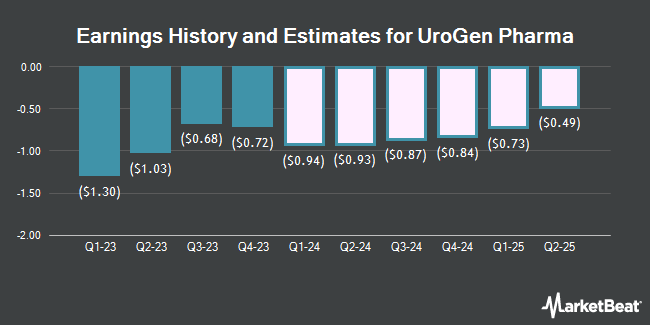

Urogen Pharma (NASDAQ:URGN - Free Report) - Investment analysts at HC Wainwright cut their Q2 2025 earnings per share estimates for Urogen Pharma in a research note issued on Monday, June 16th. HC Wainwright analyst R. Selvaraju now expects that the company will earn ($0.80) per share for the quarter, down from their prior estimate of ($0.74). HC Wainwright has a "Buy" rating and a $50.00 price objective on the stock. The consensus estimate for Urogen Pharma's current full-year earnings is ($3.12) per share. HC Wainwright also issued estimates for Urogen Pharma's Q3 2025 earnings at ($0.69) EPS, Q4 2025 earnings at ($0.69) EPS, FY2025 earnings at ($3.10) EPS, Q1 2026 earnings at ($0.56) EPS, Q2 2026 earnings at ($0.15) EPS, Q3 2026 earnings at $0.02 EPS, Q4 2026 earnings at $0.26 EPS and FY2026 earnings at $0.43 EPS.

Several other equities research analysts also recently weighed in on the stock. Scotiabank reissued an "outperform" rating on shares of Urogen Pharma in a research report on Friday, June 13th. Oppenheimer set a $31.00 price objective on Urogen Pharma and gave the stock a "buy" rating in a report on Friday, June 13th. The Goldman Sachs Group set a $16.00 target price on shares of Urogen Pharma and gave the company a "neutral" rating in a research note on Friday, June 13th. D. Boral Capital reaffirmed a "buy" rating and set a $25.00 price target on shares of Urogen Pharma in a report on Thursday, June 12th. Finally, Guggenheim reiterated a "buy" rating and issued a $30.00 price target (up from $15.00) on shares of Urogen Pharma in a research note on Friday, June 13th. One analyst has rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Buy" and a consensus price target of $32.86.

Get Our Latest Stock Analysis on URGN

Urogen Pharma Stock Down 1.5%

URGN stock traded down $0.22 during trading on Wednesday, hitting $14.65. 3,388,813 shares of the stock traded hands, compared to its average volume of 1,038,153. The firm's 50 day moving average is $8.99 and its two-hundred day moving average is $10.12. The stock has a market cap of $675.51 million, a price-to-earnings ratio of -4.61 and a beta of 0.40. Urogen Pharma has a 1 year low of $3.42 and a 1 year high of $18.15. The company has a debt-to-equity ratio of 4.77, a current ratio of 5.65 and a quick ratio of 5.47.

Urogen Pharma (NASDAQ:URGN - Get Free Report) last posted its quarterly earnings data on Monday, May 12th. The company reported ($0.92) earnings per share for the quarter, missing analysts' consensus estimates of ($0.83) by ($0.09). The company had revenue of $20.25 million for the quarter, compared to the consensus estimate of $22.71 million. Urogen Pharma had a negative net margin of 150.68% and a negative return on equity of 97,487.15%.

Insider Activity

In other Urogen Pharma news, insider Mark Schoenberg sold 5,162 shares of the company's stock in a transaction that occurred on Monday, June 9th. The shares were sold at an average price of $7.37, for a total transaction of $38,043.94. Following the completion of the sale, the insider now directly owns 153,378 shares of the company's stock, valued at approximately $1,130,395.86. This represents a 3.26% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 5.10% of the stock is owned by corporate insiders.

Institutional Trading of Urogen Pharma

Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. CWM LLC increased its holdings in Urogen Pharma by 6,047.1% during the first quarter. CWM LLC now owns 5,225 shares of the company's stock valued at $58,000 after buying an additional 5,140 shares during the last quarter. KLP Kapitalforvaltning AS purchased a new stake in Urogen Pharma during the fourth quarter valued at approximately $59,000. Lazard Asset Management LLC purchased a new stake in Urogen Pharma during the fourth quarter valued at approximately $67,000. GAMMA Investing LLC increased its holdings in Urogen Pharma by 6,908.4% during the first quarter. GAMMA Investing LLC now owns 7,499 shares of the company's stock valued at $83,000 after buying an additional 7,392 shares during the last quarter. Finally, Aquatic Capital Management LLC purchased a new stake in Urogen Pharma during the fourth quarter valued at approximately $101,000. 91.29% of the stock is owned by hedge funds and other institutional investors.

About Urogen Pharma

(

Get Free Report)

UroGen Pharma Ltd., a biotechnology company, engages in the development and commercialization of solutions for urothelial and specialty cancers. It offers RTGel, a novel proprietary polymeric biocompatible, reverse thermal gelation hydrogel technology to improve therapeutic profiles of existing drugs; and Jelmyto for pyelocalyceal solution.

Featured Stories

Before you consider Urogen Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Urogen Pharma wasn't on the list.

While Urogen Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.