Granahan Investment Management LLC raised its position in shares of Blueprint Medicines Co. (NASDAQ:BPMC - Free Report) by 8.2% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 141,890 shares of the biotechnology company's stock after acquiring an additional 10,744 shares during the period. Granahan Investment Management LLC owned approximately 0.22% of Blueprint Medicines worth $12,376,000 at the end of the most recent reporting period.

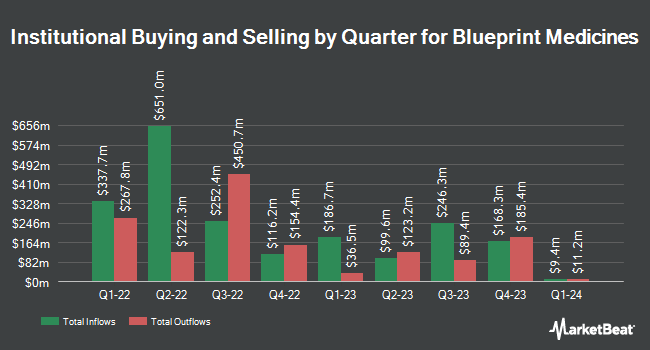

A number of other hedge funds have also made changes to their positions in BPMC. Franklin Resources Inc. increased its holdings in shares of Blueprint Medicines by 0.7% in the 3rd quarter. Franklin Resources Inc. now owns 36,761 shares of the biotechnology company's stock valued at $3,259,000 after acquiring an additional 265 shares during the last quarter. Empirical Asset Management LLC acquired a new stake in Blueprint Medicines in the fourth quarter worth approximately $2,348,000. SG Americas Securities LLC boosted its stake in Blueprint Medicines by 69.7% during the 4th quarter. SG Americas Securities LLC now owns 4,277 shares of the biotechnology company's stock valued at $373,000 after purchasing an additional 1,756 shares in the last quarter. Fifth Third Bancorp increased its position in shares of Blueprint Medicines by 207.5% during the 4th quarter. Fifth Third Bancorp now owns 3,075 shares of the biotechnology company's stock valued at $268,000 after purchasing an additional 2,075 shares during the period. Finally, KBC Group NV raised its stake in shares of Blueprint Medicines by 63.9% in the 4th quarter. KBC Group NV now owns 2,625 shares of the biotechnology company's stock worth $229,000 after buying an additional 1,023 shares in the last quarter.

Insider Transactions at Blueprint Medicines

In other news, insider Ariel Hurley sold 3,203 shares of the stock in a transaction that occurred on Monday, March 3rd. The shares were sold at an average price of $92.62, for a total transaction of $296,661.86. Following the sale, the insider now directly owns 18,270 shares of the company's stock, valued at $1,692,167.40. This represents a 14.92% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, COO Christina Rossi sold 2,274 shares of the company's stock in a transaction on Monday, March 24th. The shares were sold at an average price of $95.02, for a total value of $216,075.48. Following the transaction, the chief operating officer now directly owns 69,266 shares in the company, valued at $6,581,655.32. This trade represents a 3.18% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 10,503 shares of company stock worth $1,027,931. Insiders own 4.21% of the company's stock.

Blueprint Medicines Stock Performance

Shares of NASDAQ:BPMC traded up $2.02 during trading on Thursday, hitting $99.53. 199,220 shares of the stock were exchanged, compared to its average volume of 778,440. The company has a market capitalization of $6.43 billion, a price-to-earnings ratio of -92.09 and a beta of 0.83. The company has a debt-to-equity ratio of 1.15, a quick ratio of 2.80 and a current ratio of 2.85. Blueprint Medicines Co. has a 1-year low of $73.04 and a 1-year high of $121.90. The company's fifty day simple moving average is $89.12 and its 200-day simple moving average is $94.07.

Blueprint Medicines (NASDAQ:BPMC - Get Free Report) last posted its earnings results on Thursday, May 1st. The biotechnology company reported ($0.74) earnings per share for the quarter, missing the consensus estimate of ($0.42) by ($0.32). The firm had revenue of $149.41 million during the quarter, compared to the consensus estimate of $158.31 million. Blueprint Medicines had a negative return on equity of 77.49% and a negative net margin of 13.19%. The firm's revenue for the quarter was up 55.5% compared to the same quarter last year. During the same period in the previous year, the company posted $1.40 EPS. Sell-side analysts expect that Blueprint Medicines Co. will post -1.28 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of research firms recently issued reports on BPMC. Needham & Company LLC lowered their target price on Blueprint Medicines from $133.00 to $130.00 and set a "buy" rating on the stock in a report on Monday, April 28th. Morgan Stanley began coverage on shares of Blueprint Medicines in a report on Thursday, March 20th. They issued an "equal weight" rating and a $100.00 target price on the stock. Jefferies Financial Group initiated coverage on shares of Blueprint Medicines in a report on Monday, March 17th. They set a "buy" rating and a $135.00 target price for the company. JMP Securities reaffirmed a "market outperform" rating and issued a $125.00 price target on shares of Blueprint Medicines in a report on Friday, February 14th. Finally, Wedbush restated an "outperform" rating and issued a $128.00 target price on shares of Blueprint Medicines in a report on Thursday, May 1st. Five research analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, Blueprint Medicines currently has an average rating of "Moderate Buy" and an average price target of $126.56.

Read Our Latest Stock Report on BPMC

Blueprint Medicines Profile

(

Free Report)

Blueprint Medicines Corporation, a precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally. The company is developing AYVAKIT for the treatment of systemic mastocytosis (SM) and gastrointestinal stromal tumors; BLU-263, an orally available, potent, and KIT inhibitor for the treatment of indolent SM, and other mast cell disorders.

Further Reading

Before you consider Blueprint Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blueprint Medicines wasn't on the list.

While Blueprint Medicines currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.