Gibraltar Industries (NASDAQ:ROCK - Get Free Report) updated its FY 2025 earnings guidance on Wednesday. The company provided earnings per share (EPS) guidance of 4.800-5.050 for the period, compared to the consensus estimate of 4.730. The company issued revenue guidance of $1.4 billion-$1.5 billion, compared to the consensus revenue estimate of $1.4 billion.

Analysts Set New Price Targets

Separately, StockNews.com raised Gibraltar Industries from a "buy" rating to a "strong-buy" rating in a research report on Thursday, February 20th.

View Our Latest Stock Report on ROCK

Gibraltar Industries Price Performance

Shares of Gibraltar Industries stock traded down $0.20 during trading on Monday, hitting $57.83. 116,063 shares of the stock were exchanged, compared to its average volume of 215,667. The stock has a market cap of $1.71 billion, a price-to-earnings ratio of 12.95 and a beta of 1.30. The firm's 50-day moving average price is $58.62 and its 200 day moving average price is $62.61. Gibraltar Industries has a 12-month low of $48.96 and a 12-month high of $81.90.

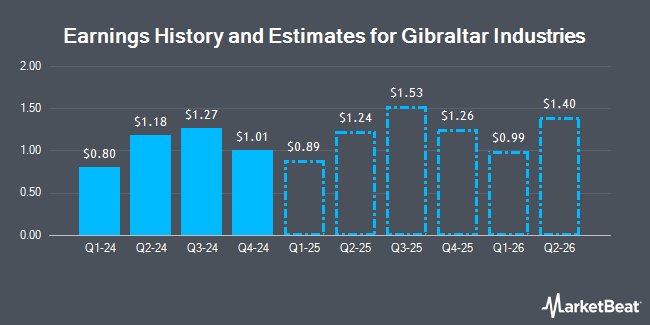

Gibraltar Industries (NASDAQ:ROCK - Get Free Report) last released its quarterly earnings data on Wednesday, April 30th. The construction company reported $0.95 EPS for the quarter, beating analysts' consensus estimates of $0.86 by $0.09. Gibraltar Industries had a return on equity of 13.19% and a net margin of 10.49%. The business had revenue of $290.02 million for the quarter, compared to the consensus estimate of $296.77 million. During the same quarter in the prior year, the business posted $0.80 EPS. The business's revenue for the quarter was down .9% on a year-over-year basis. As a group, research analysts forecast that Gibraltar Industries will post 4.91 earnings per share for the current year.

Gibraltar Industries Company Profile

(

Get Free Report)

Gibraltar Industries, Inc manufactures and provides products and services for the renewable energy, residential, agtech, and infrastructure markets in the United States and internationally. It operates through four segments: Renewables, Residential, Agtech, and Infrastructure. The Renewables segment designs, engineers, manufactures, and installs solar racking and electrical balance of systems for commercial and distributed generation scale solar installations.

Further Reading

Before you consider Gibraltar Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gibraltar Industries wasn't on the list.

While Gibraltar Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.