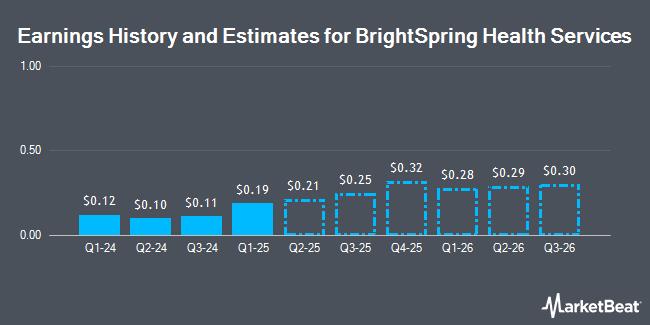

BrightSpring Health Services, Inc. (NASDAQ:BTSG - Free Report) - Leerink Partnrs issued their FY2029 earnings estimates for shares of BrightSpring Health Services in a research note issued on Tuesday, May 6th. Leerink Partnrs analyst W. Mayo anticipates that the company will earn $2.00 per share for the year. The consensus estimate for BrightSpring Health Services' current full-year earnings is $0.59 per share.

A number of other brokerages have also recently issued reports on BTSG. UBS Group boosted their target price on BrightSpring Health Services from $22.00 to $30.00 and gave the stock a "buy" rating in a report on Wednesday, January 29th. Mizuho set a $26.00 target price on BrightSpring Health Services in a report on Monday, May 5th. Finally, Morgan Stanley boosted their target price on BrightSpring Health Services from $20.00 to $25.00 and gave the stock an "overweight" rating in a report on Friday. One research analyst has rated the stock with a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $22.89.

Check Out Our Latest Report on BrightSpring Health Services

BrightSpring Health Services Trading Down 2.6%

Shares of NASDAQ BTSG traded down $0.59 on Wednesday, reaching $22.23. 1,697,365 shares of the company traded hands, compared to its average volume of 1,378,077. BrightSpring Health Services has a fifty-two week low of $10.15 and a fifty-two week high of $24.82. The company has a 50 day moving average of $17.96 and a 200 day moving average of $18.74. The company has a current ratio of 1.35, a quick ratio of 0.97 and a debt-to-equity ratio of 1.63. The stock has a market capitalization of $3.87 billion, a PE ratio of -84.98 and a beta of 2.06.

BrightSpring Health Services (NASDAQ:BTSG - Get Free Report) last posted its quarterly earnings data on Friday, May 2nd. The company reported $0.19 EPS for the quarter, beating analysts' consensus estimates of $0.09 by $0.10. BrightSpring Health Services had a negative net margin of 0.38% and a positive return on equity of 4.16%. The company had revenue of $2.88 billion during the quarter, compared to the consensus estimate of $2.74 billion. During the same quarter in the prior year, the company posted $0.12 EPS. The company's quarterly revenue was up 25.9% compared to the same quarter last year.

Hedge Funds Weigh In On BrightSpring Health Services

A number of institutional investors and hedge funds have recently bought and sold shares of BTSG. Barclays PLC boosted its holdings in BrightSpring Health Services by 22.2% in the 3rd quarter. Barclays PLC now owns 393,725 shares of the company's stock worth $5,780,000 after acquiring an additional 71,633 shares during the period. JPMorgan Chase & Co. boosted its holdings in BrightSpring Health Services by 275.2% in the 3rd quarter. JPMorgan Chase & Co. now owns 163,618 shares of the company's stock worth $2,402,000 after acquiring an additional 120,005 shares during the period. SG Americas Securities LLC boosted its stake in shares of BrightSpring Health Services by 50.9% during the 4th quarter. SG Americas Securities LLC now owns 37,000 shares of the company's stock valued at $630,000 after buying an additional 12,486 shares during the last quarter. R Squared Ltd purchased a new position in shares of BrightSpring Health Services during the 4th quarter valued at approximately $74,000. Finally, Legato Capital Management LLC boosted its stake in shares of BrightSpring Health Services by 40.0% during the 4th quarter. Legato Capital Management LLC now owns 66,910 shares of the company's stock valued at $1,139,000 after buying an additional 19,120 shares during the last quarter.

BrightSpring Health Services Company Profile

(

Get Free Report)

BrightSpring Health Services, Inc operates a home and community-based healthcare services platform in the United States. The company's platform focuses on delivering pharmacy and provider services, including clinical and supportive care in home and community settings to Medicare, Medicaid, and insured populations.

Featured Stories

Before you consider BrightSpring Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpring Health Services wasn't on the list.

While BrightSpring Health Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.