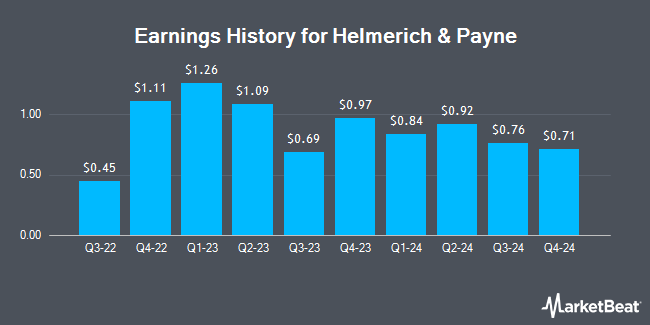

Helmerich & Payne (NYSE:HP - Get Free Report) released its quarterly earnings results on Wednesday, May 7th. The oil and gas company reported $0.02 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.65 by ($0.63), Zacks reports. Helmerich & Payne had a net margin of 11.02% and a return on equity of 11.31%. The company had revenue of $1.02 billion for the quarter, compared to analyst estimates of $961.03 million. During the same quarter last year, the firm posted $0.84 EPS. Helmerich & Payne's revenue for the quarter was up 47.7% on a year-over-year basis.

Helmerich & Payne Stock Performance

NYSE HP traded down $0.25 during trading hours on Wednesday, hitting $18.87. The company's stock had a trading volume of 993,736 shares, compared to its average volume of 1,551,068. The company has a debt-to-equity ratio of 0.60, a current ratio of 2.81 and a quick ratio of 2.52. The company's 50 day simple moving average is $21.96 and its two-hundred day simple moving average is $28.63. Helmerich & Payne has a 12 month low of $17.60 and a 12 month high of $42.60. The company has a market cap of $1.88 billion, a P/E ratio of 6.21, a price-to-earnings-growth ratio of 3.52 and a beta of 0.93.

Helmerich & Payne Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, May 30th. Investors of record on Thursday, May 15th will be issued a $0.25 dividend. The ex-dividend date is Thursday, May 15th. This represents a $1.00 annualized dividend and a yield of 5.30%. Helmerich & Payne's payout ratio is 45.66%.

Wall Street Analyst Weigh In

Several research firms recently weighed in on HP. Susquehanna reduced their price target on shares of Helmerich & Payne from $43.00 to $28.00 and set a "positive" rating for the company in a research report on Monday, April 14th. Evercore ISI restated an "in-line" rating and set a $39.00 price target (down previously from $48.00) on shares of Helmerich & Payne in a research report on Wednesday, January 15th. StockNews.com lowered shares of Helmerich & Payne from a "hold" rating to a "sell" rating in a research note on Friday, May 9th. Citigroup decreased their price target on shares of Helmerich & Payne from $32.00 to $25.00 and set a "buy" rating for the company in a research note on Tuesday. Finally, Morgan Stanley restated an "underweight" rating and set a $27.00 price target on shares of Helmerich & Payne in a research note on Thursday, March 27th. Three equities research analysts have rated the stock with a sell rating, seven have given a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $30.10.

Read Our Latest Stock Report on Helmerich & Payne

Helmerich & Payne Company Profile

(

Get Free Report)

Founded in 1920, Helmerich & Payne, Inc (H&P) NYSE: HP is committed to delivering industry leading levels of drilling productivity and reliability. H&P operates with the highest level of integrity, safety and innovation to deliver superior results for its customers and returns for shareholders.

Featured Stories

Before you consider Helmerich & Payne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helmerich & Payne wasn't on the list.

While Helmerich & Payne currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.