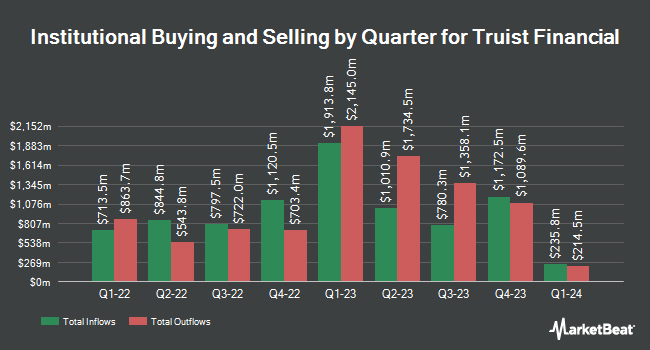

Fullerton Fund Management Co Ltd. acquired a new stake in Truist Financial Co. (NYSE:TFC - Free Report) during the 4th quarter, according to its most recent disclosure with the SEC. The fund acquired 15,298 shares of the insurance provider's stock, valued at approximately $664,000.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in TFC. Hopwood Financial Services Inc. bought a new stake in shares of Truist Financial in the fourth quarter worth $26,000. Navigoe LLC bought a new position in shares of Truist Financial in the 4th quarter valued at about $26,000. Curio Wealth LLC acquired a new stake in shares of Truist Financial in the fourth quarter valued at about $45,000. City State Bank raised its holdings in Truist Financial by 158.1% during the fourth quarter. City State Bank now owns 1,169 shares of the insurance provider's stock worth $51,000 after acquiring an additional 716 shares in the last quarter. Finally, Brown Lisle Cummings Inc. acquired a new position in Truist Financial during the fourth quarter valued at approximately $55,000. 71.28% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

TFC has been the topic of a number of analyst reports. Raymond James cut Truist Financial from an "outperform" rating to a "market perform" rating in a research note on Wednesday, April 2nd. JPMorgan Chase & Co. lowered their price objective on shares of Truist Financial from $48.00 to $42.00 and set a "neutral" rating on the stock in a research note on Thursday, April 3rd. Citigroup reduced their price target on Truist Financial from $51.00 to $44.00 and set a "neutral" rating for the company in a report on Monday, March 24th. Morgan Stanley dropped their price objective on Truist Financial from $50.00 to $43.00 and set an "equal weight" rating on the stock in a research note on Monday, April 7th. Finally, Robert W. Baird upgraded Truist Financial from a "neutral" rating to an "outperform" rating and lifted their target price for the stock from $48.00 to $52.00 in a research note on Wednesday, March 5th. Eight investment analysts have rated the stock with a hold rating, eleven have assigned a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $48.06.

Get Our Latest Stock Report on Truist Financial

Truist Financial Stock Up 0.5%

TFC traded up $0.21 during trading on Tuesday, hitting $41.33. 6,226,934 shares of the company's stock were exchanged, compared to its average volume of 8,197,585. Truist Financial Co. has a fifty-two week low of $33.56 and a fifty-two week high of $49.06. The stock has a market cap of $54.12 billion, a P/E ratio of 12.41, a PEG ratio of 1.63 and a beta of 0.83. The business's 50 day moving average is $38.82 and its two-hundred day moving average is $43.29. The company has a quick ratio of 0.83, a current ratio of 0.83 and a debt-to-equity ratio of 0.61.

Truist Financial (NYSE:TFC - Get Free Report) last posted its quarterly earnings data on Thursday, April 17th. The insurance provider reported $0.87 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.87. The firm had revenue of $4.95 billion for the quarter, compared to the consensus estimate of $4.99 billion. Truist Financial had a net margin of 15.59% and a return on equity of 9.32%. During the same period in the previous year, the firm earned $0.90 EPS. As a group, equities analysts expect that Truist Financial Co. will post 4 earnings per share for the current fiscal year.

Truist Financial Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, June 2nd. Investors of record on Friday, May 9th will be paid a $0.52 dividend. The ex-dividend date is Friday, May 9th. This represents a $2.08 annualized dividend and a yield of 5.03%. Truist Financial's payout ratio is 61.36%.

Truist Financial Company Profile

(

Free Report)

Truist Financial Corporation, a financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States. The company operates through three segments: Consumer Banking and Wealth, Corporate and Commercial Banking, and Insurance Holdings.Its deposit products include noninterest-bearing checking, interest-bearing checking, savings, and money market deposit accounts, as well as certificates of deposit and individual retirement accounts.

Read More

Before you consider Truist Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Truist Financial wasn't on the list.

While Truist Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.