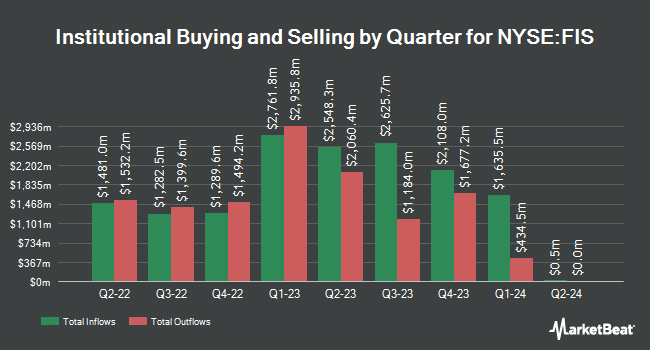

Fuller & Thaler Asset Management Inc. increased its stake in shares of Fidelity National Information Services, Inc. (NYSE:FIS - Free Report) by 3.9% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 310,191 shares of the information technology services provider's stock after buying an additional 11,504 shares during the quarter. Fuller & Thaler Asset Management Inc. owned about 0.06% of Fidelity National Information Services worth $25,054,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. R Squared Ltd acquired a new position in Fidelity National Information Services in the 4th quarter worth approximately $30,000. Morse Asset Management Inc acquired a new stake in shares of Fidelity National Information Services in the third quarter worth $37,000. OFI Invest Asset Management purchased a new stake in Fidelity National Information Services in the fourth quarter valued at $40,000. Grove Bank & Trust boosted its stake in shares of Fidelity National Information Services by 341.0% in the fourth quarter. Grove Bank & Trust now owns 516 shares of the information technology services provider's stock worth $42,000 after buying an additional 399 shares during the last quarter. Finally, Sound Income Strategies LLC lifted its stake in shares of Fidelity National Information Services by 70.2% in the 4th quarter. Sound Income Strategies LLC now owns 606 shares of the information technology services provider's stock valued at $49,000 after purchasing an additional 250 shares during the period. Institutional investors and hedge funds own 96.23% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on the stock. Keefe, Bruyette & Woods dropped their price objective on shares of Fidelity National Information Services from $102.00 to $92.00 and set an "outperform" rating for the company in a research note on Wednesday, February 12th. Stephens dropped their price objective on Fidelity National Information Services from $100.00 to $90.00 and set an "overweight" rating for the company in a research note on Wednesday, February 12th. Wells Fargo & Company dropped their price target on shares of Fidelity National Information Services from $88.00 to $80.00 and set an "equal weight" rating for the company in a research note on Wednesday, February 12th. Citigroup raised shares of Fidelity National Information Services from a "neutral" rating to a "buy" rating and raised their target price for the company from $79.00 to $86.00 in a report on Monday, April 21st. Finally, UBS Group decreased their price target on Fidelity National Information Services from $94.00 to $81.00 and set a "neutral" rating for the company in a report on Wednesday, February 12th. One analyst has rated the stock with a sell rating, eight have assigned a hold rating and fourteen have issued a buy rating to the company's stock. According to data from MarketBeat, Fidelity National Information Services currently has an average rating of "Moderate Buy" and an average target price of $89.29.

Read Our Latest Stock Report on FIS

Insider Activity at Fidelity National Information Services

In related news, Director Jeffrey A. Goldstein purchased 844 shares of the firm's stock in a transaction that occurred on Tuesday, April 15th. The stock was acquired at an average price of $72.04 per share, for a total transaction of $60,801.76. Following the transaction, the director now directly owns 11,942 shares of the company's stock, valued at $860,301.68. This trade represents a 7.60 % increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at the SEC website. Company insiders own 0.20% of the company's stock.

Fidelity National Information Services Trading Down 0.5 %

Shares of NYSE FIS traded down $0.42 during trading on Wednesday, hitting $78.21. 894,939 shares of the company traded hands, compared to its average volume of 3,530,251. The company has a 50-day moving average price of $72.62 and a 200-day moving average price of $79.37. The firm has a market capitalization of $41.43 billion, a P/E ratio of 29.97, a P/E/G ratio of 1.23 and a beta of 1.06. The company has a quick ratio of 0.85, a current ratio of 0.85 and a debt-to-equity ratio of 0.62. Fidelity National Information Services, Inc. has a 1 year low of $66.51 and a 1 year high of $91.98.

Fidelity National Information Services (NYSE:FIS - Get Free Report) last posted its earnings results on Tuesday, February 11th. The information technology services provider reported $1.40 EPS for the quarter, topping analysts' consensus estimates of $1.35 by $0.05. Fidelity National Information Services had a net margin of 14.54% and a return on equity of 17.30%. During the same quarter in the previous year, the company earned $0.94 EPS. On average, equities analysts predict that Fidelity National Information Services, Inc. will post 5.74 EPS for the current year.

Fidelity National Information Services Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, March 25th. Shareholders of record on Tuesday, March 11th were given a $0.40 dividend. This represents a $1.60 dividend on an annualized basis and a yield of 2.05%. This is an increase from Fidelity National Information Services's previous quarterly dividend of $0.36. The ex-dividend date was Tuesday, March 11th. Fidelity National Information Services's dividend payout ratio is 61.30%.

Fidelity National Information Services Profile

(

Free Report)

Fidelity National Information Services, Inc engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. It operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments. The company provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions.

Read More

Before you consider Fidelity National Information Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fidelity National Information Services wasn't on the list.

While Fidelity National Information Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.