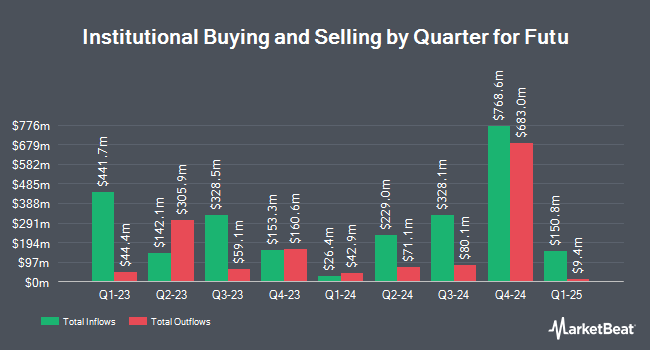

Nomura Holdings Inc. decreased its position in shares of Futu Holdings Limited (NASDAQ:FUTU - Free Report) by 34.1% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 34,482 shares of the company's stock after selling 17,828 shares during the quarter. Nomura Holdings Inc.'s holdings in Futu were worth $2,758,000 as of its most recent SEC filing.

Several other hedge funds have also recently added to or reduced their stakes in FUTU. Diversify Wealth Management LLC acquired a new stake in Futu during the 4th quarter worth about $457,000. SG Americas Securities LLC boosted its position in shares of Futu by 236.6% during the 4th quarter. SG Americas Securities LLC now owns 374,193 shares of the company's stock valued at $29,932,000 after purchasing an additional 263,040 shares in the last quarter. Blue Trust Inc. grew its stake in Futu by 15.9% during the fourth quarter. Blue Trust Inc. now owns 10,302 shares of the company's stock worth $824,000 after purchasing an additional 1,413 shares during the period. KBC Group NV grew its stake in Futu by 28.2% during the fourth quarter. KBC Group NV now owns 42,692 shares of the company's stock worth $3,415,000 after purchasing an additional 9,401 shares during the period. Finally, Robeco Institutional Asset Management B.V. bought a new stake in Futu in the fourth quarter worth approximately $1,200,000.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on FUTU shares. UBS Group increased their price target on Futu from $130.00 to $136.00 and gave the stock a "buy" rating in a report on Monday, March 17th. JPMorgan Chase & Co. boosted their target price on shares of Futu from $160.00 to $170.00 and gave the company an "overweight" rating in a research report on Friday, March 14th. One research analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $121.20.

Read Our Latest Research Report on Futu

Futu Trading Up 2.0%

Futu stock traded up $2.21 during midday trading on Thursday, reaching $111.40. The stock had a trading volume of 674,776 shares, compared to its average volume of 2,829,149. The company has a fifty day moving average price of $96.66 and a two-hundred day moving average price of $95.50. Futu Holdings Limited has a 12 month low of $51.80 and a 12 month high of $130.88. The company has a market capitalization of $15.50 billion, a P/E ratio of 27.41, a PEG ratio of 0.79 and a beta of 0.67.

Futu Profile

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Read More

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.