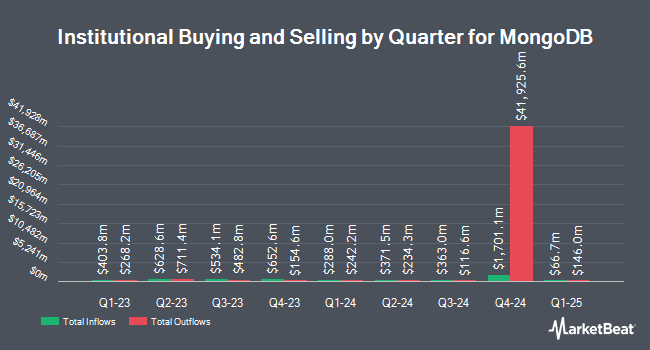

Focus Partners Wealth lifted its stake in MongoDB, Inc. (NASDAQ:MDB - Free Report) by 57.3% during the 4th quarter, according to the company in its most recent filing with the SEC. The fund owned 31,132 shares of the company's stock after acquiring an additional 11,335 shares during the quarter. Focus Partners Wealth's holdings in MongoDB were worth $7,248,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in MDB. Wealth Enhancement Advisory Services LLC lifted its holdings in shares of MongoDB by 0.5% in the 4th quarter. Wealth Enhancement Advisory Services LLC now owns 22,399 shares of the company's stock worth $5,215,000 after acquiring an additional 110 shares during the last quarter. FNY Investment Advisers LLC acquired a new position in shares of MongoDB in the 4th quarter worth approximately $411,000. Tealwood Asset Management Inc. acquired a new position in shares of MongoDB in the 4th quarter worth approximately $243,000. Assenagon Asset Management S.A. lifted its holdings in shares of MongoDB by 11,057.0% in the 4th quarter. Assenagon Asset Management S.A. now owns 296,889 shares of the company's stock worth $69,119,000 after acquiring an additional 294,228 shares during the last quarter. Finally, Park Avenue Securities LLC lifted its holdings in shares of MongoDB by 24.3% in the 4th quarter. Park Avenue Securities LLC now owns 1,723 shares of the company's stock worth $401,000 after acquiring an additional 337 shares during the last quarter. 89.29% of the stock is currently owned by institutional investors and hedge funds.

MongoDB Stock Performance

MongoDB stock traded up $0.79 during midday trading on Friday, hitting $191.29. 7,849,265 shares of the company's stock were exchanged, compared to its average volume of 1,909,421. MongoDB, Inc. has a 12-month low of $140.78 and a 12-month high of $379.06. The stock has a market cap of $15.53 billion, a price-to-earnings ratio of -69.81 and a beta of 1.49. The firm's 50 day simple moving average is $175.00 and its 200 day simple moving average is $239.84.

MongoDB (NASDAQ:MDB - Get Free Report) last released its earnings results on Wednesday, March 5th. The company reported $0.19 EPS for the quarter, missing the consensus estimate of $0.64 by ($0.45). The firm had revenue of $548.40 million during the quarter, compared to analyst estimates of $519.65 million. MongoDB had a negative return on equity of 12.22% and a negative net margin of 10.46%. During the same quarter last year, the business posted $0.86 EPS. On average, equities research analysts forecast that MongoDB, Inc. will post -1.78 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on the stock. Needham & Company LLC decreased their price objective on shares of MongoDB from $415.00 to $270.00 and set a "buy" rating on the stock in a report on Thursday, March 6th. Oppenheimer reduced their target price on shares of MongoDB from $400.00 to $330.00 and set an "outperform" rating on the stock in a report on Thursday, March 6th. Monness Crespi & Hardt upgraded shares of MongoDB from a "sell" rating to a "neutral" rating in a report on Monday, March 3rd. Citigroup reduced their target price on shares of MongoDB from $430.00 to $330.00 and set a "buy" rating on the stock in a report on Tuesday, April 1st. Finally, Robert W. Baird reduced their target price on shares of MongoDB from $390.00 to $300.00 and set an "outperform" rating on the stock in a report on Thursday, March 6th. Eight research analysts have rated the stock with a hold rating, twenty-four have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $293.91.

Get Our Latest Research Report on MongoDB

Insider Activity

In related news, Director Dwight A. Merriman sold 885 shares of the business's stock in a transaction dated Tuesday, February 18th. The shares were sold at an average price of $292.05, for a total transaction of $258,464.25. Following the sale, the director now owns 83,845 shares of the company's stock, valued at approximately $24,486,932.25. The trade was a 1.04% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CAO Thomas Bull sold 301 shares of the business's stock in a transaction dated Wednesday, April 2nd. The stock was sold at an average price of $173.25, for a total transaction of $52,148.25. Following the sale, the chief accounting officer now directly owns 14,598 shares in the company, valued at approximately $2,529,103.50. This represents a 2.02% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 34,423 shares of company stock valued at $7,148,369 over the last quarter. Corporate insiders own 3.60% of the company's stock.

MongoDB Company Profile

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.