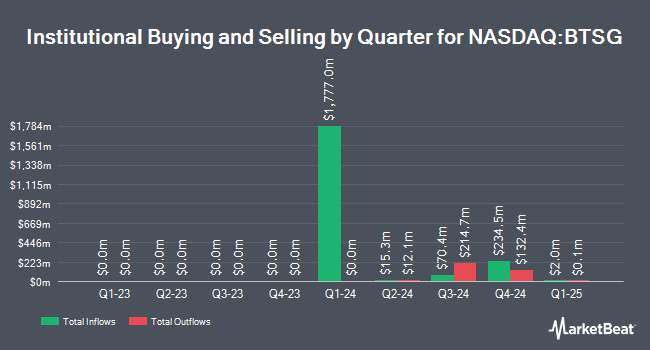

First Trust Advisors LP bought a new position in shares of BrightSpring Health Services, Inc. (NASDAQ:BTSG - Free Report) in the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor bought 57,972 shares of the company's stock, valued at approximately $987,000.

A number of other institutional investors have also recently made changes to their positions in the company. Rhumbline Advisers increased its position in shares of BrightSpring Health Services by 1.5% during the fourth quarter. Rhumbline Advisers now owns 73,583 shares of the company's stock worth $1,253,000 after purchasing an additional 1,118 shares in the last quarter. Legal & General Group Plc increased its stake in shares of BrightSpring Health Services by 4.8% in the 4th quarter. Legal & General Group Plc now owns 64,631 shares of the company's stock worth $1,101,000 after acquiring an additional 2,945 shares during the last quarter. R Squared Ltd acquired a new stake in shares of BrightSpring Health Services in the 4th quarter worth $74,000. Geode Capital Management LLC increased its stake in shares of BrightSpring Health Services by 0.5% in the 4th quarter. Geode Capital Management LLC now owns 1,311,204 shares of the company's stock worth $22,335,000 after acquiring an additional 6,990 shares during the last quarter. Finally, American Century Companies Inc. increased its stake in shares of BrightSpring Health Services by 8.8% in the 4th quarter. American Century Companies Inc. now owns 92,893 shares of the company's stock worth $1,582,000 after acquiring an additional 7,505 shares during the last quarter.

BrightSpring Health Services Stock Performance

BTSG traded up $0.16 during trading on Tuesday, hitting $22.51. 1,059,609 shares of the stock were exchanged, compared to its average volume of 1,382,494. The company has a quick ratio of 0.97, a current ratio of 1.35 and a debt-to-equity ratio of 1.63. BrightSpring Health Services, Inc. has a 1-year low of $10.15 and a 1-year high of $24.82. The stock has a fifty day moving average price of $18.04 and a two-hundred day moving average price of $18.79. The firm has a market capitalization of $3.92 billion, a P/E ratio of -86.58 and a beta of 2.06.

BrightSpring Health Services (NASDAQ:BTSG - Get Free Report) last announced its earnings results on Friday, May 2nd. The company reported $0.19 EPS for the quarter, beating analysts' consensus estimates of $0.09 by $0.10. The business had revenue of $2.88 billion for the quarter, compared to analysts' expectations of $2.74 billion. BrightSpring Health Services had a negative net margin of 0.38% and a positive return on equity of 4.16%. The company's quarterly revenue was up 25.9% on a year-over-year basis. During the same period in the previous year, the company posted $0.12 EPS. As a group, sell-side analysts predict that BrightSpring Health Services, Inc. will post 0.59 earnings per share for the current year.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on BTSG shares. UBS Group increased their price target on BrightSpring Health Services from $22.00 to $30.00 and gave the stock a "buy" rating in a report on Wednesday, January 29th. Morgan Stanley increased their price target on BrightSpring Health Services from $20.00 to $25.00 and gave the stock an "overweight" rating in a report on Friday. Finally, Mizuho set a $26.00 price target on BrightSpring Health Services in a report on Monday, May 5th. One analyst has rated the stock with a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat.com, BrightSpring Health Services has an average rating of "Moderate Buy" and an average price target of $22.89.

Get Our Latest Stock Analysis on BrightSpring Health Services

BrightSpring Health Services Profile

(

Free Report)

BrightSpring Health Services, Inc operates a home and community-based healthcare services platform in the United States. The company's platform focuses on delivering pharmacy and provider services, including clinical and supportive care in home and community settings to Medicare, Medicaid, and insured populations.

Recommended Stories

Before you consider BrightSpring Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpring Health Services wasn't on the list.

While BrightSpring Health Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.