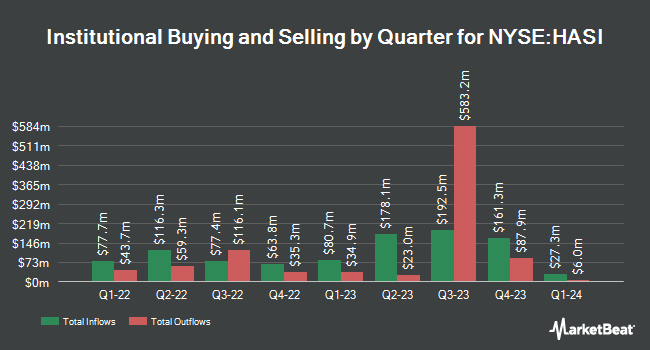

Envestnet Asset Management Inc. grew its stake in HA Sustainable Infrastructure Capital, Inc. (NYSE:HASI - Free Report) by 14.3% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 212,520 shares of the real estate investment trust's stock after purchasing an additional 26,560 shares during the quarter. Envestnet Asset Management Inc. owned about 0.18% of HA Sustainable Infrastructure Capital worth $5,702,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Legend Financial Advisors Inc. purchased a new stake in shares of HA Sustainable Infrastructure Capital in the 4th quarter worth about $27,000. Blue Trust Inc. grew its holdings in HA Sustainable Infrastructure Capital by 57.8% in the fourth quarter. Blue Trust Inc. now owns 1,076 shares of the real estate investment trust's stock worth $29,000 after purchasing an additional 394 shares during the period. Smartleaf Asset Management LLC lifted its holdings in shares of HA Sustainable Infrastructure Capital by 46.7% during the fourth quarter. Smartleaf Asset Management LLC now owns 1,380 shares of the real estate investment trust's stock valued at $37,000 after purchasing an additional 439 shares during the last quarter. Roxbury Financial LLC bought a new stake in shares of HA Sustainable Infrastructure Capital in the 4th quarter worth approximately $39,000. Finally, Allworth Financial LP increased its position in HA Sustainable Infrastructure Capital by 1,267.2% during the 4th quarter. Allworth Financial LP now owns 1,709 shares of the real estate investment trust's stock valued at $46,000 after buying an additional 1,584 shares in the last quarter. 96.14% of the stock is owned by hedge funds and other institutional investors.

HA Sustainable Infrastructure Capital Price Performance

Shares of NYSE HASI traded up $0.36 during midday trading on Friday, reaching $25.11. The stock had a trading volume of 869,611 shares, compared to its average volume of 1,146,328. The company has a debt-to-equity ratio of 1.83, a quick ratio of 13.55 and a current ratio of 11.25. HA Sustainable Infrastructure Capital, Inc. has a 12-month low of $21.98 and a 12-month high of $36.56. The stock has a 50-day moving average of $27.31 and a 200-day moving average of $28.90. The company has a market capitalization of $3.04 billion, a price-to-earnings ratio of 15.89, a price-to-earnings-growth ratio of 1.06 and a beta of 1.83.

HA Sustainable Infrastructure Capital (NYSE:HASI - Get Free Report) last announced its quarterly earnings data on Thursday, February 13th. The real estate investment trust reported $0.57 EPS for the quarter, missing the consensus estimate of $0.59 by ($0.02). HA Sustainable Infrastructure Capital had a net margin of 52.15% and a return on equity of 11.84%. The business had revenue of $37.74 million during the quarter, compared to analysts' expectations of $25.93 million. As a group, research analysts anticipate that HA Sustainable Infrastructure Capital, Inc. will post 2.45 EPS for the current fiscal year.

HA Sustainable Infrastructure Capital Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, April 18th. Shareholders of record on Friday, April 4th were paid a $0.42 dividend. The ex-dividend date was Friday, April 4th. This represents a $1.68 annualized dividend and a yield of 6.69%. This is a boost from HA Sustainable Infrastructure Capital's previous quarterly dividend of $0.42. HA Sustainable Infrastructure Capital's payout ratio is presently 106.33%.

Analyst Upgrades and Downgrades

Several research firms have recently issued reports on HASI. Wells Fargo & Company started coverage on HA Sustainable Infrastructure Capital in a research report on Thursday, February 27th. They issued an "overweight" rating and a $33.00 price target for the company. Truist Financial began coverage on shares of HA Sustainable Infrastructure Capital in a research note on Thursday, February 6th. They issued a "buy" rating and a $40.00 target price on the stock. Citigroup upgraded shares of HA Sustainable Infrastructure Capital from a "neutral" rating to a "buy" rating and set a $36.00 price objective for the company in a report on Wednesday, January 8th. Robert W. Baird cut their target price on HA Sustainable Infrastructure Capital from $47.00 to $41.00 and set an "outperform" rating on the stock in a research note on Tuesday, April 15th. Finally, JPMorgan Chase & Co. decreased their target price on HA Sustainable Infrastructure Capital from $42.00 to $39.00 and set an "overweight" rating for the company in a research report on Thursday, January 23rd. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating, twelve have assigned a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $38.92.

Read Our Latest Research Report on HASI

About HA Sustainable Infrastructure Capital

(

Free Report)

HA Sustainable Infrastructure Capital, Inc, through its subsidiaries, engages in the investment of energy efficiency, renewable energy, and sustainable infrastructure markets in the United States. The company's portfolio includes equity investments, commercial and government receivables, real estate, and debt securities.

Featured Stories

Before you consider HA Sustainable Infrastructure Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HA Sustainable Infrastructure Capital wasn't on the list.

While HA Sustainable Infrastructure Capital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.