data on Thursday, March 27th. The company reported ($0.05) earnings per share for the quarter, beating analysts' consensus estimates of ($0.06) by $0.01. The business had revenue of ($20.18) million during the quarter. As a group, research analysts forecast that TMC the metals company Inc. will post -0.22 earnings per share for the current year.

Wall Street Analyst Weigh In

Several analysts have weighed in on TMC shares. Alliance Global Partners started coverage on shares of TMC the metals in a research note on Wednesday, January 15th. They issued a "buy" rating and a $3.75 price objective for the company. Wedbush reaffirmed a "neutral" rating and issued a $4.00 price objective on shares of TMC the metals in a research note on Friday, March 28th.

Get Our Latest Analysis on TMC

TMC the metals Company Profile

(

Free Report)

TMC the metals company Inc, a deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California. It primarily explores for nickel, cobalt, copper, and manganese products. The company holds exploration and commercial rights in three polymetallic nodule contract areas in the Clarion Clipperton Zone of the Pacific Ocean.

See Also

Before you consider TMC the metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TMC the metals wasn't on the list.

While TMC the metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.