Fred Alger Management LLC cut its position in Builders FirstSource, Inc. (NYSE:BLDR - Free Report) by 3.1% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 257,400 shares of the company's stock after selling 8,340 shares during the quarter. Fred Alger Management LLC owned approximately 0.22% of Builders FirstSource worth $36,790,000 at the end of the most recent quarter.

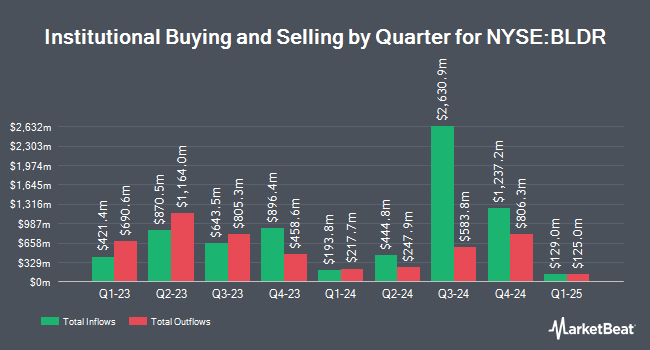

A number of other large investors have also recently made changes to their positions in BLDR. Meiji Yasuda Asset Management Co Ltd. raised its position in Builders FirstSource by 3.4% during the 4th quarter. Meiji Yasuda Asset Management Co Ltd. now owns 1,943 shares of the company's stock worth $278,000 after buying an additional 64 shares during the last quarter. Integrated Investment Consultants LLC lifted its holdings in shares of Builders FirstSource by 0.4% in the 4th quarter. Integrated Investment Consultants LLC now owns 15,008 shares of the company's stock valued at $2,145,000 after buying an additional 65 shares during the period. TFB Advisors LLC increased its stake in Builders FirstSource by 2.1% in the 4th quarter. TFB Advisors LLC now owns 3,819 shares of the company's stock valued at $546,000 after purchasing an additional 79 shares in the last quarter. HighPoint Advisor Group LLC grew its position in shares of Builders FirstSource by 5.2% in the fourth quarter. HighPoint Advisor Group LLC now owns 1,677 shares of the company's stock valued at $262,000 after purchasing an additional 83 shares during the last quarter. Finally, Aptus Capital Advisors LLC increased its position in Builders FirstSource by 6.0% during the fourth quarter. Aptus Capital Advisors LLC now owns 1,494 shares of the company's stock worth $214,000 after buying an additional 85 shares in the last quarter. 95.53% of the stock is owned by institutional investors and hedge funds.

Builders FirstSource Stock Performance

Shares of Builders FirstSource stock traded up $6.66 on Tuesday, reaching $124.65. 3,056,613 shares of the company were exchanged, compared to its average volume of 1,678,000. The company has a debt-to-equity ratio of 0.86, a quick ratio of 1.16 and a current ratio of 1.77. The company's 50-day moving average is $121.71 and its two-hundred day moving average is $147.74. The firm has a market cap of $13.78 billion, a price-to-earnings ratio of 13.76, a P/E/G ratio of 0.80 and a beta of 1.79. Builders FirstSource, Inc. has a 1-year low of $103.81 and a 1-year high of $203.14.

Builders FirstSource (NYSE:BLDR - Get Free Report) last posted its earnings results on Thursday, May 1st. The company reported $1.51 EPS for the quarter, beating the consensus estimate of $1.50 by $0.01. Builders FirstSource had a return on equity of 30.54% and a net margin of 6.57%. The firm had revenue of $3.66 billion for the quarter, compared to analysts' expectations of $3.67 billion. During the same period last year, the firm earned $2.65 EPS. The firm's revenue was down 6.0% compared to the same quarter last year. As a group, research analysts expect that Builders FirstSource, Inc. will post 11.59 earnings per share for the current fiscal year.

Builders FirstSource announced that its Board of Directors has authorized a share repurchase plan on Thursday, May 1st that authorizes the company to buyback $500.00 million in outstanding shares. This buyback authorization authorizes the company to purchase up to 3.9% of its stock through open market purchases. Stock buyback plans are typically an indication that the company's leadership believes its shares are undervalued.

Analysts Set New Price Targets

A number of brokerages have recently commented on BLDR. Deutsche Bank Aktiengesellschaft began coverage on Builders FirstSource in a research report on Tuesday, April 1st. They issued a "buy" rating and a $151.00 price objective for the company. Robert W. Baird set a $130.00 price target on Builders FirstSource in a research report on Friday, May 2nd. Truist Financial decreased their target price on Builders FirstSource from $220.00 to $180.00 and set a "buy" rating for the company in a research report on Friday, February 21st. UBS Group lowered their price objective on shares of Builders FirstSource from $180.00 to $163.00 and set a "buy" rating for the company in a research report on Friday, May 2nd. Finally, Benchmark reduced their price target on Builders FirstSource from $200.00 to $170.00 and set a "buy" rating for the company in a report on Friday, February 21st. Six analysts have rated the stock with a hold rating, fifteen have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, Builders FirstSource currently has an average rating of "Moderate Buy" and an average price target of $167.58.

Read Our Latest Report on BLDR

About Builders FirstSource

(

Free Report)

Builders FirstSource, Inc, together with its subsidiaries, manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States. It offers lumber and lumber sheet goods comprising dimensional lumber, plywood, and oriented strand board products that are used in on-site house framing; manufactured products, such as wood floor and roof trusses, floor trusses, wall panels, stairs, and engineered wood products; and windows, and interior and exterior door units, as well as interior trims and custom products comprising intricate mouldings, stair parts, and columns under the Synboard brand name.

Featured Stories

Before you consider Builders FirstSource, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Builders FirstSource wasn't on the list.

While Builders FirstSource currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.