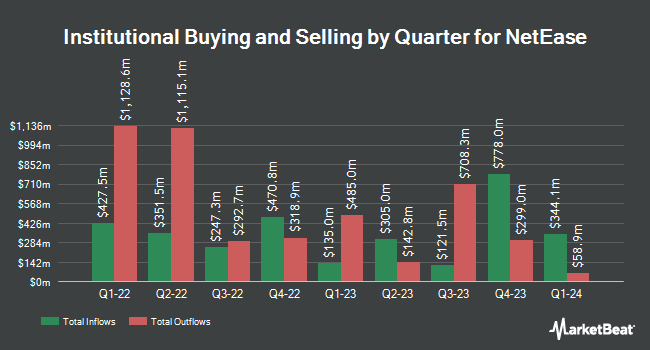

First Trust Advisors LP grew its stake in shares of NetEase, Inc. (NASDAQ:NTES - Free Report) by 129.0% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 5,821 shares of the technology company's stock after acquiring an additional 3,279 shares during the quarter. First Trust Advisors LP's holdings in NetEase were worth $519,000 as of its most recent SEC filing.

Other hedge funds have also recently modified their holdings of the company. Farther Finance Advisors LLC increased its holdings in NetEase by 81.7% in the 4th quarter. Farther Finance Advisors LLC now owns 338 shares of the technology company's stock worth $30,000 after buying an additional 152 shares during the period. Brooklyn Investment Group acquired a new position in NetEase in the 4th quarter worth approximately $34,000. UMB Bank n.a. grew its stake in shares of NetEase by 33.3% during the 4th quarter. UMB Bank n.a. now owns 444 shares of the technology company's stock worth $40,000 after purchasing an additional 111 shares during the period. Live Oak Investment Partners acquired a new stake in shares of NetEase during the 4th quarter worth approximately $62,000. Finally, Avior Wealth Management LLC grew its stake in shares of NetEase by 148.9% during the 4th quarter. Avior Wealth Management LLC now owns 993 shares of the technology company's stock worth $89,000 after purchasing an additional 594 shares during the period. Institutional investors and hedge funds own 11.07% of the company's stock.

NetEase Stock Performance

Shares of NTES stock traded up $14.93 on Thursday, hitting $122.04. 2,235,445 shares of the stock traded hands, compared to its average volume of 1,591,122. The firm's 50-day moving average price is $101.95 and its two-hundred day moving average price is $96.55. The stock has a market capitalization of $77.32 billion, a PE ratio of 19.06, a PEG ratio of 3.37 and a beta of 0.66. NetEase, Inc. has a twelve month low of $75.85 and a twelve month high of $122.21.

NetEase (NASDAQ:NTES - Get Free Report) last posted its earnings results on Thursday, May 15th. The technology company reported $2.21 EPS for the quarter, beating analysts' consensus estimates of $2.03 by $0.18. NetEase had a net margin of 28.17% and a return on equity of 22.12%. On average, equities research analysts anticipate that NetEase, Inc. will post 6.91 EPS for the current fiscal year.

NetEase Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, March 20th. Shareholders of record on Thursday, March 6th were given a $0.435 dividend. The ex-dividend date was Thursday, March 6th. This represents a $1.74 dividend on an annualized basis and a yield of 1.43%. NetEase's payout ratio is currently 76.45%.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on NTES shares. Barclays raised their price objective on shares of NetEase from $82.00 to $104.00 and gave the stock an "equal weight" rating in a research note on Monday, February 24th. Morgan Stanley lifted their price target on shares of NetEase from $108.00 to $117.00 and gave the company an "overweight" rating in a research note on Wednesday, February 12th. Bank of America lifted their price target on shares of NetEase from $120.00 to $122.00 and gave the company a "buy" rating in a research note on Wednesday, January 15th. Benchmark lifted their price target on shares of NetEase from $105.00 to $115.00 and gave the company a "buy" rating in a research note on Friday, February 21st. Finally, Deutsche Bank Aktiengesellschaft assumed coverage on shares of NetEase in a research note on Monday. They issued a "buy" rating and a $130.00 price target on the stock. One research analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $115.14.

Get Our Latest Report on NTES

NetEase Company Profile

(

Free Report)

NetEase, Inc engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally . The company operates through Games and Related Value-Added Services, Youdao, Cloud Music, and Innovative Businesses and Others segments.

Read More

Before you consider NetEase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetEase wasn't on the list.

While NetEase currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.